So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

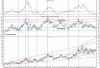

South African production has been falling since the 70s

world production has been falling since 2001.

world production has been falling since 2001.