- Joined

- 13 February 2006

- Posts

- 5,358

- Reactions

- 12,408

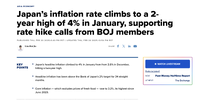

| The good news about the U.S. economy in January is that inflation was subdued and Americans were making more money. The bad news is that people weren't interested in spending it. Why it matters: The latest data on the state of the economy as President Trump took office is further evidence that there was something of an air pocket in spending and confidence to start the year.

|

Oil News:

Friday, February 28, 2025

Following extremely rangebound trading throughout most of mid-February, oil prices are set to post their largest weekly loss in three weeks, with the potential resumption of Iraqi exports from Ceyhan and Trump’s diplomatic efforts on the Russia-Ukraine track tilting sentiment towards bearishness. Concurrently, the US president has also signalled tighter supply from Venezuela, but with ICE Brent futures dropping to $73 per barrel, the oil markets seem to be downplaying any potential short-term supply disruptions.

Trump to Cancel Chevron’s Venezuela Waiver. US President Donald Trump announced he would revoke the 2022 Venezuela sanctions waiver from March 1 onwards, giving the US major Chevron (NYSE:CVX) a six-month wind down period to halt operations in the country that made up 10% of its production last year.

Beijing Warns US on Copper Tariffs. China’s Commerce Ministry urged the United States to halt its investigation on new tariffs on US copper imports, with Donald Trump using the Trade Expansion Act of 1962 that he did in his first term, pledging to retaliate if Chinese entities get affected by the levies.

Shifting Policy, BP Means ‘Back to Petroleum’. In its much-anticipated investor day, UK oil major BP (NYSE:BP) pledged to increase annual oil and gas spending to 10 billion, cut investment into renewables from $5 billion to $1.5-2 billion per year and carry out divestments worth $20 billion by 2027.

Majors Consolidate Malaysian Upstream Assets. Italian oil major ENI (BIT:ENI) and Malaysia’s state oil company Petronas agreed to create a joint venture that would combine some of their upstream assets in Malaysia and Indonesia, with the new entity set to boast some 3 billion boe of reserves.

Indonesia Arrests Top Oil Executives. Indonesia has arrested four top executives at state oil firm Pertamina over alleged corruption in crude and oil product imports, with the country’s attorney general claiming that the alleged offenses between 2018 and 2023 cost the nation some $12 billion.

China Expands into Algeria’s Oil Sector. Algeria’s state energy firm Sonatrach and China’s state-controlled major Sinopec (SHA:600028) signed an exploration pact worth $850 million to develop the Hassi Berkane play, even before US oil majors Chevron and ExxonMobil got their respective blocks.

US Waives Sanctions on Serbian Refinery. The US has suspended sanctions for 30 days on Serbia’s national oil company NIS, majority-owned by Russian companies and providing fuel for the entirety of Serbian territory, as the largest stakeholder Gazprom Neft transferred a 5% stake to Gazprom this week.

Japan Locks in More Emirati LNG. ADNOC, the national oil company of the UAE, has signed a 15-year term supply agreement with one of Japan’s largest gas buyers Osaka Gas (TYO:9532) to deliver up to 0.8 million tonnes LNG per year starting from 2028, its fourth sales agreement for the Ruwais LNG project.

Russia Seeks to Build First Refinery in Myanmar. Russia and Myanmar have agreed to build a refinery in the South Asian country that currently has zero refining capacity, eyeing the Dawei special economic zone for it with further plans to build a port and a coal-fired thermal power plant there.

US, Ukraine Agree on Critical Minerals Deal. Ukraine’s President Zelensky is set to sign a comprehensive critical minerals deal with US President Trump this Friday, committing Kyiv to pay $500 billion from resource extraction as a repayment for past and future aid provisions, without security guarantees.

IAEA Sees Iranian Uranium Stock Surging. According to the IAEA, Tehran’s stockpile of enriched uranium surged more than 50% over the past three months to 839,200 kg as Iran prepares for Trump sanctions, driven by an alleged sevenfold increase in enrichment activities since December.

Petrobras Posts Rare Quarterly Loss. Brazil’s national oil company Petrobras (NYSE

Iron Ore Feels the Pinch of China Tariffs. The benchmark May iron ore futures traded on China’s Dalian exchange fell to ¥805 per metric tonne ($110/mt) this week after Asian countries followed Trump’s lead, with Vietnam slapping anti-dumping levies on Chinese steel with South Korea going for a 38% tariff rate.

Iraq to Resume Kurdish Flow Soon. The Iraqi government is set to announce the resumption of oil exports from the breakaway region of Kurdistan over the upcoming days, initially starting off with some 185,000 b/d to be marketed by state oil firm SOMO and gradually increasing the volumes over time.

The international order forged after World War II is imploding, squeezed on all sides by the return of strongmen, nationalism and spheres of influence — with President Trump leading the charge, Axios' Zachary Basu writes.

- Why it matters: Trump is openly scornful of international institutions and traditional alliances. Instead, he sees great opportunity in a world dominated by superpowers and dictated through dealmaking.

The big picture: Trump's approach is based, according to U.S. officials, in "realism" — and the belief that "shared values," international norms and other squishy concepts can never replace "hard power."

The big picture: Trump's approach is based, according to U.S. officials, in "realism" — and the belief that "shared values," international norms and other squishy concepts can never replace "hard power."- "The postwar global order is not just obsolete," Secretary of State Marco Rubio declared at his confirmation hearing last month. "It is now a weapon being used against us."

- Trump's first term posed newfound threats to 20th-century alliances and structures — NATO, the World Trade Organization, even the UN.

- A second Trump term could render them virtually obsolete.

Zoom in: The frailty of the rules-based order was exposed this week on the preeminent global stage built to support it.

Zoom in: The frailty of the rules-based order was exposed this week on the preeminent global stage built to support it.- At the UN General Assembly on Monday, the U.S. voted againsta resolution condemning Russia for invading Ukraine on the third anniversary of the war.

- It was the first time since 1945 that the U.S. sided with Russia — and against Europe — on a resolution related to European security, according to the BBC's James Lansdale.

- Nearly all other Western leaders see Russia as a rogue state and an aggressor. Trump sees a potential partner.

Zoom out: For Europe, which has relied on the U.S. to guarantee its security for the last eight decades, this isn't just a wakeup call. It's an existential challenge that throws the entire transatlantic alliance into question.

Zoom out: For Europe, which has relied on the U.S. to guarantee its security for the last eight decades, this isn't just a wakeup call. It's an existential challenge that throws the entire transatlantic alliance into question.- Germany's conservative leader and chancellor-in-waiting, Friedrich Merz, said after his election victory Sunday that his "absolute priority" is to rapidly strengthen Europe so it can "achieve independence from the USA."

Between the lines: In today's multipolar world, the U.S., Russia and China are all racing to secure their strategic interests and solidify — or expand — their spheres of influence.

Between the lines: In today's multipolar world, the U.S., Russia and China are all racing to secure their strategic interests and solidify — or expand — their spheres of influence.- Russian President Vladimir Putin dreams of reconstituting the Soviet bloc and has tried to do so by force — invading Ukraine and meddling in elections across the Western world.

- China, an economic and military superpower under Xi Jinping, is watching Ukraine carefully as it ponders whether to invade Taiwan and cement Xi's legacy through "reunification."

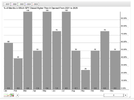

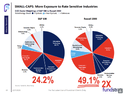

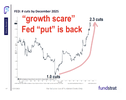

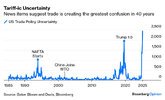

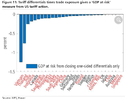

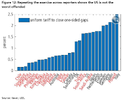

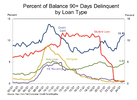

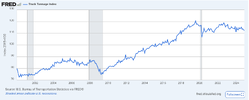

| They're mere tremors at this point, not an earthquake. But worries about the outlook for U.S. economic growth are starting to mount. Why it matters: On-again, off-again tariffs on major trading partners have added uncertainty to the business outlook, making hiring and investment decisions more complex.

|

Not exactly a picture of a strong economy.

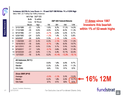

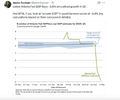

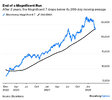

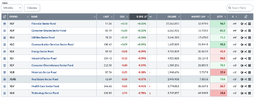

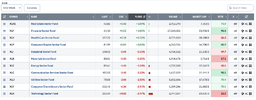

Buffett raising cash. All other Fund managers at all time lows in cash holdings. Who do you believe?

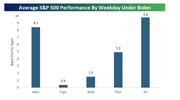

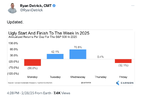

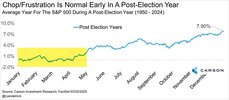

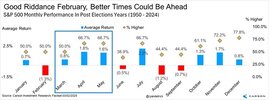

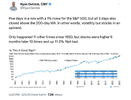

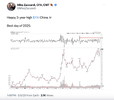

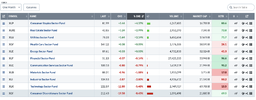

Still have a couple of hours trading left in February:

Not a great Feb. for the Bulls.

jog on

duc