over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,556

- Reactions

- 8,166

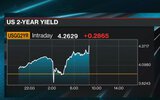

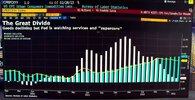

The question is why they're dumping and it's not because markets think inflation is under control.Quite the opposite to what I was expecting but, Hell, I'll take it.

Explosion|Implosion.... Pffft, whatevaaahhh!