- Joined

- 1 June 2007

- Posts

- 173

- Reactions

- 0

Hong Kong is undergoing a rare bout of deflation, brought on by the Asian financial crisis in 1997 and following a strong inflationary trend that lasted for decades in the territory. Economic contraction in Hong Kong has never previously resulted in inflation dipping below zero and recovery was invariably quick. The present deflationary situation is unique. On the one hand, the economic adjustment needed after the crisis was substantial; on the other, this adjustment could only be achieved through real cost reduction, as the linked exchange rate system prevents any nominal adjustment through currency depreciation. To restore external competitiveness, Hong Kong's property prices and wage costs had to fall and this inevitably led to serious deflation. In the more than two years since the outbreak of the crisis, Hong Kong property prices have roughly halved from their peak and wages have been slashed or frozen. Have they fallen enough to revive cost competitiveness and bring an end to this deflationary cycle?

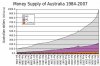

Don't come tell me property prices don't fall fellow posters. This an atricle from 2000 post the Asian financial crisis....admittedly may not be the same situation ....but for better or worse who knows, agreed in the long term house prices are a good investment and if your raising a family who gives a toss.......but fact is property prices can and do fall....look at HK and Japan following their falls from property booms........and now the US and the UK......