Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

"Just had a look at their latest presentation. It doesnt look bad. They are continuing with their plans. Yet the SP is still under the pump!"

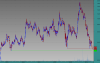

On the price side of things LNG is just above the May 2005 low of 29c. Have to wait for the tide to turn now I suppose. Gradually approaching base camp for the moment which I think was 20c.

Log. scale perspective.

On the price side of things LNG is just above the May 2005 low of 29c. Have to wait for the tide to turn now I suppose. Gradually approaching base camp for the moment which I think was 20c.

Log. scale perspective.