skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

At the start of the year I threw out some ideas. Lets see,

Not a bad scorecard. Enjoy the holiday... just don't exchange your Yen until the minute you need to use it...

At the start of the year I threw out some ideas. Lets see,

I think this powerful bull market is not going to end easily and we may see year end rally as well.

Not that I'm living by it ... but if there is to be the "so called xmas rally" it's not looking good with all the neg data for Australia.

You mean you don't believe in Santa ?It is a figment of imagination. There is no difference in price action to any other time of year.

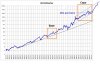

Does anyone have any explanation as to just WTF was happening in the world when this occurred:

View attachment 61140

That is an almost 50% drop in valuation in approximately 15 minutes. R.I.P stop loss, I hardly knew thee.

As I write this, IB is showing that the AUDCHF pair has lost 13% - I have never seen a double digit % loss for any pair.

EDIT: Just checked google finance. Swiss franc has decoupled from Euro. Interest rates heading deep into negative territory. Reserve bank of India also decides to cut rates.

References:

http://money.cnn.com/2015/01/15/investing/premarket-stocks-trading/

http://www.nytimes.com/2015/01/16/business/swiss-national-bank-euro-franc-exchange-rate.html

http://www.nytimes.com/2015/01/16/b...-chief-backs-growth-policies-in-the-modi.html

My goodness, what a day for the FX traders....I was short CAD, but that's it. Had a trailing stop and got taken out.....lucky it wasn't a CHF trade!

There was lots to be made on the AUDUSD after the volatility ended but I was too clenched up to make a move

So what does this mean in the short term? I would imagine that alot of money would be heading outside of Europe?

Skimmed some of DAX last nite. The DOM was moving so fast i could not execute with mouse, had to use hotkeys and i have a 30" monitor with large DOM. You don't see that very often

EXCEL Markets said:------------------------------------ ------------------------------------ ------------------

The dramatic move on the Swiss franc fueled by the Swiss National Bank's unexpected policy reversal of capping the Swiss franc against the euro has resulted in rare volatility and illiquidity. Both our primary and backup liquidity providers became unresponsive or illiquid for hours after the event. The majority of clients in a franc position were on the losing side and sustained losses amounting to far greater than their account equity. When a client cannot cover their losses it is passed onto us.

ALL OPEN POSITIONS MUST BE CLOSED BY 5PM NEW YORK TIME OR THEY WILL BE AUTOMATICALLY CLOSED AT THAT TIME. NEW POSITIONS CANNOT BE OPENED AS OF THIS TIME.

ALL CLIENT FUNDS ARE IN SEGREGATED ACCOUNTS AND NEVER USED FOR LP MARGINS. 100% OF POSITIVE CLIENT EQUITY OR BALANCE IS SAFE AND WITHDRAWABLE IMMEDIATELY.

Global Brokers NZ Ltd. STP's 100% of order flow and has sustained a total loss of operating capital. GBL can no longer meet regulatory minimum capitalization requirements of N$1,000,000 and will not be able to resume business. Losses incurred on trades that could not be exited due to illiquidity were losses incurred directly with the liquidity provider and we do not have the ability to reimburse those. Please note the interbank market for francs was illiquid for hours after the event and no traders with an open franc position were able to close it for a significant period of time, at any broker.

News of the impact of this event on companies and traders is just beginning to come to light. As Directors and Shareholders we would like to offer our sincerest apologies for this devastating turn of events, and to thank you for being such a supportive group.

We ask that you place withdrawal requests for your account balance at your earliest convenience and allow for minor delays as our team begins to experience higher than usual service volumes.

Best Regards,

Excel Markets, Global Brokers NZ Ltd

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.