Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 14,076

- Reactions

- 11,283

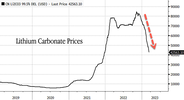

Only the big guys like WES will be able to wait out the low price, supply difficulties, lack of labour and inflationary costs.

Deep pockets will be required and I wonder if other ASX Li stocks will be able to avoid dilution or capital raisings

gg

Deep pockets will be required and I wonder if other ASX Li stocks will be able to avoid dilution or capital raisings

gg