- Joined

- 3 July 2009

- Posts

- 27,879

- Reactions

- 24,950

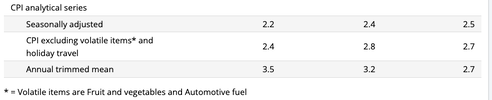

The Govt is pushing for an increase in the basic wage, so the last thing they want is inflation dropping.My guess is things will get "interesting" in the market once the masses realise this.

It's one of those things that'll take far longer to occur than logic says it ought but I expect it'll be real quick once it finally dawns as to the true nature of the situation.

The energy transition is going to cost, the subs are going to cost, the housing is going to cost, the NDIS, is going to cost, they already have a trillion dollars of debt from covid.

Like the Govt wants inflation to drop.