wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,954

- Reactions

- 13,247

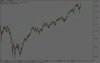

Totally agree Wayne, but some people seem obsessed either bullish or bearish, doesn't really matter.I am sure we have all at some point leant to far one way, I know I have, don't mind admitting it, I've lost plenty trying to short the market but really the recent bull run has been unstoppable.As we all know markets often react very differently to how we expect.

Sure the US is in trouble down the line, but the markets aren't confirming this with negative price action, infact quite the opposite.

All I am saying is look at what is happening now -, even with all the perceived problems.

Yep agree.

But looking at "why" the market is bullish, viz, the ridiculous .5% cut by Uncle Ben, and then "why" Uncle Ben cut .5%, could give a clue as to the future.