- Joined

- 3 November 2013

- Posts

- 1,570

- Reactions

- 2,776

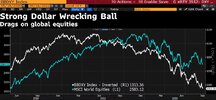

FedEx ringing the bell

finance.yahoo.com

finance.yahoo.com

FedEx issues ominous warning about the global economy, shares tumble

FedEx withdrew its full year earnings guidance as macro trends 'significantly worsened,' sending share tumbling in extended trading.