- Joined

- 12 January 2008

- Posts

- 7,215

- Reactions

- 17,879

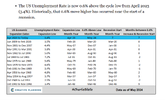

i guess we no longer have to worry about digging a hole to China , China is more likely to dig a hole to Australia , rendering our navy and submarines useless against invasionWe in Australia, often consider ourselves as a big mining country, and it is true domestically in the absence of much else but I find this perspective in miners sizes interesting

We are even with Canada, Indonesia but below many other, just a bit more than half of Brazil and 15 times smaller than China .

Oh, @ducati916 I hope you were awake for this. A decimal place is such a beautiful thing.

View attachment 178590

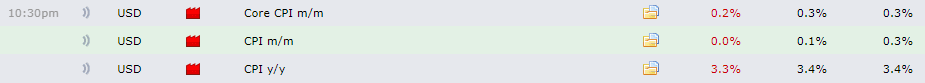

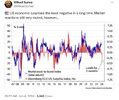

USD down, commodities, AUD, EUR, GBP all up!

I placed a few pending bracket orders trading both ways. Everything up and all hit +2R targets.

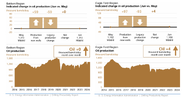

View attachment 178591

The US is yet to open and all my US positions look like opening gap up. I won't be sleeping tonight.

Nice work with your option trades last week. Who knew that XLK would spike as high as it did?

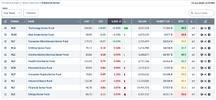

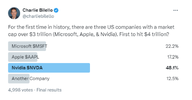

NVDA and the Apple AI news pulling the US index higher. Market breadth is dreadfully thin. Bear market thin but it's going up.

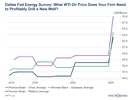

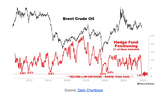

WTI oil back into it's neutral trading range. I'll buy again when it dips down to $73.

Good to see the 20% copper smelters closing for seasonal maintenance. May stop price drifting lower next week.

Possible "peak gold" production eh? They'll be looking at the recent lava flows then for gold once they cool down.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.