over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,479

- Reactions

- 7,967

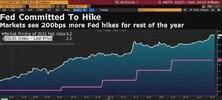

I'm going to go with no more rate hikes or at least much smaller ones. Once we see 50's and/or 25's we should be past the bottom.Broken windscreen and glass everwhere, car on it's roof, branches and leaves everywhere, airbags deployed and all partially submerged in a swamp.

Just to reuse the car analogy.