So let me ask the property bears this - if the supply/demand argument is bogus, why HAVEN'T Oz prices fallen in line long ago with the UK and US??

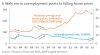

Simple - economic conditions are not as bad presently as the UK or US, in terms of unemployment, lending criteria and other factors driving businesses, and home owners to the wall.

In fact, these things are starting to happen in smaller numbers, and the signs are not too encouraging for next year.

Whether the rest of the world pulls through in late 2009, and helps Australia come out of this before the worst of it hits is the million dollar question. Maybe we will.

More signs of the times... increased holiday vacancies, reduced rates to attract wealthier holidaymakers.

http://www.news.com.au/business/money/story/0,28323,24807152-5017313,00.html