CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Hopping on a trend is similar in all timeframes.

I'd suggest the hard part is staying in the trend once on.

I find that using the order flow to pick an entry point in a pullback much more difficult that fading a spike. That could be because the locals are a little more obvious and tend to show their hand. Whereas market orders hitting the bid or offer are more difficult to use for this. I could be wrong, just not sure how to articulate the reason why, but it's just something that I feel. There is also a reluctance to enter ona pullback because of the fear that the trend may have ended, as they frequently do these days. As I said, indexes are mean reverting, and have been on the whole since 2009.

I will however, need the flexibility and skills to be able to identify potential in a new trend so that I can use that when it makes more sense than fading. This will take some time I feel. I believe that I correctly identified the possibility for a trend on my blog yesterday, but failed to capitalize on the trend once it showed its potential.

Live and learn...

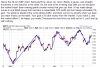

attached from Jason Leavitt's site: Hard for swing traders in this crap...

CanOz