Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,989

- Reactions

- 11,051

I don't believe so, although on the face of it it should. The Ugandan deposit is estimated at $USD 12tn. China a few days ago announced a find of $USD 83b assayed which they estimate would last demand for only 1.4 years in China. So I will use China demand and those figures as a reference point.Is there much effect from the Ugandan gold deposit?

So just using fingers with some rounding to estimate, the Ugandan find if verified and mined would supply Chinese demand for 200 years. This is not world demand but it is still huge.

On the other side of the argument is Uganda which is an absolute shithole with an average earnings number for the unfortunate inhabitants of $800 a year. It is rife with corruption and tribal discord. They tossed out all their Indian inhabitants about 50 years ago who made the joint run and it relies on the usual suspects, World Bank, UNESCO and other asshiners to keep the show going. The Chinese are assisting with their Gold industry which is very kind of them and about the only positive which shows how bright the Ugandans are.

In addition between 20,000 and 40,000 poor souls are engaged in illegal mining of gold and are treated horribly when caught. The rich get richer and the poor poorer. There will be civil disturbance there for years, accelerating if the gold actually exists.

The Ugandan "find" is by aerial survey only and nobody has gotten off their butt to begin to survey and confirm by drilling, assays etc. So were the possie in the US, China or even India I would imagine it could have an effect. Even if it would supply China demand for 200 years it will take the Ugandans that number of years to actually get it in to bar, most of it will go to the Chinese, local Chieftains, Ju-Ju men and urchins.

gg

- Joined

- 13 February 2006

- Posts

- 5,381

- Reactions

- 12,486

1. I find it puzzling, and perhaps indicative of bias, that you would respond to my question of 'how might this affect things?' with 'I disagree'. That's not a valid answer to a question about how much of something does or will exist.

2. As for what you said, I agree with some of it but not all.

3. Yes, I agree that the USD is going to lose its place as the reserve currency and it'll largely be replaced with gold (exactly how this plays out and in what timeframe is uncertain). It was always quite bizarre for the USD to be the reserve currency when one individual country could sit there printing more of it, etc etc.

4. But, this has always been the case and was not an answer to my question.

5. As for your assertion that multiple hot wars have a negligible impact on the price of gold, and only impact it by adding to American debt, I can not agree. I think we all understand that multiple major global conflicts cause fear and a rush to safe havens such as gold, just to name one impact it has. How much, was my question, and I disagree with your assertion of zero/negligible.

1. I disagree.

Why?

Beacuse the WAR that matters is not the hot war in Ukraine or the ME: it is the war that China and BRICS are waging against the UST and USD markets.

Gold is responding to that war. And because gold is rising, the West is losing. The West is also losing the hot war. This is almost certainly not being factored into the gold price currently. If it were, it would I suspect add premium.

So now we can jump to:

5. While Trump may have the desire, how much actual ability does he have?

Your position would seem to be that if the hot wars ended due to Trump negotiating a conclusion, that a premium would come out of gold.

My position is that the war to worry about is the financial war, not the hot war in Ukraine or ME.

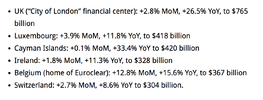

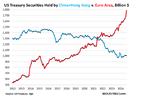

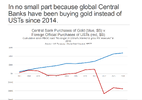

The financial war is intensifying not abating. The forces that are propelling gold higher are spreading from the BRICS to Europe as European banks are now starting to replace UST with gold.

The catalyst that put a premium into gold when the Russians invaded the Ukraine was not the Russians invading but the US confiscating Russian owned US assets.

About this, Trump can do nothing. In fact, rather than de-escalating the confrontation with China, he is, if he follows through on his election promises, will escalate the war with China via tariffs. This will be inflationary for the US and deflationary for China. Paradoxically it will likely send the USD higher (when Trump has stated he wants it (needs it) lower) as less USD will be emitted to Eurodollar users, thus likely pushing US 10yr rates higher as foreign holders of US assets (remember the US runs a (-67% NIIP) sell US assets to obtain USD.

Then we look at another Trump strategem: utilising BTC as a Treasury Reserve asset, to be financed through a revaluation of US gold. This is first and foremost a strategy to find another sucker with enough spare balance sheet capacity to purchase UST paper as the deficits continue to blow out. That is Tether. Tether is currently the 16'th largest holder of UST globally. That if Trump gets his way will increase. But as far as gold is concerned that bumps it to $4000oz. Why is JPM now custodian of GLD's gold?

So while you chose to misquote me, I didn't state, I implied, that there is a minimal hot war premium in gold, correct, the hot war premium is minimal to zero.

jog on

duc

Sdajii

Sdaji

- Joined

- 13 October 2009

- Posts

- 2,216

- Reactions

- 2,473

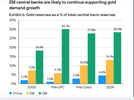

View attachment 188716

1. I disagree.

Why?

View attachment 188725View attachment 188724View attachment 188723View attachment 188722View attachment 188721View attachment 188720View attachment 188719View attachment 188718View attachment 188717

Beacuse the WAR that matters is not the hot war in Ukraine or the ME: it is the war that China and BRICS are waging against the UST and USD markets.

Gold is responding to that war. And because gold is rising, the West is losing. The West is also losing the hot war. This is almost certainly not being factored into the gold price currently. If it were, it would I suspect add premium.

So now we can jump to:

View attachment 188715

5. While Trump may have the desire, how much actual ability does he have?

Your position would seem to be that if the hot wars ended due to Trump negotiating a conclusion, that a premium would come out of gold.

View attachment 188726

My position is that the war to worry about is the financial war, not the hot war in Ukraine or ME.

The financial war is intensifying not abating. The forces that are propelling gold higher are spreading from the BRICS to Europe as European banks are now starting to replace UST with gold.

The catalyst that put a premium into gold when the Russians invaded the Ukraine was not the Russians invading but the US confiscating Russian owned US assets.

About this, Trump can do nothing. In fact, rather than de-escalating the confrontation with China, he is, if he follows through on his election promises, will escalate the war with China via tariffs. This will be inflationary for the US and deflationary for China. Paradoxically it will likely send the USD higher (when Trump has stated he wants it (needs it) lower) as less USD will be emitted to Eurodollar users, thus likely pushing US 10yr rates higher as foreign holders of US assets (remember the US runs a (-67% NIIP) sell US assets to obtain USD.

Then we look at another Trump strategem: utilising BTC as a Treasury Reserve asset, to be financed through a revaluation of US gold. This is first and foremost a strategy to find another sucker with enough spare balance sheet capacity to purchase UST paper as the deficits continue to blow out. That is Tether. Tether is currently the 16'th largest holder of UST globally. That if Trump gets his way will increase. But as far as gold is concerned that bumps it to $4000oz. Why is JPM now custodian of GLD's gold?

So while you chose to misquote me, I didn't state, I implied, that there is a minimal hot war premium in gold, correct, the hot war premium is minimal to zero.

jog on

duc

I wasn't misquoting you, and you confirmed what I said, that you think the hot war premium is negligible or zero. I disagree with that. Whatever else is going on, hot wars do impact the price of gold, even if that's not the largest impact, and I wasn't claiming or implying it was, just speculating on how much. You say zero or near enough. I think it's significantly more than zero, and likely enough to drop gold prices at least a little, temporarily. At the very least, the announcement of the Russia-Ukraine war will drop gold prices that day, whenever it happens. With so many issues impacting the POG, it's often difficult to single out the impact of any one thing.

Most of your post was trying to convince me of what I already agree with. Yes, everything you say about the financial war is significant and yes, the West is losing, and yes, in the big picture the POG will rise. I've made my position on that abundantly clear over the last six months or so in this thread, no need to try to convince me.

How much ability Trump has to end conflicts is debatable, you clearly think it's very low, but 8 years ago that was the same story everyone was telling and yet he did indeed very quickly do a brilliant job, surprising even most of his fans who had big expectations. The media of course played it down heavily and instead of saying 'Wow, he ended that war in the Middle East we told you he couldn't possibly end' they said 'He tweets mean things and here's a woman we totally didn't pay to claim he raped her 173 years ago' and instead of saying 'Wow, Trump actually made things with North Korea lovely, turning Rocket Man around from threatening to nuke everyone and we were telling you that Trump was going to escalate that and cause and nuclear war, now we're all happy, how amazing' they said 'Trump is a monster because he is having open discussion with the leader of a rogue state and we're yelling you to be outraged about that', and similar for other issues around the world. If he has similar results this time to last time, major international conflicts will end in the first half of 2025. Last time everyone said it was impossible and I was highly sceptical, then surprised at the success.

Of course, there's no guarantee he'll be as successful this time as last time, no guarantee he can do what he claims he will, but he did it last time and it's likely he can again, and of course I hope he can end as much conflict as possible.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,598

- Reactions

- 12,154

Gold's U.S. market share to quadruple? What happens to gold price when that happens – Rick Rule

(Kitco News) - The only way for the U.S. to escape its current debt crisis is to inflate away the value of its obligations, much like what happened in the 1970s, said Rick Rule, veteran investor and President & CEO of Rule Investment Media. This dynamic creates a bullish case for commodities like precious metals, uranium, and copper, with energy also poised to benefit under the new presidential administration.According to Rule, the U.S. will ultimately honor its debt obligations in nominal terms but will allow inflation to erode their real value, as it did during the 1970s.

"We faced the same circumstance, although less dire, in the 1970s," Rule told Kitco News anchor Jeremy Szafron on the sidelines of the New Orleans Investment Conference. "We will honor the nominal amount of our obligations, but we'll inflate away the net present value of the obligations."

- Joined

- 25 December 2018

- Posts

- 258

- Reactions

- 232

Gold update

Did not like the way Gold is sitting at the moment in the middle of that range bar so I went back and rechecked the calculations . Usually when a Cycle expires it will be followed by space expansion and heavy vol which has not been the case today with price holding steady.

After going back over the Notes in relation to the current position of the market I would be wary of shorts now and it may be wise to take any short positions off the table. It looks like we are in a position to move higher especially if we take out Nov 29th 2690 which looks likely to occur so I have drawn up a new Curve which I wanted to put out in time for tonight.

It looks like we could be up till Dec 9th where Top is indicated so if you reverse to the long side and we move up into this point it would be prudent to take profits so we will assess how price moves into this point over the coming days and I will work out some price targets if the upside move gets underway. That would be the first section we are looking at trading. From there we could be lower into Dec 17th where counter trend Low is indicated . There are still more points and price targets to be calculated but its important I release this asap.

studentofgann twitter

Regards Grant

Attachments

- Joined

- 8 June 2008

- Posts

- 13,594

- Reactions

- 20,217

Martial law in St Korea..will ramp up the war noise and gold up?

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,989

- Reactions

- 11,051

The Koreans are revolting but it has now settled according to the NYT. Gold seems stable. atm. !Martial law in St Korea..will ramp up the war noise and gold up?

gg

- Joined

- 15 June 2023

- Posts

- 1,345

- Reactions

- 2,996

Gold prices wobbled and then dipped after they announced it and then came back up.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,598

- Reactions

- 12,154

This sideways chop chop is encouraging that this consolidation is just consolidation as part of the longer term up trend.

Self proclaimed TA expert Gary Wagner over at Kitco thinks we could be an an ABC correction and once we hit the C then it's back off to the races. Likely C position to be on a Fib mark which happens to be around that support across 2500 ish.

But, doesn't look like it's going lower at this point in time to me.

Waiting to watch this unfold before restarting the PM fund.

www.kitco.com

www.kitco.com

Self proclaimed TA expert Gary Wagner over at Kitco thinks we could be an an ABC correction and once we hit the C then it's back off to the races. Likely C position to be on a Fib mark which happens to be around that support across 2500 ish.

But, doesn't look like it's going lower at this point in time to me.

Waiting to watch this unfold before restarting the PM fund.

Videos

100% blokeThis sideways chop chop is encouraging that this consolidation is just consolidation as part of the longer term up trend.

...

moreover it is only a matter of time when this 'consolidation' reaches new higher levels. For mine.

Have a very nice day, today.

Kind regards

rcw1

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,989

- Reactions

- 11,051

This sideways chop chop is encouraging that this consolidation is just consolidation as part of the longer term up trend.

Self proclaimed TA expert Gary Wagner over at Kitco thinks we could be an an ABC correction and once we hit the C then it's back off to the races. Likely C position to be on a Fib mark which happens to be around that support across 2500 ish.

But, doesn't look like it's going lower at this point in time to me.

Waiting to watch this unfold before restarting the PM fund.

View attachment 188879

Videos

www.kitco.com

A self proclaimed Gumnut predicted the same 10 days ago, although I feel it will go below $2500.

ggView attachment 188513

We appear to be just under half way through a wave 3 of a 1-2-3 correction which will see us at the mid to high 2400’s once it completes. There are some nice support/resistance points at that level.

gg

- Joined

- 25 December 2018

- Posts

- 258

- Reactions

- 232

- Joined

- 13 February 2006

- Posts

- 5,381

- Reactions

- 12,486

- Joined

- 13 February 2006

- Posts

- 5,381

- Reactions

- 12,486

BTC and Silver

Consider the following from the WEF:

Blackrock also operates the world’s largest Bitcoin (BTC) ETF (‘IBIT’-NY), started in early 2024, that has grown rapidly to now hold 521,164 BTC of 19,898,162 BTC that are extant today.

On December 4, 2024 this Substack noted the words of warning of renowned fund manager John Paulson of Paulson Funds:

Let’s compare silver and BTC as assets.

Silver / Silver ETFs / BTC / BTC ETFs

Mined p.a. 823M oz. 325,000 BTC

Global Bullion Stock 2B oz.

Global Coin Stock 3B oz.

Total Global Stock 25B oz. 763.3M oz. 19.9M BTC 1.052M BTC

In comparison, especially with Larry’s Blackrock IBIT ETF entering the comparatively illiquid BTC market, suddenly shocking the price of BTC higher appears to this writer to have been like shooting fish in a barrel.

jog on

duc

Consider the following from the WEF:

Blackrock is the world’s largest asset manager managing $11.5 trillion (T) of client assets.

Does anyone find it unusual that the CEO of the world’s largest asset manager belongs to an organization that has produced material claiming “You’ll own nothing. And you’ll be happy.” ? You will own no assets - and you’ll be happy. Hello? Anyone?

Blackrock In The Silver And Bitcoin Markets

Blackrock runs the world’s largest Exchange Traded Fund (ETF) iShares Silver Trust (‘SLV’-NY) that states it holds 474 million (M) oz. of silver in trust for its shareholders. That is 62% of all silver ETF holdings globally.Blackrock also operates the world’s largest Bitcoin (BTC) ETF (‘IBIT’-NY), started in early 2024, that has grown rapidly to now hold 521,164 BTC of 19,898,162 BTC that are extant today.

On December 4, 2024 this Substack noted the words of warning of renowned fund manager John Paulson of Paulson Funds:

“I would describe cryptocurrencies as a limited supply of nothing. …

… There is no intrinsic value to any of the cryptocurrencies except that there is a limited amount.

Once the exuberance wears off, or liquidity dries up, they will go to zero. I wouldn’t recommend anyone invest in cryptocurrencies.”

Let’s compare silver and BTC as assets.

Silver / Silver ETFs / BTC / BTC ETFs

Mined p.a. 823M oz. 325,000 BTC

Global Bullion Stock 2B oz.

Global Coin Stock 3B oz.

Total Global Stock 25B oz. 763.3M oz. 19.9M BTC 1.052M BTC

It should be noted that in less than 12 months the IBIT ETF has accumulated 2.6% of all BTC extant as of this date.

Further, IBIT’s 521,164 BTC accumulated in less than 12 months is at a pace of 160% of all BTC to be ‘mined’ this year.

Figure 1 - SLV Holdings (Light Green) Over Time In Comparison To Other ETFs And Exchanges; source: GoldChartsRUs.comIn comparison, the SLV ETF has accumulated, over an 18 year period, 474M oz. of silver which is 1.9% of above ground silver stocks or, in total, just 58% of silver to be mined this year.

The Impact of Blackrock Stepping Into The BTC Market

Bitcoin holding are extremely concentrated with approximately 92.5% of all BTC in existence held by just 1.86% of all wallet addresses.Figure 2 - Bitcoin 2024 Price Chart; source: TradingView.comFurther, bitcoin investors have faced technical hurdles to directly acquiring bitcoin and have not had highly liquid and well known asset managers such as Blackrock allowing easy investment access to this space - until now.

This highly concentrated ownership of BTC, the slow BTC mining rate, and prior access barriers to BTC investment imply that the entrance of Blackrock’s IBIT shock buying volume appears to have had a material impact on the price of BTC. BTC has seen a 132% rise in the price of BTC since early February 2024. The BTC market has gone ape.

Comparing The Silver Market To BTC’s Market

Silver’s market price has been much more laconic and that should be no surprise.And recall that London silver delivery is in the form of 1,000 oz. bullion bars. Global silver refinery capacity is just not available to quickly convert other forms of silver, if they were even available for rapid sale, into 1,000 oz. bars should a material amount of the spot claim holders in London demand delivery.First, with an estimated 4.2B oz. to 6.4B oz. of silver sold in the form of immediate delivery promissory notes into the London cash/spot market compared to an estimated 2B oz. of global silver bullion holdings (most of which is not immediately available to market) creating an obvious suppressive force on the price of silver - so long as metal delivery is not demanded.

Unlike BTC which is closely held and not widely sold into the market in the form of promissory notes or (that we know of) sold by ETFs without informing their client shareholders, silver appears to have several artificial and virtual supplies that artificially suppress silver’s price.Second, Jeff Currie, Goldman Sachs’ former Global Head of Commodity Research, has made a disturbing claim that some silver ETFs short their clients silver bars (perhaps many times each) into the market artificially increasing apparent silver supply and thus suppressing the silver price.

In comparison, especially with Larry’s Blackrock IBIT ETF entering the comparatively illiquid BTC market, suddenly shocking the price of BTC higher appears to this writer to have been like shooting fish in a barrel.

The BIG Question

If John Paulson is right, the BTC crypto and BTC ETF ‘hodlers’ will be left with nothing in the end when the structured mania subsides- and they bloody well won’t be happy.The BIG question to be asked is this : are investors being led into an investment black hole by overwhelmingly driving the price of BTC suddenly higher to initiate a BTC/crypto mania in an asset class that John Paulson has warned will go to zero.

jog on

duc

- Joined

- 8 March 2007

- Posts

- 3,029

- Reactions

- 4,210

I wonder what you all think about this podcast?

- Joined

- 13 February 2006

- Posts

- 5,381

- Reactions

- 12,486

I wonder what you all think about this podcast?

Cap'n Chaza, interesting video. Mr Saylor is articulate. He is also a bit of a chancer, narrowly avoided going bankrupt in the 2000 bust with MSTR trading down from $400 share +/- to $0.45 a share and now back to $400 share +/- with a high at $600 share +/-.

So it was actually very illuminating to hear him describe his reasons for initially getting into BTC. He was not this visionary who grasped the revelation of BTC, rather:

1. Was desperate and going bankrupt

2. Stumbled upon BTC

3. Started buying BTC and managed to leverage the rising price into an opportunity to raise further capital

4. This was due to the volatility of BTC

This variable was posted in the DDD thread:

n this case, MicroStrategy has essentially created a financial instrument that’s part loan, part lottery ticket. How could it raise $3bn at a zero-per cent coupon and a conversion price of $672.40 per share when the stock was trading at $433? The answer lies in the stock’s explosive volatility, driven by and magnified through its bitcoin holdings. This volatility significantly enhances the value of the embedded call option in the bond, which, in turn, offsets the cost of the bond itself.

As a result, the company is able to borrow at rates far below those of conventional debt. And volatile it is. MicroStrategy’s stock moves like a hyperactive toddler let loose in a candy store, ricocheting from aisle to aisle with boundless, chaotic energy. Its 252-day historic volatility is currently 106 per cent (implying an average move of 6.6 per cent per day!). The implied volatility of 30-day options in its stock is 2.5 times more than similar duration options in bitcoin itself. And MicroStrategy is unembarrassed by this: in its third-quarter earnings presentation, management crowed about MicroStrategy options trading a higher implied volatility than any S&P 500 stock.

This sheds light on one of the paradoxes around the MicroStrategy story: why does co-founder Michael Saylor relentlessly hype bitcoin while his company is buying it? Most people would talk down an asset they’re accumulating. But for MicroStrategy, volatility is the real currency. Saylor’s bombastic interviews, grandiose predictions, and relentless social media posting aren’t just noise — they’re the fuel for the financial fire. There’s never a dull moment with the guy.

The crazier the stock, the better the terms for the next convertible. MicroStrategy has effectively engineered its own volatility — and reaped the rewards. Before August 2020, the company’s stock exhibited both realised and implied volatilities in the low 30s. But once MicroStrategy reinvented itself as a binge-buyer of bitcoin, volatility skyrocketed, first surpassing 70 per cent and later breaching 100 per cent. The dynamic is self-reinforcing: acquiring more bitcoin amplifies share price volatility, allowing MicroStrategy to issue convertible bonds on increasingly favourable terms, which it then uses to buy even more bitcoin — further fuelling the volatility. And so the cycle continues.

Another looming risk is that MicroStrategy’s five previous convertible bonds — now deeply in the money, with conversion prices between $143.25 and $232.72 — might ultimately not convert if bitcoin’s price (and, by extension, MicroStrategy’s stock price) plummets. What happens then? How would MicroStrategy manage up to $6.2bn in bond repayments if the tide turns and the principal on the bonds comes due at maturity?The company’s options would be stark. Its lossmaking software business generates no cash, and its treasure chest of 402,100 bitcoins, currently valued at $39bn, would offer little solace.

Selling bitcoin to raise cash would likely be a last resort, but by then, the price of bitcoin would presumably have dropped significantly, exacerbated by the impact of any sales themselves. While convertible bondholders hold a senior claim to these bitcoin assets over stockholders in the event of bankruptcy, the actual “coverage” may prove far thinner than it appears.And don’t assume the stock can’t tumble below the conversion prices — it was trading below $130 as recently as three months ago. For context, the spot-price value of MicroStrategy’s bitcoin holdings translates to $166 per share.

Until February 2024, the stock traded more or less in line with the net asset value (NAV) of its bitcoin. It’s only the hefty premium to NAV that has kept most of these convertible bonds so comfortably in the money.Anyhow, mitigating this credit risk isn’t straightforward for investors.One approach is to keep a short position even when the convertible is well out of the money, hedging against the possibility of (or even likelihood that) the company’s creditworthiness deteriorates alongside its share price. But this creates its own challenges. Instead of buying into a falling market (as for gamma trading), investors may find themselves selling shares as the price is tumbling. Depending on size and liquidity, selling into weakness risks being self-defeating; it is not an easy trade to execute.Nevertheless, for now, the strategy is working wonders. By weaponising its stock’s volatility, MicroStrategy has created a seemingly self-perpetuating loop: cheap funding buys bitcoin, which boosts the stock’s volatility, which secures even better bond terms to buy more bitcoin. The investors? They may or may not be bitcoin believers or Saylor groupies; many are just thrill-seekers riding the wave. As long as the stock keeps zigzagging, the show goes on. But like any high-wire act, there’s always the danger of a fall.

While it works, it works. When it doesn't, it not only takes MSTR to zero, but could create a real issue in BTC as BTC would already be showing problems.

5. Will replace gold. Unlikely.

No sovereign nation will give up their right to print their own currency. To pass their 'trust' to the US by using USD...100% will not happen. Gold IS the international Reserve Asset and being re-monetised.

Saylor wants this to be BTC.

It is gold's LACK of VOLATILITY compared to BTC is one of the reasons that makes gold more attractive to Central Banks.

This trend is continuing.

6. AI buying BTC and hoarding. Would need to think through this one a bit.

As Mr Saylor stated himself, BTC was a hail Mary gamble, that is currently paying off.

jog on

duc

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,989

- Reactions

- 11,051

I would agree duc. Microstrategy is "currently" paying off.Cap'n Chaza, interesting video. Mr Saylor is articulate. He is also a bit of a chancer, narrowly avoided going bankrupt in the 2000 bust with MSTR trading down from $400 share +/- to $0.45 a share and now back to $400 share +/- with a high at $600 share +/-.

So it was actually very illuminating to hear him describe his reasons for initially getting into BTC. He was not this visionary who grasped the revelation of BTC, rather:

1. Was desperate and going bankrupt

2. Stumbled upon BTC

3. Started buying BTC and managed to leverage the rising price into an opportunity to raise further capital

4. This was due to the volatility of BTC

This variable was posted in the DDD thread:

n this case, MicroStrategy has essentially created a financial instrument that’s part loan, part lottery ticket. How could it raise $3bn at a zero-per cent coupon and a conversion price of $672.40 per share when the stock was trading at $433? The answer lies in the stock’s explosive volatility, driven by and magnified through its bitcoin holdings. This volatility significantly enhances the value of the embedded call option in the bond, which, in turn, offsets the cost of the bond itself.

As a result, the company is able to borrow at rates far below those of conventional debt. And volatile it is. MicroStrategy’s stock moves like a hyperactive toddler let loose in a candy store, ricocheting from aisle to aisle with boundless, chaotic energy. Its 252-day historic volatility is currently 106 per cent (implying an average move of 6.6 per cent per day!). The implied volatility of 30-day options in its stock is 2.5 times more than similar duration options in bitcoin itself. And MicroStrategy is unembarrassed by this: in its third-quarter earnings presentation, management crowed about MicroStrategy options trading a higher implied volatility than any S&P 500 stock.

This sheds light on one of the paradoxes around the MicroStrategy story: why does co-founder Michael Saylor relentlessly hype bitcoin while his company is buying it? Most people would talk down an asset they’re accumulating. But for MicroStrategy, volatility is the real currency. Saylor’s bombastic interviews, grandiose predictions, and relentless social media posting aren’t just noise — they’re the fuel for the financial fire. There’s never a dull moment with the guy.

The crazier the stock, the better the terms for the next convertible. MicroStrategy has effectively engineered its own volatility — and reaped the rewards. Before August 2020, the company’s stock exhibited both realised and implied volatilities in the low 30s. But once MicroStrategy reinvented itself as a binge-buyer of bitcoin, volatility skyrocketed, first surpassing 70 per cent and later breaching 100 per cent. The dynamic is self-reinforcing: acquiring more bitcoin amplifies share price volatility, allowing MicroStrategy to issue convertible bonds on increasingly favourable terms, which it then uses to buy even more bitcoin — further fuelling the volatility. And so the cycle continues.

Another looming risk is that MicroStrategy’s five previous convertible bonds — now deeply in the money, with conversion prices between $143.25 and $232.72 — might ultimately not convert if bitcoin’s price (and, by extension, MicroStrategy’s stock price) plummets. What happens then? How would MicroStrategy manage up to $6.2bn in bond repayments if the tide turns and the principal on the bonds comes due at maturity?The company’s options would be stark. Its lossmaking software business generates no cash, and its treasure chest of 402,100 bitcoins, currently valued at $39bn, would offer little solace.

Selling bitcoin to raise cash would likely be a last resort, but by then, the price of bitcoin would presumably have dropped significantly, exacerbated by the impact of any sales themselves. While convertible bondholders hold a senior claim to these bitcoin assets over stockholders in the event of bankruptcy, the actual “coverage” may prove far thinner than it appears.And don’t assume the stock can’t tumble below the conversion prices — it was trading below $130 as recently as three months ago. For context, the spot-price value of MicroStrategy’s bitcoin holdings translates to $166 per share.

Until February 2024, the stock traded more or less in line with the net asset value (NAV) of its bitcoin. It’s only the hefty premium to NAV that has kept most of these convertible bonds so comfortably in the money.Anyhow, mitigating this credit risk isn’t straightforward for investors.One approach is to keep a short position even when the convertible is well out of the money, hedging against the possibility of (or even likelihood that) the company’s creditworthiness deteriorates alongside its share price. But this creates its own challenges. Instead of buying into a falling market (as for gamma trading), investors may find themselves selling shares as the price is tumbling. Depending on size and liquidity, selling into weakness risks being self-defeating; it is not an easy trade to execute.Nevertheless, for now, the strategy is working wonders. By weaponising its stock’s volatility, MicroStrategy has created a seemingly self-perpetuating loop: cheap funding buys bitcoin, which boosts the stock’s volatility, which secures even better bond terms to buy more bitcoin. The investors? They may or may not be bitcoin believers or Saylor groupies; many are just thrill-seekers riding the wave. As long as the stock keeps zigzagging, the show goes on. But like any high-wire act, there’s always the danger of a fall.

View attachment 189053View attachment 189054

While it works, it works. When it doesn't, it not only takes MSTR to zero, but could create a real issue in BTC as BTC would already be showing problems.

5. Will replace gold. Unlikely.

View attachment 189052

No sovereign nation will give up their right to print their own currency. To pass their 'trust' to the US by using USD...100% will not happen. Gold IS the international Reserve Asset and being re-monetised.

Saylor wants this to be BTC.

View attachment 189051

It is gold's LACK of VOLATILITY compared to BTC is one of the reasons that makes gold more attractive to Central Banks.

View attachment 189050

This trend is continuing.

6. AI buying BTC and hoarding. Would need to think through this one a bit.

As Mr Saylor stated himself, BTC was a hail Mary gamble, that is currently paying off.

jog on

duc

Popcorn time.

gg

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,989

- Reactions

- 11,051

- Joined

- 24 July 2021

- Posts

- 194

- Reactions

- 574

I bet Mr Saylor will go bankrupt again if he keeps buying more bitcoin and other crypto. Crypto and shares can't keep going up to infinity, there has to be reckoning one day. For me Crypto is similar to Forex trading, really easy to lose all your investment. You are betting on crypto tokens going higher and higher until one day it won't and you will lose your shirt, it really isn't an asset to hold on to unlike physical gold.Cap'n Chaza, interesting video. Mr Saylor is articulate. He is also a bit of a chancer, narrowly avoided going bankrupt in the 2000 bust with MSTR trading down from $400 share +/- to $0.45 a share and now back to $400 share +/- with a high at $600 share +/-.

So it was actually very illuminating to hear him describe his reasons for initially getting into BTC. He was not this visionary who grasped the revelation of BTC, rather:

1. Was desperate and going bankrupt

2. Stumbled upon BTC

3. Started buying BTC and managed to leverage the rising price into an opportunity to raise further capital

4. This was due to the volatility of BTC

This variable was posted in the DDD thread:

n this case, MicroStrategy has essentially created a financial instrument that’s part loan, part lottery ticket. How could it raise $3bn at a zero-per cent coupon and a conversion price of $672.40 per share when the stock was trading at $433? The answer lies in the stock’s explosive volatility, driven by and magnified through its bitcoin holdings. This volatility significantly enhances the value of the embedded call option in the bond, which, in turn, offsets the cost of the bond itself.

As a result, the company is able to borrow at rates far below those of conventional debt. And volatile it is. MicroStrategy’s stock moves like a hyperactive toddler let loose in a candy store, ricocheting from aisle to aisle with boundless, chaotic energy. Its 252-day historic volatility is currently 106 per cent (implying an average move of 6.6 per cent per day!). The implied volatility of 30-day options in its stock is 2.5 times more than similar duration options in bitcoin itself. And MicroStrategy is unembarrassed by this: in its third-quarter earnings presentation, management crowed about MicroStrategy options trading a higher implied volatility than any S&P 500 stock.

This sheds light on one of the paradoxes around the MicroStrategy story: why does co-founder Michael Saylor relentlessly hype bitcoin while his company is buying it? Most people would talk down an asset they’re accumulating. But for MicroStrategy, volatility is the real currency. Saylor’s bombastic interviews, grandiose predictions, and relentless social media posting aren’t just noise — they’re the fuel for the financial fire. There’s never a dull moment with the guy.

The crazier the stock, the better the terms for the next convertible. MicroStrategy has effectively engineered its own volatility — and reaped the rewards. Before August 2020, the company’s stock exhibited both realised and implied volatilities in the low 30s. But once MicroStrategy reinvented itself as a binge-buyer of bitcoin, volatility skyrocketed, first surpassing 70 per cent and later breaching 100 per cent. The dynamic is self-reinforcing: acquiring more bitcoin amplifies share price volatility, allowing MicroStrategy to issue convertible bonds on increasingly favourable terms, which it then uses to buy even more bitcoin — further fuelling the volatility. And so the cycle continues.

Another looming risk is that MicroStrategy’s five previous convertible bonds — now deeply in the money, with conversion prices between $143.25 and $232.72 — might ultimately not convert if bitcoin’s price (and, by extension, MicroStrategy’s stock price) plummets. What happens then? How would MicroStrategy manage up to $6.2bn in bond repayments if the tide turns and the principal on the bonds comes due at maturity?The company’s options would be stark. Its lossmaking software business generates no cash, and its treasure chest of 402,100 bitcoins, currently valued at $39bn, would offer little solace.

Selling bitcoin to raise cash would likely be a last resort, but by then, the price of bitcoin would presumably have dropped significantly, exacerbated by the impact of any sales themselves. While convertible bondholders hold a senior claim to these bitcoin assets over stockholders in the event of bankruptcy, the actual “coverage” may prove far thinner than it appears.And don’t assume the stock can’t tumble below the conversion prices — it was trading below $130 as recently as three months ago. For context, the spot-price value of MicroStrategy’s bitcoin holdings translates to $166 per share.

Until February 2024, the stock traded more or less in line with the net asset value (NAV) of its bitcoin. It’s only the hefty premium to NAV that has kept most of these convertible bonds so comfortably in the money.Anyhow, mitigating this credit risk isn’t straightforward for investors.One approach is to keep a short position even when the convertible is well out of the money, hedging against the possibility of (or even likelihood that) the company’s creditworthiness deteriorates alongside its share price. But this creates its own challenges. Instead of buying into a falling market (as for gamma trading), investors may find themselves selling shares as the price is tumbling. Depending on size and liquidity, selling into weakness risks being self-defeating; it is not an easy trade to execute.Nevertheless, for now, the strategy is working wonders. By weaponising its stock’s volatility, MicroStrategy has created a seemingly self-perpetuating loop: cheap funding buys bitcoin, which boosts the stock’s volatility, which secures even better bond terms to buy more bitcoin. The investors? They may or may not be bitcoin believers or Saylor groupies; many are just thrill-seekers riding the wave. As long as the stock keeps zigzagging, the show goes on. But like any high-wire act, there’s always the danger of a fall.

View attachment 189053View attachment 189054

While it works, it works. When it doesn't, it not only takes MSTR to zero, but could create a real issue in BTC as BTC would already be showing problems.

5. Will replace gold. Unlikely.

View attachment 189052

No sovereign nation will give up their right to print their own currency. To pass their 'trust' to the US by using USD...100% will not happen. Gold IS the international Reserve Asset and being re-monetised.

Saylor wants this to be BTC.

View attachment 189051

It is gold's LACK of VOLATILITY compared to BTC is one of the reasons that makes gold more attractive to Central Banks.

View attachment 189050

This trend is continuing.

6. AI buying BTC and hoarding. Would need to think through this one a bit.

As Mr Saylor stated himself, BTC was a hail Mary gamble, that is currently paying off.

jog on

duc

Similar threads

- Replies

- 4

- Views

- 1K

- Replies

- 171

- Views

- 12K

- Replies

- 9

- Views

- 2K