- Joined

- 13 February 2006

- Posts

- 5,426

- Reactions

- 12,681

So let's start with this:

Full: https://www.cbsnews.com/news/lindse...rolina-face-the-nation-transcript-06-09-2024/

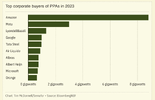

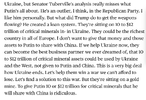

Rather indicates what the war is 'actually' about.

Now with USD hegemony intact, the US can just print USD to exchange for that mineral wealth.

Mr Putin on increasing NATO/US involvement:

Full: http://en.kremlin.ru/events/president/news/74223

Trucking is a big deal, as we saw in the exit stages of covid.

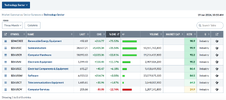

Nothing really major in earnings.

Manufacturing data and PMI data are the only important stuff.

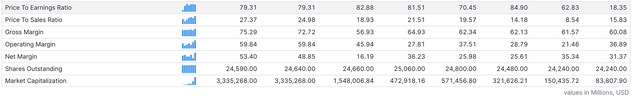

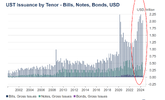

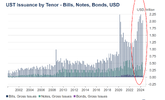

Back to the UST markets:

So essentially Yellen has no choice in issuing Bills as opposed to Notes or Bonds. There is no more demand for Notes or Bonds. What demand there was, she issued.

Any excess issue would result in higher interest rates (more supply than demand = falling price and increased yield) which immediately pushes USD higher which crashes everything except gold.

So as low interest debt rolls off it is replaced with largely high interest short term Bills. Which obviously need to be rolled over far more quickly. So the Fed's 'higher for longer' really hurts the US Treasury whose interest payments are now exceeding $1Trillion.

Over the next few years, a further $17 Trillion of longer term maturing low interest debt needs to be refinanced.

At what rate? The Fed's 'higher for longer'?

Powell is absolutely killing Yellen.

So you just know that at some point, Powell will politically be forced to cave in and lower rates. The Fed is independent you say? LOL.

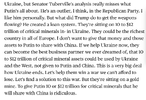

Then we have Senator Graham warmongering for the US to go full Vietnam in the Ukraine:

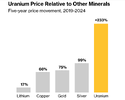

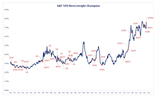

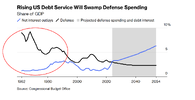

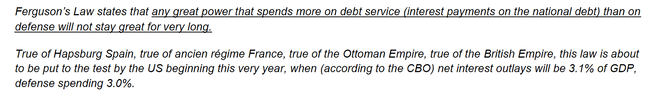

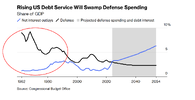

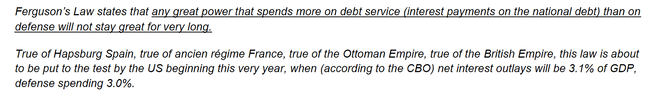

Really? Remember this chart:

Already the interest expense exceeds US military spending. The Senator wants to ramp the war up? With what? And has anyone actually told him that China actually manufactures the US weapons and munitions?

The US is in twilight.

It can be turned around over time. But not with the current f*ckwits in charge.

The roots of this crisis lie in the Obama administration back in 2014.

If another broad European hot war breaks out, that will undoubtably trigger a hot WWIII. The US and Europe seem intent on so doing. Particularly the French and British. Unbelievable.

*Note

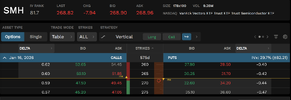

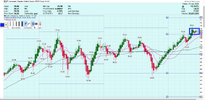

I will change that XLE trade to a 'No Trade'. Just reviewing the charts, still not looking that great.

GLD will also be a PUT @ $214-$210

TLT

CALL @ $93-$95

So just a word on entering trades: I can enter Option spread trades conditionally. Buy $93 Call, sell $95 Call, IF price trades at $XX. So this means I can automate the positions over the w/e, enter them for Monday's trading and some, all or none will actually trade based on price. Further I can require that trades only be executed after say 10am, which avoids the early morning volatility.

jog on

duc

Full: https://www.cbsnews.com/news/lindse...rolina-face-the-nation-transcript-06-09-2024/

Rather indicates what the war is 'actually' about.

Now with USD hegemony intact, the US can just print USD to exchange for that mineral wealth.

Mr Putin on increasing NATO/US involvement:

Full: http://en.kremlin.ru/events/president/news/74223

Trucking is a big deal, as we saw in the exit stages of covid.

Nothing really major in earnings.

Manufacturing data and PMI data are the only important stuff.

Back to the UST markets:

So essentially Yellen has no choice in issuing Bills as opposed to Notes or Bonds. There is no more demand for Notes or Bonds. What demand there was, she issued.

Any excess issue would result in higher interest rates (more supply than demand = falling price and increased yield) which immediately pushes USD higher which crashes everything except gold.

So as low interest debt rolls off it is replaced with largely high interest short term Bills. Which obviously need to be rolled over far more quickly. So the Fed's 'higher for longer' really hurts the US Treasury whose interest payments are now exceeding $1Trillion.

Over the next few years, a further $17 Trillion of longer term maturing low interest debt needs to be refinanced.

At what rate? The Fed's 'higher for longer'?

Powell is absolutely killing Yellen.

So you just know that at some point, Powell will politically be forced to cave in and lower rates. The Fed is independent you say? LOL.

Then we have Senator Graham warmongering for the US to go full Vietnam in the Ukraine:

Really? Remember this chart:

Already the interest expense exceeds US military spending. The Senator wants to ramp the war up? With what? And has anyone actually told him that China actually manufactures the US weapons and munitions?

The US is in twilight.

It can be turned around over time. But not with the current f*ckwits in charge.

The roots of this crisis lie in the Obama administration back in 2014.

If another broad European hot war breaks out, that will undoubtably trigger a hot WWIII. The US and Europe seem intent on so doing. Particularly the French and British. Unbelievable.

*Note

I will change that XLE trade to a 'No Trade'. Just reviewing the charts, still not looking that great.

GLD will also be a PUT @ $214-$210

TLT

CALL @ $93-$95

So just a word on entering trades: I can enter Option spread trades conditionally. Buy $93 Call, sell $95 Call, IF price trades at $XX. So this means I can automate the positions over the w/e, enter them for Monday's trading and some, all or none will actually trade based on price. Further I can require that trades only be executed after say 10am, which avoids the early morning volatility.

jog on

duc

Last edited: