- Joined

- 13 February 2006

- Posts

- 5,057

- Reactions

- 11,457

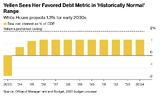

Or Inflation be close to the interest rate . In '23 inflation cancelled treasury interest burden in real terms . It's a catch22 scenarioFor this chart to remain flat, as above, then GDP growth must consistently be ABOVE INTEREST RATES.

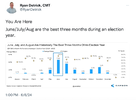

that is because they are already enjoying one ( and don't believe the 'phantom pains ' radiating from their pocket )No one worried about a recession:

And if you are stupid enough to hold bonds means that in real terms you lose money going forward.

Higher inflation = higher for longer rates = stronger USD for longer especially as Europe starts to cutHigher inflation = weaker USD. Which is of course where we came in. That is longer term. Currently the USD is looking rather too bullish for my liking vis -a- vis stocks, which could well take a tumble.

Higher inflation = higher for longer rates = stronger USD for longer especially as Europe starts to cut

Duc's Daily Dozen I think.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.