- Joined

- 30 June 2008

- Posts

- 16,071

- Reactions

- 8,019

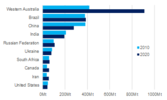

Still no indication that iron ore prices are receding.

Financial Times story indicates that predicted supply of ore from miners is reducing for a range of reasons. A reduction in supply would hold up the price as well.

Financial Times story indicates that predicted supply of ore from miners is reducing for a range of reasons. A reduction in supply would hold up the price as well.