- Joined

- 3 May 2019

- Posts

- 6,384

- Reactions

- 10,127

Core Lithium CXO probably looking even better, being Australia's newest producer with a beaten up share price, in my opinion.Another reason for ALB to want to buy near lithium producers in Aust (LTR).

Core Lithium CXO probably looking even better, being Australia's newest producer with a beaten up share price, in my opinion.Another reason for ALB to want to buy near lithium producers in Aust (LTR).

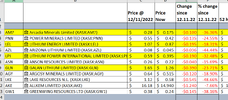

my modest watchlist for brine focused companies. They did better than the hard rock (WA and increasingly Canada) explorers and miners.Today's announcement of a merger of Allkem and Livent along with the previous LTR/WES/Albemarle and DLI/MIN/Gina rumours looks to have given the lithium market an extra boost today.

.. and from around the traps;....Hopefully it will lead to some more M & A action.

It's been a tough run for lithium. M and A should help prices but there'll be plenty of stale bulls looking to get out.Who’s Next? was the question on the ASX on Thursday after investors went searching for more candidates for mergers and acquisitions action after more than $21 billion in bids and deals since March.

Sounds interesting, but not sure how far $25 million is going to go....US-focused lithium explorer Chariot Corp has booked meetings with local fund managers to build support for a $25 million initial public offering as it targets a mid-2023 ASX float.

Chariot owns the largest known lithium exploration land holding in the US, fund managers were told. Its flagship assets are the Resurgent claystone lithium project spanning northern Nevada and southern Oregon and the Black Mountain hardrock project in central Wyoming.

Their Resurgent project neighbours with NYSE-listed miner Lithium Americas Corp’s Thacker Pass which received a $US650 million ($998) equity investment from General Motors in January.

Chariot Corp has appointed Wilsons and Jett Capital Advisors as joint lead managers for the proposed listing. Wilsons will also act as bookrunner.

About two years of directors fees and management costs.Sounds interesting, but not sure how far $25 million is going to go....

About two years of directors fees and management costs.

Mick

Be a director or management consultant.The only way to make money out of speccy miners

Hi Houtman, I’m currently a Allkem holder and I believe after the merger with Livent the new companys primary listing will be on the NYSE. Does this mean that they will have a secondary listing on the ASX? If they aren’t listed on the ASX can I trade my ‘new’ shares as normal or do I need to have an international trading account and are there tax implications in the USA for that? Sorry , I’m a total novice any advice or information from you or anyone would be greatly appreciated.Today's announcement of a merger of Allkem and Livent along with the previous LTR/WES/Albemarle and DLI/MIN/Gina rumours looks to have given the lithium market an extra boost today.

Hopefully it will lead to some more M & A action.

Hi Houtman, I’m currently a Allkem holder and I believe after the merger with Livent the new companys primary listing will be on the NYSE. Does this mean that they will have a secondary listing on the ASX? If they aren’t listed on the ASX can I trade my ‘new’ shares as normal or do I need to have an international trading account and are there tax implications in the USA for that? Sorry , I’m a total novice any advice or information from you or anyone would be greatly appreciated.

Lithium has had a great run in recent years due to increasing demand from primarily electric car and battery manufacturers. However, just recently I have noticed various reports suggesting that lithium supply is going to outstrip demand in the coming years due to the increased production largely coming from Chile and Australia. Yesterday, Morgan Stanley forecast that lithium prices would fall by 45% by 2021 as a result of increasing global supply. Another article at oilprice.com is similarly suggesting that the current lithium price is approaching bubble territory.

Of course, there is no shortage of articles suggesting the exact opposite, that while lithium supply will undoubtedly grow so will demand. A number of countries, including China and India, are planning to phase out sales of gasoline and diesel cars entirely, although most of the timelines I have seen suggest that this is 15 to 25 years away. Some smaller European countries such as Norway hope to implement bans as early as 2025.

Then there is the battery market which has grown strongly due to the proliferation of smart phones and other portable electronic devices, not to mention the huge growth of solar power where the bulk of battery sales are yet to come due to the current price of products like the Tesla Powerwall not representing a good return on investment for most of those home owners with solar panels installed on their roofs.

So, what is the future of lithium? Apparently it is abundant and relatively cheap to mine. I guess the big question is, can demand keep up with supply?

Why Australia is expected to earn less from lithium as demand for EVs soars

The value of Australia’s lithium exports is expected to fall after quadrupling to a record $19.5bn last year, as global production catches up with soaring demand for electric cars.

The Department of Industry’s latest Resources and Energy quarterly report shows the overall exports in the sector are set to decline from a record $460bn to $390bn, with energy exports expected earnings set to fall noticeably.

While prices are expected to moderate towards levels before Russia’s invasion of Ukraine early last year, the report also outlines the future of the internal combustion engine.

It expects the share of electrical cars sold in the passenger vehicle market to exceed 20 per cent by 2025, with China, Europe and the US leading the charge.

“As a result the global ICE (internal combustion engine) passenger vehicle fleet is forecast to plateau over the next two years, compared to the average of 3.3 per cent growth per year in the four years before the pandemic,” the Department of Industry report states.

The demise of the ICE will dent global oil consumption, which is forecast to rise 2.2 per cent to 102 million barrels a day in 2023, before slowing to average annual growth of 0.9 per cent in 2024 and 2025.

“The shift in the composition of the global vehicle fleet towards EVs will accelerate over time as EVs gain market share in new car sales, resulting in an accelerated fall in demand for petrol and diesel.”

But this isn’t expected to deliver a bonanza for Australian lithium producers in return, as global supply catches up with demand.

“The value of exports is expected to be $19.5bn in 2022-23, a significant increase from the previous record of $5bn in 2021-22,” the Department of Industry’s report states.

“The increase was driven by prices nearly tripling and the volume of spodumene exports increasing by 44 per cent. The value of lithium exports is forecast to decline to $17.8bn in 2023-24, then decrease further to $14.9bn in 2024-25.

“Global lithium supply is not only increasing but also diversifying, reflecting efforts by governments to secure supplies of critical minerals.”

The report highlights increased capacity from Chile, which is expected to maintain about 60 per cent of global refining output, as well as increased investments locally and in Argentina and the US. Recycling is expected to comprise 2-3 per cent of lithium supply within the next two years.

JARED LYNCH REPORTER

And in the meantime the smart money invested will grow substantially.Lithium is starting to look a bit like copper. Copper is always promising to be the next gold rush of riches, price hikes and talks of shortages, only to see prices back to the average.

“The shift in the composition of the global vehicle fleet towards EVs will accelerate over time as EVs gain market share in new car sales, resulting in an accelerated fall in demand for petrol and diesel.”But this isn’t expected to deliver a bonanza for Australian lithium producers in return, as global supply catches up with demand.“The value of exports is expected to be $19.5bn in 2022-23, a significant increase from the previous record of $5bn in 2021-22,” the Department of Industry’s report states.

MickAn ancient supervolcano along the Nevada-Oregon border contains what could be the world's largest single deposit of lithium. The findings could reshape the West's supply of the critical metal -- and might even change the geopolitical game with China.

Researchers from Lithium Americas Corporation, GNS Science, and Oregon State University published their findings in the Journal for Science Advances on Aug. 31. They found the McDermitt Caldera, a caldera measuring 28 miles long and 22 miles wide, on the Nevada-Oregon border, contains around 20 to 40 million metric tons of lithium – a figure that would dwarf deposits in Australia and Chile.

Commenting on the findings is Anouk Borst, a geologist at KU Leuven University and the Royal Museum for Central Africa in Tervuren, Belgium, who told Chemistr

y World that the McDermitt Caldera deposit "could change the dynamics of lithium globally, in terms of price, security of supply and geopolitics."

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.