wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,581

- Reactions

- 12,707

FWIW

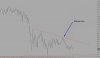

The chart below shows the 20 day average of the total put/call index, Generally, when this average extends below 1 standard deviation there is some sort of a market top; an intermediate top at least. We are now at 2 standard deviations.

The chart below shows the 20 day average of the total put/call index, Generally, when this average extends below 1 standard deviation there is some sort of a market top; an intermediate top at least. We are now at 2 standard deviations.