You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,941

- Reactions

- 10,938

From another thread.

www.aussiestockforums.com

www.aussiestockforums.com

One wonders what effect the US Treasury purchase of BTC with gold reserves will have on the price of gold.

gg

Trump Era 2025-2029 : Stock and Economic Comment

Markets are getting nervous. This is your single biggest indicator of general market sentiment and as you can see it's shot up by miles since mid feb. HY = High Yield IG = Investment Grade (risky but high return vs AAA rated but low return. Rates are plotted on the left and right axes...

www.aussiestockforums.com

www.aussiestockforums.com

One wonders what effect the US Treasury purchase of BTC with gold reserves will have on the price of gold.

gg

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,941

- Reactions

- 10,938

how long is a piece of string bloke

just beautiful ...

Kind regards

rcw1

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,551

- Reactions

- 12,050

I think the average of the last 2 big gold bull markets was 8 x from the breakout. Not sure if the conditions are exactly the same.

- Joined

- 8 March 2007

- Posts

- 3,016

- Reactions

- 4,191

Have you taken into Consideration the Fact that the Earth is ROUND!

ie: NOT FLAT!

In a Round Earth World Ships and Everything look a lot smaller as they go further into the Horizon

As an old Architectural Student we called this PERSPECTIVE and

BTW I won the Australia wide Competition to Design and Build the 1970 Expo in OSAKA Japan in 1968/69

The rest is a long story

Back to "Perspective"

I have found that Long Term Calculations/ Prophesies are Best Studied in LOGARITHMIC SCALE!

FWIW: " The Friend is Your Friend Until She Is NOT"

ie: NOT FLAT!

In a Round Earth World Ships and Everything look a lot smaller as they go further into the Horizon

As an old Architectural Student we called this PERSPECTIVE and

BTW I won the Australia wide Competition to Design and Build the 1970 Expo in OSAKA Japan in 1968/69

The rest is a long story

Back to "Perspective"

I have found that Long Term Calculations/ Prophesies are Best Studied in LOGARITHMIC SCALE!

FWIW: " The Friend is Your Friend Until She Is NOT"

That's why the myth about Christopher Columbus' crew trying to mutiny as the ship got closer to falling off the edge of the earth is pure bulldust , Captain . Never happened !In a Round Earth World Ships and Everything look a lot smaller as they go further into the Horizon

Back on topic. I'll be hanging on to my Globalx gold etf and perth mint until they have made 100 % before I'll even think about bailing out . Not long to wait , I'm thinking now .

- Joined

- 29 January 2006

- Posts

- 7,221

- Reactions

- 4,450

Trump has proven his economic credentials beyond doubt, propelling gold to all time highs at a rapid pace.

We need to put aside his lies, geopolitical incompetence, and crashing of the stock market, to see where money flows in turbulent times.

Trump may well go down in history as presiding over the bigggliest increase in POG in the shortest timeframe, because there's a lot more to come.

What Trump is establishing is a level of isolationism that has never been contemplated by a so-called democracy, because it's actually a plutocracy wherin it's own key players openly flout the law to market products or legislate against their competition.

The crazy part is that the worst effects don't significantly impact markets for several months, which is why pundits see POG's upside continuing biggly.

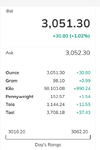

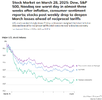

Overnight US markets:

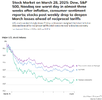

And overnight POG:

We need to put aside his lies, geopolitical incompetence, and crashing of the stock market, to see where money flows in turbulent times.

Trump may well go down in history as presiding over the bigggliest increase in POG in the shortest timeframe, because there's a lot more to come.

What Trump is establishing is a level of isolationism that has never been contemplated by a so-called democracy, because it's actually a plutocracy wherin it's own key players openly flout the law to market products or legislate against their competition.

The crazy part is that the worst effects don't significantly impact markets for several months, which is why pundits see POG's upside continuing biggly.

Overnight US markets:

And overnight POG:

- Joined

- 19 October 2005

- Posts

- 4,869

- Reactions

- 7,323

Tell us again what a great place communist China is. Send it to your masters. Should be good for some more brownie points.We need to put aside Trump's lies, geopolitical incompetence,

- Joined

- 20 July 2021

- Posts

- 12,312

- Reactions

- 17,142

can't be that bad .. the EU is desperate to be even harder and stricter , surely those refined Europeans ( where Communism was theorized ) would know all about empires and make informed choicesTell us again what a great place communist China is. Send it to your masters. Should be good for some more brownie points.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,941

- Reactions

- 10,938

Gold is quoted and traded in ounces. It is transferred in bulk however between countries in either 5 kilo or 10 kilo bars. So the price per kilogram is an important consideration. I believe New York prefers 5kg and London 10kg. Many of my fellow members who transfer gold between these two centres may be able to correct me if I am wrong. It did cause a bit of a kerfuffle recently when larger than normal amounts were going to the US. The smelters couldn’t keep up in changing size.

The price of gold per kilogram is $99,948.78 presently and $100,000 may be some resistance or support once exceeded going forward.

gg

The price of gold per kilogram is $99,948.78 presently and $100,000 may be some resistance or support once exceeded going forward.

gg

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,941

- Reactions

- 10,938

Sorry my quoting of the POG per kilogram was wrong. It is $USD 99,176.93Gold is quoted and traded in ounces. It is transferred in bulk however between countries in either 5 kilo or 10 kilo bars. So the price per kilogram is an important consideration. I believe New York prefers 5kg and London 10kg. Many of my fellow members who transfer gold between these two centres may be able to correct me if I am wrong. It did cause a bit of a kerfuffle recently when larger than normal amounts were going to the US. The smelters couldn’t keep up in changing size.

The price of gold per kilogram is $99,948.78 presently and $100,000 may be some resistance or support once exceeded going forward.

View attachment 196383

gg

gg

- Joined

- 13 February 2006

- Posts

- 5,370

- Reactions

- 12,460

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,551

- Reactions

- 12,050

Looks like it's only JUST broken up.

- Joined

- 25 July 2021

- Posts

- 881

- Reactions

- 2,224

I think that SPY will find a bottom soon and GLD will find a top. The SPY has the potential to make a big move up and GLD maybe only a small to medium move down. Just documenting my thoughts here.

- Joined

- 13 February 2006

- Posts

- 5,370

- Reactions

- 12,460

Looks like it's only JUST broken up

I think that SPY will find a bottom soon and GLD will find a top. The SPY has the potential to make a big move up and GLD maybe only a small to medium move down. Just documenting my thoughts here.

SPY is heading lower. We had the bounce early this week which proved to be very weak indeed. I think we may have seen the top in SPY for this cycle. The fundamentals are atrocious.

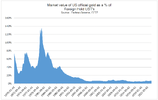

Re. gold:

With the market value of US official gold back to only 7% and a multipolar world clearly re-emerging, the chart above suggests that gold may be one of the cheapest assets on the board. It would need to triple just to get back to 1989 valuations relative to foreign-held USTs, and would have to rise nearly 20x to return to 1980 levels relative to foreign-held UST.

Gold has plenty of space to grow into.

We will see gold $4000oz this year.

jog on

duc

- Joined

- 25 July 2021

- Posts

- 881

- Reactions

- 2,224

- Joined

- 13 February 2006

- Posts

- 5,370

- Reactions

- 12,460

Gold and AI

If the AI and robotics revolutions achieve even a fraction of what they promise on even a reasonably investable time horizon, wide stretches of the debt-based monetary system (consumer debt, banks, sovereign debt) will be pushed into default

Defaults which global Central Banks will likely prevent on a nominal basis by printing money.

The cleanest 'AI' and 'robotics' plays is gold. You do not have to try to understand which AI and robotics platforms are likely to win. You just need to know AI and robotics are continuing to develop, which will force the status quo debt-based monetary system to collapse in time. Forcing global Central Bankers to print.

This is such an under-appreciated problem. The ultimate Luddite nightmare. My profession is towards the slower replacement with AI but I'm still concerned. I carry no debt other than a credit card balance, but mortgages are the potential collapse trigger for the financial system.

Anyway, food for thought. Simply another catalyst for gold moving much higher much more quickly.

jog on

duc

If the AI and robotics revolutions achieve even a fraction of what they promise on even a reasonably investable time horizon, wide stretches of the debt-based monetary system (consumer debt, banks, sovereign debt) will be pushed into default

Defaults which global Central Banks will likely prevent on a nominal basis by printing money.

The cleanest 'AI' and 'robotics' plays is gold. You do not have to try to understand which AI and robotics platforms are likely to win. You just need to know AI and robotics are continuing to develop, which will force the status quo debt-based monetary system to collapse in time. Forcing global Central Bankers to print.

This is such an under-appreciated problem. The ultimate Luddite nightmare. My profession is towards the slower replacement with AI but I'm still concerned. I carry no debt other than a credit card balance, but mortgages are the potential collapse trigger for the financial system.

Anyway, food for thought. Simply another catalyst for gold moving much higher much more quickly.

jog on

duc

- Joined

- 25 July 2021

- Posts

- 881

- Reactions

- 2,224

In my mind the question is 'when will this really start to happen?' Next year would be a time to watch closely, being the second year of an election cycle.Gold and AI

View attachment 196415

If the AI and robotics revolutions achieve even a fraction of what they promise on even a reasonably investable time horizon, wide stretches of the debt-based monetary system (consumer debt, banks, sovereign debt) will be pushed into default

Defaults which global Central Banks will likely prevent on a nominal basis by printing money.

The cleanest 'AI' and 'robotics' plays is gold. You do not have to try to understand which AI and robotics platforms are likely to win. You just need to know AI and robotics are continuing to develop, which will force the status quo debt-based monetary system to collapse in time. Forcing global Central Bankers to print.

This is such an under-appreciated problem. The ultimate Luddite nightmare. My profession is towards the slower replacement with AI but I'm still concerned. I carry no debt other than a credit card balance, but mortgages are the potential collapse trigger for the financial system.

Anyway, food for thought. Simply another catalyst for gold moving much higher much more quickly.

jog on

duc

Similar threads

- Replies

- 4

- Views

- 967

- Replies

- 171

- Views

- 11K

- Replies

- 9

- Views

- 2K