Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Oh ok cool - what I meant was, can you do this. esignal data feed into IB and then that data also feeding ninja?

Nah they just both feed NT.

Oh ok cool - what I meant was, can you do this. esignal data feed into IB and then that data also feeding ninja?

Well I intend to, Avid Chartist is pretty good and provides very good insights at MB commentary. What I don't understand are the basis of your criticisms.

$40 an ounce times 1000 ounces anyones?

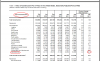

A guess but maybe they "from time to time" don't back shares issued to actual holdings?I am having trouble figuring out this chart...

A guess but maybe they "from time to time" don't back shares issued to actual holdings?

I think it makes sense looking here,

http://www.spdrgoldshares.com/sites/us/value/

There was a mini flash crash in the EURCHF cross yesterday.

I was watching markets on a screen. When I saw the EURCHF price break I called a lady I know on an FX desk. She picked up the phone after a few seconds and yelled at me:

“We’re 16 bid. It’s a piece of ****!”

and then hung up...

Translation:

“FX Bank is prepared to buy Euros and sell Swiss Francs at 1.2016 currently. There is no breach of the CHF peg at this time. It was just some computers gunning stop losses. Nothing to worry about. Please excuse me, as I have to take another call. Have a nice day!"

Are we looking at some shorts going into the qtr close as they window dress? Long VIX and/or Short Dow anyone?? So tempting...the Dow is so out of align with everything??

I'm in the middle of a move Sinner and haven't fully connected my bank of Super Computers yetBreadth starting to look reaallllyyy weak. T/H how's it looking in Aussieland?

12 Melb/Syd time there should be some more fire works today. Lots of "data" from China,

View attachment 46715

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.