From memory, IPL seems to have paid a very high price for the current stock of fertiliser. Also I have read the local farmers were complaining about IPL in passing this mistake to them, in the form of high priced "poo''. A 6 cents bounce at the moment.

Haunting's economics blog

- Thread starter haunting

- Start date

-

- Tags

- blog china economics global economy

- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

Cheers Haunting, another interesting post.

Our property market has to be about the only one that hasn't experienced a serious correction to date........

Our property market has to be about the only one that hasn't experienced a serious correction to date........

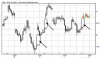

Here's how I see it. 3 arrows pointing at 3 sets of red candle showing the "pattern" of selling.

Arrow 1 shows there were two strong red candles due to hard selling.

Arrow 2 shows a very strong red candle indicating there was a strong selling day but the magnitude was declining as shown by the higher low.

Arrow 3 shows the selling has receded with 2 very weak red candles.

What's next?

Possibly a break out of the 81.50 resistance but the real resistance is actually 82.50, that is where we will find out what is the real strength of the US$.

Let's watch.

Arrow 1 shows there were two strong red candles due to hard selling.

Arrow 2 shows a very strong red candle indicating there was a strong selling day but the magnitude was declining as shown by the higher low.

Arrow 3 shows the selling has receded with 2 very weak red candles.

What's next?

Possibly a break out of the 81.50 resistance but the real resistance is actually 82.50, that is where we will find out what is the real strength of the US$.

Let's watch.

Attachments

- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

Yes, that is the level I am looking for this bounce to reach. At 82.50 area I will be looking to re-establish shorts.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,645

- Reactions

- 12,247

The GD sent the market down 90% or so. That's another 50% or so from here I guess. So, if we have some cash, or have enough invested that gives us a good margin lend, it will be an absolutely amazing buying opportunity once the worst case scenarios eventuate. Whoohoo!! Stop painting fear and see the opportunity that this crisis/depression represents. Already some people saw that there was going to be significant bear bounce, which has been a great trading op. Those who were too scared to invest sat on the side and saw their cash earn 2% or so. I was only half invested but still has earnt me more than the average wage. Yes, the economy is ****e, but lets see the opportunity!!! A once in a lifetime opportunity!! Good luck.

Has China gone too far?... by A.Kohler

But with any luck China’s fiscal and monetary stimulus will see us through till the rest of the world starts to recover...

Nice Alan. That's assuming China firstly still play nice with some Aussie miners; secondly they do not feel threatened at all by the merger of the two miners; and thirdly, they are some kind of lame duck which can only swim around in a circle panicking whilst knowing the hunter and his dogs are closing in on it...

Yes? They are some lame ducks, right?

Gud on ya... I luv your story.

... and your expert view.

But with any luck China’s fiscal and monetary stimulus will see us through till the rest of the world starts to recover...

Nice Alan. That's assuming China firstly still play nice with some Aussie miners; secondly they do not feel threatened at all by the merger of the two miners; and thirdly, they are some kind of lame duck which can only swim around in a circle panicking whilst knowing the hunter and his dogs are closing in on it...

Yes? They are some lame ducks, right?

Gud on ya... I luv your story.

... and your expert view.

World Bank, OECD grim; glimmers from Germany, Japan... this piece of news kind of brought up a report I read not too long ago. That is, because of the dying of the US consumption, the export dependent countries such as Japan, Germany... and China will suffer. In another report, from UK as usual, the writer was kind of pointing his finger at China(not sure), Germany and Japan in particular I think, accusing them of... because of their dirty habit of big time saving whilst vigorously exporting to others who couldn't stop consuming, they have now created such a humongous imbalance in the global financial system that these saver nations are now deserving every bit of misery bestowed on them - like collapse in exports and the ensuing crashing of economy due to the large contribution of these exports to the overall economy.

And to top it all, if the consuming nations (read US+UK+friends) were to default on their debt, these saver nations should blame themselves... coz, they are part of the cause of the GFC.

Great argument huh?

Well, I agree firstly with the collapse in exports in these big exporting nations and the ensuing contraction in their respective economy. No argument here.

But accusing them of saving too much and not spending enough? There is a lot of crap there, if not, a very one-eyed argument that could only come from some UK media brain, which typically is very pessimistic and chauvinistic since quite some of them are still living through the Great British Empire withdrawal syndrome as well as the memory of winning the WWII. Naturally the Germans should always be treated with suspicion if not derision... it's the only right thing to do.

Anyway, I got side tracked. I was actually wanting to talk about the "made in China" badge.

From a report not too long ago, it was highlighting the fact that whilst the "West", as usual, it means US+UK are believing the Chinese economy will suffer because of their lack of domestic market and the over dependence on exports, they will not be able to absorb the excess capacity due to the drop of consumption in the West.

This is partially true as reflected in the Chinese economy. But, the report went ahead and pointed out that may be someone should analyse deeper into the Chinese exports because whilst the Chinese is exporting bulk of the export in the made in China badge as in a finished product, many of its key components are made elsewhere. Hence in terms of real percentage of damage, the Chinese did not come off as bad as some of these component makers since the Chinese contribution constituted only a small part (labour mainly)of the overall value of the goods.

A good example the report has given is Ipod (I think) - it is assembled in China as the final product, but the most important and costly component was made elsewhere (Japan, for eg)... etc, hence, it kind of explain why in this world of trades and death to the evil exporters blame game, China doesn't seem to be hurting that much comparing to Japan and Germany.

The report went further to explore the life of such made-in-China goods and surprisingly it observed and concluded that a large number of these goods was actually consumed within China (can't remember the %, but it was something like 40% or 60%...)

That probably explains why China is now the world's largest auto market, I think.

And to top it all, if the consuming nations (read US+UK+friends) were to default on their debt, these saver nations should blame themselves... coz, they are part of the cause of the GFC.

Great argument huh?

Well, I agree firstly with the collapse in exports in these big exporting nations and the ensuing contraction in their respective economy. No argument here.

But accusing them of saving too much and not spending enough? There is a lot of crap there, if not, a very one-eyed argument that could only come from some UK media brain, which typically is very pessimistic and chauvinistic since quite some of them are still living through the Great British Empire withdrawal syndrome as well as the memory of winning the WWII. Naturally the Germans should always be treated with suspicion if not derision... it's the only right thing to do.

Anyway, I got side tracked. I was actually wanting to talk about the "made in China" badge.

From a report not too long ago, it was highlighting the fact that whilst the "West", as usual, it means US+UK are believing the Chinese economy will suffer because of their lack of domestic market and the over dependence on exports, they will not be able to absorb the excess capacity due to the drop of consumption in the West.

This is partially true as reflected in the Chinese economy. But, the report went ahead and pointed out that may be someone should analyse deeper into the Chinese exports because whilst the Chinese is exporting bulk of the export in the made in China badge as in a finished product, many of its key components are made elsewhere. Hence in terms of real percentage of damage, the Chinese did not come off as bad as some of these component makers since the Chinese contribution constituted only a small part (labour mainly)of the overall value of the goods.

A good example the report has given is Ipod (I think) - it is assembled in China as the final product, but the most important and costly component was made elsewhere (Japan, for eg)... etc, hence, it kind of explain why in this world of trades and death to the evil exporters blame game, China doesn't seem to be hurting that much comparing to Japan and Germany.

The report went further to explore the life of such made-in-China goods and surprisingly it observed and concluded that a large number of these goods was actually consumed within China (can't remember the %, but it was something like 40% or 60%...)

That probably explains why China is now the world's largest auto market, I think.

Talking gold can be a sensitive subject here because you can never tell if you are in the company of a goldbug...

But, what the heck, if there's money in it, why not?

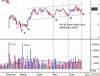

Three charts, chart1- 60 min DXY chart, chart2 - Gold futures weekly, chart 3 - Gold daily.

Chart1 shows it takes only relatively small bounce in the US$ to knock the gold down a fair chunk (refer to the gold daily chart).

Why? Dunno.

But if you buy the suggestion that it's due to safe haven type of flight to safety investment tactic, then, you really need to ask this question on how come gold is not considered as a safe haven this time?

The US$ and US$ based assets are safe haven and gold is not? Funny that...

In any case DXY and the US$ I suspect will be moving range bound as suggested in one of my earlier post elsewhere. The rationale in this scenario rests entirely on the need to stabilise the US$ and the cost of borrowing just so the US can press on with their QE without showing too much strain causing a wholesale loss of confidence in the US$ and US's ability to rescue its economy from a severe recession.

What better rationale or justification in telling the whole wide world that the US$ and US$ based assets are safe havens.?

Assuming this marketing tactic works and US$ is again believed by the "people" of the world that it is safe and it is worth, say at the current "value" - can you hear the collective sigh of relief from all the vested interests among the big global palyers? The USA is happy again because it can now sell more bonds, the EU is happy because the EUR is dropping and the W.European banks won't have to face up to the pressure of writing off more bad loans in E.Europe; the Japanese are happy coz the Yen is cheap again, and the Chinese, their 760bln US$ asset is safe...

Nice and happy all round. And why not?

But what about gold?

Tough man. If the US$ were to nudge higher, gold I think will drop lower to about 860... yes measured in US$. At the moment, it's still not that obvious and certain that the drop will come as shown by the weekly gold chart - the up trend is still in tact but shaky.

By next week may be we will be able to detect a firmer trend, but meantime, if you are holding gold, or gold stocks... errh, good luck and plenty of it too.

But, what the heck, if there's money in it, why not?

Three charts, chart1- 60 min DXY chart, chart2 - Gold futures weekly, chart 3 - Gold daily.

Chart1 shows it takes only relatively small bounce in the US$ to knock the gold down a fair chunk (refer to the gold daily chart).

Why? Dunno.

But if you buy the suggestion that it's due to safe haven type of flight to safety investment tactic, then, you really need to ask this question on how come gold is not considered as a safe haven this time?

The US$ and US$ based assets are safe haven and gold is not? Funny that...

In any case DXY and the US$ I suspect will be moving range bound as suggested in one of my earlier post elsewhere. The rationale in this scenario rests entirely on the need to stabilise the US$ and the cost of borrowing just so the US can press on with their QE without showing too much strain causing a wholesale loss of confidence in the US$ and US's ability to rescue its economy from a severe recession.

What better rationale or justification in telling the whole wide world that the US$ and US$ based assets are safe havens.?

Assuming this marketing tactic works and US$ is again believed by the "people" of the world that it is safe and it is worth, say at the current "value" - can you hear the collective sigh of relief from all the vested interests among the big global palyers? The USA is happy again because it can now sell more bonds, the EU is happy because the EUR is dropping and the W.European banks won't have to face up to the pressure of writing off more bad loans in E.Europe; the Japanese are happy coz the Yen is cheap again, and the Chinese, their 760bln US$ asset is safe...

Nice and happy all round. And why not?

But what about gold?

Tough man. If the US$ were to nudge higher, gold I think will drop lower to about 860... yes measured in US$. At the moment, it's still not that obvious and certain that the drop will come as shown by the weekly gold chart - the up trend is still in tact but shaky.

By next week may be we will be able to detect a firmer trend, but meantime, if you are holding gold, or gold stocks... errh, good luck and plenty of it too.

Attachments

This easy money call to attract more gullible money from the investing public... is DISGUSTING to say the least. To recycle an old write up on a day where the market is facing a serious selling off with a real potential of further selling frankly is not forgivable. It's just not good enough. *&^%$!

Attachments

Attack dog retreats on China investment...

Yes, I know I have been on and on and on this China investment for a friggin' long time... I know. And I know not many people like this kind of drivel, but then if you can look further than this petty parochial OZ vs China mentality and see them as our new future financier for our mining industry and jobs and a better economy, then, at a min, there's no need of such stupid maneuvers as described in this news from Swan's department.

Which brings to the question - how much Chinese "true friend" Kevin Rudd meant the last time when he was in Beijing lecturing the Chinese on Tibet? In my eyes, this guy wears a "I'm a Chinese expert" label on is head but in reality and in action, he is behaving like a buffoon when come to dealing with the Chinese - from not wanting to sit near an ex-Chinese ambassador to Oz on TV interview to his proposal of wanting to act as a leader in an Asian-Pacific grouping including China, the USA, Japan, etc... very clownish and very childish.

An expert? Nah!

(...he won't be getting my vote in the next election, I can assure you)

Back to the question of future Chinese investment that potentially could mean many jobs to Aussies, with the current policy not changing and is continually projecting a discriminatory attitude towards the Chinese, I am not so sure if the Chinese will still take it sitting down. And if I read them right, they will hit back, in one way or other.

Just wait and see, esp on how they conclude their deal with RIO, and possibly BHP... this should serve as a litmus test.

Yes, I know I have been on and on and on this China investment for a friggin' long time... I know. And I know not many people like this kind of drivel, but then if you can look further than this petty parochial OZ vs China mentality and see them as our new future financier for our mining industry and jobs and a better economy, then, at a min, there's no need of such stupid maneuvers as described in this news from Swan's department.

Which brings to the question - how much Chinese "true friend" Kevin Rudd meant the last time when he was in Beijing lecturing the Chinese on Tibet? In my eyes, this guy wears a "I'm a Chinese expert" label on is head but in reality and in action, he is behaving like a buffoon when come to dealing with the Chinese - from not wanting to sit near an ex-Chinese ambassador to Oz on TV interview to his proposal of wanting to act as a leader in an Asian-Pacific grouping including China, the USA, Japan, etc... very clownish and very childish.

An expert? Nah!

(...he won't be getting my vote in the next election, I can assure you)

Back to the question of future Chinese investment that potentially could mean many jobs to Aussies, with the current policy not changing and is continually projecting a discriminatory attitude towards the Chinese, I am not so sure if the Chinese will still take it sitting down. And if I read them right, they will hit back, in one way or other.

Just wait and see, esp on how they conclude their deal with RIO, and possibly BHP... this should serve as a litmus test.

Read about them expert view on China...

Frankly if they were to spend a bit of time tracing the Chinese cultural traits back to the Pre-Christ era, they probably could see much clearer and understand better.

Here's the biggest clue I hope they can see - the Great Wall of China. You can even see this sucker from the moon.

Why did so many Chinese dynasties through centuries built and extended this wall? Very simple - to keep the barbarians out and to keep the Chinese citizens in.

If someone has been trying so hard to keep others out of their country, would they really want to rule the rest of the world? Which basically mean more headache if you were to think along the line of building another wall?

Ok, if this doesn't make sense to you... try seeing more objectively from the Chinese angle on how the current Communist ruler in China conduct their affairs. The out cry from the West is they oppress and suppress their own citizens and deny them their freedom, justice and a whole lots of other western ideals... quite true if you are outside looking in and if you are not aware of the Chinese idea of how to keep your dynastic rein running for a thousand years.

Yes, it's quite obvious - the current Chinese communist rulers are doing exactly what the Chinese rulers have been doing in the last 10,000 years... for example, instead of building a physical great wall, they have build a new great firewall to keep their people in, away from all the outside influence, so their dynasty can remain safe.

They are quite good in doing that as they have been doing that for thousands of years.

Do they have time and energy and the ambition to rule the rest of the world and wage wars to conquer new territories?

Look, don't be silly. They rather do business with you than want to run your life. They already have a handful of people to worry about - 1.3bln and counting.

So take my words for it. They don't want to rule the world. They just want to do business with you...

Frankly if they were to spend a bit of time tracing the Chinese cultural traits back to the Pre-Christ era, they probably could see much clearer and understand better.

Here's the biggest clue I hope they can see - the Great Wall of China. You can even see this sucker from the moon.

Why did so many Chinese dynasties through centuries built and extended this wall? Very simple - to keep the barbarians out and to keep the Chinese citizens in.

If someone has been trying so hard to keep others out of their country, would they really want to rule the rest of the world? Which basically mean more headache if you were to think along the line of building another wall?

Ok, if this doesn't make sense to you... try seeing more objectively from the Chinese angle on how the current Communist ruler in China conduct their affairs. The out cry from the West is they oppress and suppress their own citizens and deny them their freedom, justice and a whole lots of other western ideals... quite true if you are outside looking in and if you are not aware of the Chinese idea of how to keep your dynastic rein running for a thousand years.

Yes, it's quite obvious - the current Chinese communist rulers are doing exactly what the Chinese rulers have been doing in the last 10,000 years... for example, instead of building a physical great wall, they have build a new great firewall to keep their people in, away from all the outside influence, so their dynasty can remain safe.

They are quite good in doing that as they have been doing that for thousands of years.

Do they have time and energy and the ambition to rule the rest of the world and wage wars to conquer new territories?

Look, don't be silly. They rather do business with you than want to run your life. They already have a handful of people to worry about - 1.3bln and counting.

So take my words for it. They don't want to rule the world. They just want to do business with you...

Took a punt on the SUN yesterday, it turns out alright. According to their ann. they are rebranding themselves as the new Sun Uni Live or something like that, a shift back to their insurance biz. This probably explains the bounce and if the short term channel is telling anything, is this - some invisible hand doesn't want Sun to move too high, say beyond 7.00 per pop. With today's announcement, it probably makes sense to suspect the sale of their banking arm should be quite near...

Insurance seems to be the new growth sector judging by NAB's gobbling up the Aviva Aussie operation. With rising premium (last checked seems to indicate >10%), Sun without the bank may avoid burning itself out, and may turn out to be not so bad moving forward. But first, there's a need to find out how much they are going to flog their banking division - a good decent price will be a bonus.

Insurance seems to be the new growth sector judging by NAB's gobbling up the Aviva Aussie operation. With rising premium (last checked seems to indicate >10%), Sun without the bank may avoid burning itself out, and may turn out to be not so bad moving forward. But first, there's a need to find out how much they are going to flog their banking division - a good decent price will be a bonus.

Attachments

China's new Iron find... can't be good news for RIO and BHP. Also in a separate report , Wuhan spokesman was quoted to have said this... "Chinalco's failure tells us that we should cooperate with companies that are honest and faithful," - I would take it to reflect how the other Chinese biz people are thinking. Not good at all.

focus will be on Asian equities. If they falter on weak US equities overnight,

they could reduce the appetite for carry trades. In particular, AUD/USD will find it

increasingly difficult to ignore downside risks in Asian equities... against a weak equity background, markets will favour currencies that depend more on domestic demand than exports for growth... 'tis others' opinion.

In any case, the arrow seems to be pointing at RBA's hold on the current rate, with US Fed doing nothing with theirs, RBA is running out of option... the rate has to come down - my guess.

they could reduce the appetite for carry trades. In particular, AUD/USD will find it

increasingly difficult to ignore downside risks in Asian equities... against a weak equity background, markets will favour currencies that depend more on domestic demand than exports for growth... 'tis others' opinion.

In any case, the arrow seems to be pointing at RBA's hold on the current rate, with US Fed doing nothing with theirs, RBA is running out of option... the rate has to come down - my guess.

Attachments

... the news

Australian energy retailer, AGL Energy, may be forced to write down assets. Merrill Lynch analysts said that AGL may have to make a total write-down of $A1.3 billion for its Southern Hydro, Powerdirect and Loy Yang A assets. Its stake in Loy Yang could be at risk if lenders will not refinance a $A515 million debt facility due in November 2010.

But... now that it is all out in the open, opportunity could be knocking... soon.

Australian energy retailer, AGL Energy, may be forced to write down assets. Merrill Lynch analysts said that AGL may have to make a total write-down of $A1.3 billion for its Southern Hydro, Powerdirect and Loy Yang A assets. Its stake in Loy Yang could be at risk if lenders will not refinance a $A515 million debt facility due in November 2010.

But... now that it is all out in the open, opportunity could be knocking... soon.

Attachments

FMG is overpriced?

You bet. In fact most iron ore plays by now are beginning to smell stale and it's about time to get off the train. But how many are actually seeing the early alert? Doubt if there's any. In every party, there are always people who would stay to the end and ended up switching off the light. The last one to go usually has this "honour". This time around, there shouldn't be any difference.

The party will not end just like that though... it will drag on for a while. The smaller, more speculative mines will be the ones making big $$$ for the speculators first (like now) but they are the fly traps that will eventually end up killing the most flies - small flies that couldn't resist staying on after getting their fill of the bait... many small speculators will get their hands burned this time by the small mines, which are basically a plot of land in the wild with a lot of dirt and a lot of hot air. And the vendors? They would tell you they have received many calls from China so they can pass off the deal with potential Chinese interest. Haha... there's a Chinese gold rush on going if you are not aware!

The bigger flies? They will die in the hand in the likes of FMG, which basically doesn't have a lot of substance - an empty vessel if you like - 3 quarters of air and the rest is dirt with iron ore and a lot of debt. Eventually, Tricky Twiggy will be selling his share to the Chinese to pay off his debt, and losing the whole plot in the process. The Chinese simply do not trust him, as they see him to be a very good operator but a cunning one. They don't see a lot of "honour" in him, esp his words. They don't like to do biz with people who don't honour and twist their words.

To the Chinese, your words and hand shake matter more than a piece of paper contract. Much much more. That's why they are furious with RIO, and the local Chinese experts and media brains in Australia, have no idea of what's important and what's not... to the Chinese. It's a perspective thing. But at the end, there's always a price to pay for everything. Just remember that.

So how will the iron ore script plays out?

Watch the next two quarters first. Keep an eye on RIO's sales vs BHP's sales vs Vale's sales vs Chinese+Japanese demand. And if you like the thrill, check FMG's sales against the big three and feel the chill why someone would want to pay so much for FMG?

By 2015 or earlier, when the new Chinese iron ore find comes into production (and it will be and will be very low cost), it will become obvious to many then why RIO's and BHP's iron ore assets do not worth what you are paying them now. In addition try consider one important factor that help pushed the iron ore price to last year's high - BHP's hand in buying up all shippers from S.America to Asia to press for the last 15%.

The Chinese are trying hard to reverse that but they are still disorganised at this stage, hence they are unable to bargain more effectively. But they will regroup - if there were to be a next round of negotiation - it won't be this easy for BHP and RIO. If the Chinese can't get what they want this round, they will get it in the next round. It's just a matter of time, or a matter of how the cycle turns.

The rust is setting in, but then 2015 is still a long way to go... do you care? Do I care?

Nah... unless you are the long term buy and hold type.

You bet. In fact most iron ore plays by now are beginning to smell stale and it's about time to get off the train. But how many are actually seeing the early alert? Doubt if there's any. In every party, there are always people who would stay to the end and ended up switching off the light. The last one to go usually has this "honour". This time around, there shouldn't be any difference.

The party will not end just like that though... it will drag on for a while. The smaller, more speculative mines will be the ones making big $$$ for the speculators first (like now) but they are the fly traps that will eventually end up killing the most flies - small flies that couldn't resist staying on after getting their fill of the bait... many small speculators will get their hands burned this time by the small mines, which are basically a plot of land in the wild with a lot of dirt and a lot of hot air. And the vendors? They would tell you they have received many calls from China so they can pass off the deal with potential Chinese interest. Haha... there's a Chinese gold rush on going if you are not aware!

The bigger flies? They will die in the hand in the likes of FMG, which basically doesn't have a lot of substance - an empty vessel if you like - 3 quarters of air and the rest is dirt with iron ore and a lot of debt. Eventually, Tricky Twiggy will be selling his share to the Chinese to pay off his debt, and losing the whole plot in the process. The Chinese simply do not trust him, as they see him to be a very good operator but a cunning one. They don't see a lot of "honour" in him, esp his words. They don't like to do biz with people who don't honour and twist their words.

To the Chinese, your words and hand shake matter more than a piece of paper contract. Much much more. That's why they are furious with RIO, and the local Chinese experts and media brains in Australia, have no idea of what's important and what's not... to the Chinese. It's a perspective thing. But at the end, there's always a price to pay for everything. Just remember that.

So how will the iron ore script plays out?

Watch the next two quarters first. Keep an eye on RIO's sales vs BHP's sales vs Vale's sales vs Chinese+Japanese demand. And if you like the thrill, check FMG's sales against the big three and feel the chill why someone would want to pay so much for FMG?

By 2015 or earlier, when the new Chinese iron ore find comes into production (and it will be and will be very low cost), it will become obvious to many then why RIO's and BHP's iron ore assets do not worth what you are paying them now. In addition try consider one important factor that help pushed the iron ore price to last year's high - BHP's hand in buying up all shippers from S.America to Asia to press for the last 15%.

The Chinese are trying hard to reverse that but they are still disorganised at this stage, hence they are unable to bargain more effectively. But they will regroup - if there were to be a next round of negotiation - it won't be this easy for BHP and RIO. If the Chinese can't get what they want this round, they will get it in the next round. It's just a matter of time, or a matter of how the cycle turns.

The rust is setting in, but then 2015 is still a long way to go... do you care? Do I care?

Nah... unless you are the long term buy and hold type.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,645

- Reactions

- 12,247

While there's going to be a medium term blip in the market and oversupply/stockpile of IO, in 10 years time the tables will be turned once again and the demand from Chindia with xxxxx million peasants moving to cities and buying cars will probably mean there's not enough IO on the planet to appease them. Short term, I agree, longer term (not that much really) commodities will be even hotter. 2c

Similar threads

- Replies

- 75

- Views

- 11K

- Replies

- 47

- Views

- 14K

- Replies

- 6

- Views

- 4K

- Replies

- 39

- Views

- 10K