over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,422

- Reactions

- 7,841

Did you see they're actually thinking about topping them back up at the $80 mark?When

When does the US shut off SPR releases?

Did you see they're actually thinking about topping them back up at the $80 mark?When

When does the US shut off SPR releases?

Yep, but are those rumours or legit? I thought the SPR was still sitting above 50% capacityDid you see they're actually thinking about topping them back up at the $80 mark?

"The biden administration is considering..."Yep, but are those rumours or legit? I thought the SPR was still sitting above 50% capacity

Sleeping on it... the silly old goat"The biden administration is considering..."

Good afternoon/evening fugal.rock,What is it and what does it mean though? ?

Edumacate me please!

We might have an inflation problem but it's only going to be transitory.What is it and what does it mean though? ?

Edumacate me please!

Is that because inverted yield as such guarantees recession and no one will be able to afford anything, thus reducing inflation inflammation? ?We might have an inflation problem but it's only going to be transitory.

Honest >_>

Yield inversion is often correlated with a subsequent recession historically but not a Guarantee of recession.Is that because inverted yield as such guarantees recession and no one will be able to afford anything, thus reducing inflation inflammation? ?

Assume I'm as thick as 2 bricks and spell it out. Don't hold back.

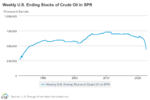

Was expected to end in October if inflation started coming down. However looks like they will have to go on for longer as inflation is still skyhigh and elections are still not done yet. I believe they are down to 434 now. Look at the chart link, its falling off a cliff, starting going down even before the war. the rate they are going, its probably only gonna last another 1.5years.When

When does the US shut off SPR releases?

Well because it's just inverted, this means that we only reckon the inflation is going to be short(er) term. A bit like just pumping the brakes on a speeding car for a second to wipe some speed off and get back to a safe pace after we pressed the throttle a bit too hard.Is that because inverted yield as such guarantees recession and no one will be able to afford anything, thus reducing inflation inflammation? ?

Assume I'm as thick as 2 bricks and spell it out. Don't hold back.

Is this an electric car or ICE though?Well because it's just inverted, this means that we only reckon the inflation is going to be short(er) term. A bit like just pumping the brakes on a speeding car for a second to wipe some speed off and get back to a safe pace after we pressed the throttle a bit too hard.

It's only when we realise that we were accelerating the car right before we went over the crest of a hill when we actually should have seen the crest coming and just coasted over it and there's now gravity (long term supply side problems) that's speeding it up instead of our foot on the throttle and that said gravity is also outside of our control (i.e we went over the crest of the hill way too fast) that we'll realise that we have to keep the brakes on much harder for much longer than we initially thought (long dated rates are going to soar as well).

There's also the non-linear nature of speed reduction we now have to contend with too. It takes the square of the increase in the amount to actually stop the car, so it takes 4x the distance to stop from 2x the speed, 9x the distance to stop from 3x the speed, and so on and so forth, so the problem becomes exponentially worse the more you go over your intended speed too, which we obviously have.

We're boned either wayIs this an electric car or ICE though?

Actually the inverted 2/10 yield curve DOES NOT 'guarantee' a recession. Having listened to the author (A university researcher/Ph.D student ? of some US University in maybe 1980's or 1990's) of the paper her wrote that assessed this phenomenon in a podcast he stated that 'it all depends on how long the inversion lasts for'. I can't remember for the life of me what timeframe it needs to be to 'statistically confirm the future occurrance of a recession' however just that it is inverted does not confirm a recession.Is that because inverted yield as such guarantees recession and no one will be able to afford anything, thus reducing inflation inflammation? ?

Assume I'm as thick as 2 bricks and spell it out. Don't hold back.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.