- Joined

- 13 February 2006

- Posts

- 5,056

- Reactions

- 11,454

So early start to work today:

I wouldn't pay 1oz gold for 1 BTC.

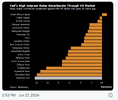

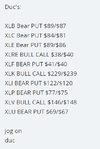

So I finally managed to get short NVDA at slightly higher than the chart indicates (short @ $124.43). The stock split enables retail to play more easily in the stock now. Even buying PUTS previously set you back $10,000 odd a contract.

NVDA is such a significant % of SMH or any other semiconductor ETF, you might as well go short NVDA (actually cheaper). It is the stock de jour, so might as well play it.

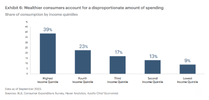

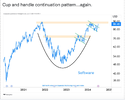

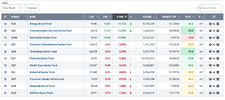

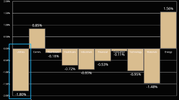

So as Mr fff alludes, the semi's and QQQ are bouncing, everything else pretty much, selling off again. This market is really bifurcated. There is actually no point in looking at SPY currently. You need to look at RSP:

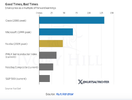

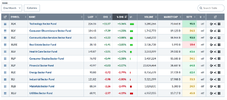

Unless you are trading NVDA, MSFT, AAPL, GOOG, AMZN:

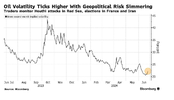

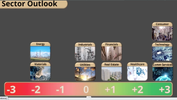

So now you need to hedge your hedge. If you are short the big 5 you need to be long the sectors individually (more or less not XLK). With my NVDA short I can play the sectors with better balance. Check out yesterday's heatmap.

Off to work!

jog on

duc

I wouldn't pay 1oz gold for 1 BTC.

So I finally managed to get short NVDA at slightly higher than the chart indicates (short @ $124.43). The stock split enables retail to play more easily in the stock now. Even buying PUTS previously set you back $10,000 odd a contract.

NVDA is such a significant % of SMH or any other semiconductor ETF, you might as well go short NVDA (actually cheaper). It is the stock de jour, so might as well play it.

So as Mr fff alludes, the semi's and QQQ are bouncing, everything else pretty much, selling off again. This market is really bifurcated. There is actually no point in looking at SPY currently. You need to look at RSP:

Unless you are trading NVDA, MSFT, AAPL, GOOG, AMZN:

So now you need to hedge your hedge. If you are short the big 5 you need to be long the sectors individually (more or less not XLK). With my NVDA short I can play the sectors with better balance. Check out yesterday's heatmap.

Off to work!

jog on

duc