- Joined

- 27 May 2009

- Posts

- 54

- Reactions

- 0

Here is the interesting one...Arco would you be able to provide your feedback on that one.

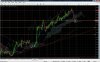

M30 on USDCAD does not look promising at all. Although I can observe KS/TS X and Chikou span is bullish, kumo sentiment is still bearish. However, on 4H chart the price just broke above bearish kumo and bullish kumo is forming. Am I missing something here? Perhaps I should wait for candle on 4H to close to get in....

My entry was at 1.0503 with SL @ 1.0476. Now I'm hoping for a long term trade here with price going to 50% fib of 1.0959-1.0205 decline. However I do have a feeling that SL is rather tight for such long position. Any comment?

And lastly (I hope you don't mind me picking your brain - but I do find Ichimoku rather fascinating topic ) if say on 4H TM you have a clear bearish sentiment would you still trade long on lower TM say M30 or 1H?

) if say on 4H TM you have a clear bearish sentiment would you still trade long on lower TM say M30 or 1H?

Cheers

M30 on USDCAD does not look promising at all. Although I can observe KS/TS X and Chikou span is bullish, kumo sentiment is still bearish. However, on 4H chart the price just broke above bearish kumo and bullish kumo is forming. Am I missing something here? Perhaps I should wait for candle on 4H to close to get in....

My entry was at 1.0503 with SL @ 1.0476. Now I'm hoping for a long term trade here with price going to 50% fib of 1.0959-1.0205 decline. However I do have a feeling that SL is rather tight for such long position. Any comment?

And lastly (I hope you don't mind me picking your brain - but I do find Ichimoku rather fascinating topic

Cheers

.

.