Those bastard didn't charge you an arm and a leg.My new Stratco shed thats coming will drive demand

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How Far Will The Market Fall?

- Thread starter IFocus

- Start date

-

- Tags

- market collapse

IFocus

You are arguing with a Galah

- Joined

- 8 September 2006

- Posts

- 7,668

- Reactions

- 4,758

Those bastard didn't charge you an arm and a leg.

I didn't feel completely raped after paying

The spec is OK for what it is plus they changed a few things for me.

It gets delivered 1st of May guess I'll find out putting it up.

- Joined

- 3 July 2009

- Posts

- 27,725

- Reactions

- 24,691

A tip, that you may already have covered, if it doesn't include insulation under the roof tin. Grab some like insulbreak or similar and get the guys to chuck it under the roof sheets, it makes it bearable in summer.I didn't feel completely raped after paying

The spec is OK for what it is plus they changed a few things for me.

It gets delivered 1st of May guess I'll find out putting it up.

Just a thought, but you probably have already covered it.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

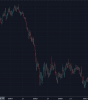

Market thought:

The first leg down was sharp and deep.

The reflexive rally since then has reflected relative strength of different sectors and countries.

Everyone is speculating about V bottom vs re-test of the lows or whatever. People are thinking the next leg will be the same as the first leg.

My thoughts are that we will probably go lower, but it is going to be an ugly/drawn out/choppy route.

The most common market reaction after big vol spikes across all asset classes is extended chop, even within a trending environment.

Those positioned for a repeat of the first leg might eventually be right in price, but not in time and space.

The first leg down was sharp and deep.

The reflexive rally since then has reflected relative strength of different sectors and countries.

Everyone is speculating about V bottom vs re-test of the lows or whatever. People are thinking the next leg will be the same as the first leg.

My thoughts are that we will probably go lower, but it is going to be an ugly/drawn out/choppy route.

The most common market reaction after big vol spikes across all asset classes is extended chop, even within a trending environment.

Those positioned for a repeat of the first leg might eventually be right in price, but not in time and space.

Attachments

- Joined

- 3 July 2009

- Posts

- 27,725

- Reactions

- 24,691

Good summation IB, I can't help but feel the underlying market fallout, isn't going to be as bad as expected.Market thought:

The first leg down was sharp and deep.

The reflexive rally since then has reflected relative strength of different sectors and countries.

Everyone is speculating about V bottom vs re-test of the lows or whatever. People are thinking the next leg will be the same as the first leg.

My thoughts are that we will probably go lower, but it is going to be an ugly/drawn out/choppy route.

The most common market reaction after big vol spikes across all asset classes is extended chop, even within a trending environment.

Those positioned for a repeat of the first leg might eventually be right in price, but not in time and space.

Discretionary spending, hospitality, tourism and education will be hammered, but the productive side of the economy still seems to be ticking over, I feel the Government spend has kept the consumer staples ticking over which flows through into the agricultural sector and mining is still bubbling along.

So as you say, I also think if there is a fall or rise, it will be a long protracted event.

There will be good news mixed with the bad.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,962

- Reactions

- 13,264

...and central banks are buying everything in sightGood summation IB, I can't help but feel the underlying market fallout, isn't going to be as bad as expected.

Discretionary spending, hospitality, tourism and education will be hammered, but the productive side of the economy still seems to be ticking over, I feel the Government spend has kept the consumer staples ticking over which flows through into the agricultural sector and mining is still bubbling along.

So as you say, I also think if there is a fall or rise, it will be a long protracted event.

There will be good news mixed with the bad.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

...and central banks are buying everything in sight

Buying junk bonds or whatever in the secondary markets using bank reserves is completely ineffective and will have no effect on the real economy and if it has any effect on asset market it is only via a trick of perception on real money accounts who are foolish enough to believe the Fed has power, not by virtue of any technical actions they took.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,962

- Reactions

- 13,264

Yeah but that's not all they're buyingBuying junk bonds or whatever in the secondary markets using bank reserves is completely ineffective and will have no effect on the real economy and if it has any effect on asset market it is only via a trick of perception on real money accounts who are foolish enough to believe the Fed has power, not by virtue of any technical actions they took.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Yeah but that's not all they're buying

Bank reserves are inert.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,962

- Reactions

- 13,264

So are the chemical properties of Gold.Bank reserves are inert.

The alphabet soup of Fed activities (both disclosed and undisclosed) are distortionary(sic) for price discovery however.

- Joined

- 14 February 2005

- Posts

- 15,340

- Reactions

- 17,656

An issue I see is the contrast between Australia and the US with the background situation of COVID-19 and responses to it.

Given this is an Australian site and most of us are investing at least partially on the ASX there's a natural tendency to focus on the Australian situation. Looking at the US though, well they're on track to hit 1 million COVID-19 cases about Tuesday - Wednesday next week Australian time. They've got a shockingly high death rate and overall a situation that's drastically worse than that in Australia at the present time.

Whilst Australia might be considering re-opening for business a few weeks from now, it's going to be considerably longer in the US at least unless they're willing to end up with a huge death toll. It's hard to say exactly what the time lag is, but Australia achieved a leveling off in active cases 3 weeks ago and that has since been followed by decline. The US hasn't achieved that leveling off yet, so they're at least 3 weeks behind where we are and probably longer. It's not back to business as usual in a hurry.

So far as the market is concerned, well my concern is that no matter what factors either technical or fundamental might support the ASX going up or sideways, we could well see it dragged down by influences from the US in particular. Some will argue that there's not really that much correlation between the two but I'll pose a question. If the S&P 500 re-tests the lows or goes to new lows, then does anyone seriously think the ASX won't at least see a decent slump?

Given this is an Australian site and most of us are investing at least partially on the ASX there's a natural tendency to focus on the Australian situation. Looking at the US though, well they're on track to hit 1 million COVID-19 cases about Tuesday - Wednesday next week Australian time. They've got a shockingly high death rate and overall a situation that's drastically worse than that in Australia at the present time.

Whilst Australia might be considering re-opening for business a few weeks from now, it's going to be considerably longer in the US at least unless they're willing to end up with a huge death toll. It's hard to say exactly what the time lag is, but Australia achieved a leveling off in active cases 3 weeks ago and that has since been followed by decline. The US hasn't achieved that leveling off yet, so they're at least 3 weeks behind where we are and probably longer. It's not back to business as usual in a hurry.

So far as the market is concerned, well my concern is that no matter what factors either technical or fundamental might support the ASX going up or sideways, we could well see it dragged down by influences from the US in particular. Some will argue that there's not really that much correlation between the two but I'll pose a question. If the S&P 500 re-tests the lows or goes to new lows, then does anyone seriously think the ASX won't at least see a decent slump?

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

OK, my turn to guess. Let's see...The tide has definitely gone out in the oil market and we'll soon see who's been swimming without bathers.

It would be funny to see them start a program abbreviated as STIMMYAs you said more probably more undisclosed ones, but below is some of the disclosed

View attachment 102566

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

My comments pertained to the equity markets in general. Today's price action in the ASX was very bullish. This may not be apparent in the banks and the top 20 but buyers were happy to pile into riskier equities (XSO and XEC). Did we see a panic selloff just before the close today, knowing that it's a extra long weekend for the ASX? FOMO is alive and well in the ASX today.

Still feeling this vibe @peter2 ?

- Joined

- 12 January 2008

- Posts

- 7,365

- Reactions

- 18,408

That comment seems so long ago. Gold and oil have both gone up and down since then. The XAO still struggles to go up and the bounce off the low is only 38%. There's been plenty of opportunities to trade stocks in the bounce off the lows but that seems to have petered out. Buying now seems like chasing. I've gone to cash anticipating another dip to the low but there's no panic selling atm. Talk about easing restrictions and restarting the economy has strengthened the demand. Nobody has a clue how the shutdown has impacted most companies until they report. Ascertaining value must be difficult without information. I ride the coat tails of the large insto investors and I'm still waiting for them to show up.

If the XAO closes above 5600 I have to start buying, but I'll do it cautiously and sparingly. I'd love to see a dip to the low again soon. In the meanwhile I'm buying into gold rallies, shorting oil rallies and day trading US equities.

If the XAO closes above 5600 I have to start buying, but I'll do it cautiously and sparingly. I'd love to see a dip to the low again soon. In the meanwhile I'm buying into gold rallies, shorting oil rallies and day trading US equities.

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

I have also been very much on the cautious side and not having the confidence to participate, especially with the big Banks not participating in the rally. There is signs they may join in, based on price rise today:

My thinking was, without broader market participation, you can get caught up in some of the growth speculation stocks that are bouncing back. If history is any guide, they will usually reverse the moment I catch them after chasing the fast rallies

Anyway, today I have decided to dip the toe in, very selectively though because I think some sectors may be too risky to venture into even now.

So I bought Beach Energy Ltd (BPT) today which is a really well run stock in the Energy sector, been following this stock for years. Beach has cash to withstand the Oil crash and no debt as well as low production costs. Price has crashed along with all the other risky Energy stocks in the sector giving me a chance to buy around 50% discount to the Jan peak. Will update purchase details in Speculative Stock Portfolio later in the evening...

My thinking was, without broader market participation, you can get caught up in some of the growth speculation stocks that are bouncing back. If history is any guide, they will usually reverse the moment I catch them after chasing the fast rallies

Anyway, today I have decided to dip the toe in, very selectively though because I think some sectors may be too risky to venture into even now.

So I bought Beach Energy Ltd (BPT) today which is a really well run stock in the Energy sector, been following this stock for years. Beach has cash to withstand the Oil crash and no debt as well as low production costs. Price has crashed along with all the other risky Energy stocks in the sector giving me a chance to buy around 50% discount to the Jan peak. Will update purchase details in Speculative Stock Portfolio later in the evening...

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

So I bought Beach Energy Ltd (BPT) today which is a really well run stock in the Energy sector, been following this stock for years

@aus_trader "The Ducati Blue Bar Strategy" chart confirms "dipping your toe in" at this time is warranted as a buy signal has been generated today.

"The Ducati Blue Bar Strategy" has the uncanny ability in picking the move. Will this move be successful, only time will tell.

Skate.

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Excellent Skate, always like getting some technical support to back a buying decision.@aus_trader "The Ducati Blue Bar Strategy" chart confirms "dipping your toe in" at this time is warranted as a buy signal has been generated today.

View attachment 103056

"The Ducati Blue Bar Strategy" has the uncanny ability in picking the move. Will this move be successful, only time will tell.

Skate.

This stock has fallen far more than what I expected, dragged down by the broader market sell down as well as ETF sell down. BPT is in the ASX top 200, so any of those local Index ETF's would have it as one of it's constituents.

I also bought a finger-licking stock close to the market close

Similar threads

- Replies

- 0

- Views

- 3K

- Replies

- 85

- Views

- 27K