- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

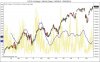

I do enjoy the T/H internals post. But wheres the 52 week highs/lows?

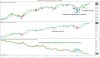

perhaps mkt takes a breather before kicking higher?

perhaps mkt takes a breather before kicking higher?