Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,888

- Reactions

- 10,788

Same here but when Nato aka US and EU government starts saying they will send weapons to Ukraine, that obviously force the Russians to widen the offensive instead of just seizing back the Russian southern and eastern areas, imho their initial plan.Yeah Mick same here as I really hope for peace as well (have all my extended family throughout Europe).

So looking at it objectively, the west started and now is fuelling a major hot war.

I hope you are kidding.The only contribution the West could have made to this was establishing the Ukrainian borders which meant big parts of Ukraine were ethnic Slav and Russian speakers. I don’t think they did.

I hope you are kidding.

US has pushed further and further with talk of NATO and EU membership for ukraine, not atarted yesterday.what do you think Biden 's son was doing during Obama and what do you think the Ukrainian regime was doing once Biden was back in power with its leverage?

There was a tacit/implicit agreement during the berlin wall collapse that a buffer zone would remain.

i highly invite you to read this 2009 book by Friedman about the next 100y.

This will clearly explain the play of the US there, Ukraine Bielorussia and the road ahead especially for Poland and Turkey,and EU complete collapse

In a nutshell the play of the US is to destabilise and avoid rise of any potential contestant to world supremacy.

imho, they lost with China, but Middle East , Europe/EU and Russia: done and success.

Morally, they deserve a nice karma..but history does not care about right and wrong.

The big losers ahead imho with this mess: Ukrainian obviously, EU as number 2, maybe Russia but we will talk again in 3 to 5 y.

The big winner: China, India..the US imho has no clue as what it unleashed..and may get a splashback it deserves

So for geo political play, people are dying.......

And people were celebrating good Biden vs Evil Trump..?

Agree there are many complex issues involved here but people are dying because they are being bombed, shelled and shot at.So for geo political play, people are dying.......

My point..but i would really hope people look a bit behind the bullet.Agree there are many complex issues involved here but people are dying because they are being bombed, shelled and shot at.

Everyone involved have been pushing their own agenda, their own interests, to gain the best advantage for them, I can even understand where Putin is coming from as a Russian Nationalist but I blame Putin not Russia for choosing war, the man is drunk on power. I really think that if he doesn't finish this war soon then he could be removed from power internally. Russians are being ordered to kill their brothers and sisters.My point..but i would really hope people look a bit behind the bullet.

I'm calling USD$2000+ for Gold next week.

The cousins from Guam dropped yesterdays WSJ in to the hotel last night after landing at Garbutt Field.

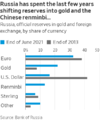

Russia will have immense problems in trade both in receipts for Oil from Europe and paying for goods to China. Gold will be the intermediate currency for trade in the Euro and the Renminbi.

I will add further.

.View attachment 138612

gg

More from the WSJI think there's quite a war premium priced into POG at the moment, but once that's gone inflation will be the focus. Then China will attack Taiwan... So, the planets are aligning for the yellow metal.

Must be some healthy consolidation soon, probably under the Aug 20 high of $2070. I'd be very happy for consolidation above old resistance across the $1950 mark, but the overall market's so volatile we could see some pretty big swings depending on war news and rumour. Case in point the uranium plant BS yesterday.

Certainly looking good as we have 2 more days of Ukranian devastation to pump up the very many commodity sectors plus precious metals before Monday's market opensI'm calling USD$2000+ for Gold next week.

I think that GLD is headed up to the 190-195 area, it's still got good volume coming into the move up.

View attachment 138625

I saw @divs4ever mention AIS in another thread and had a bit of a look at them.That volume and break through previous resistance would lead to that zone. Should expect it to stop around there for a break.

While I think gold's move has been more long term fundamental and technical than on daily news, I don't think we can discount wild swings due to significant events in Ukraine. For eg, a sudden cease fire and truce could stop gold in it's tracks. On the other hand, if a stray bomb hits a NATO country, or if Russia does something way outside the normal laws of war that brings an international military response, then gold could go parabolic.

I saw @divs4ever mention AIS in another thread and had a bit of a look at them.

They managed to get ANZ recently to fix their production at AUD$2640 from memory, so the Gold desks at the banks must be looking at an increase in POG this year.

gg

I agree well said.. & reason I really like upcoming producer TULAnd, there's a few gold companies who have produced PFS/DFS in the past two years based on USD1400-1600 ish POG. Once they come out with BFS/FID based on $2000 POG it's going to significantly change the landscape. For eg, TIE has used USD1400 on their DFS. They might be able to change that to start with a 2 in any updated DFS/FID. I don't think general punters realise how significant the potential uplift in POG is going to have on developers and producers with high leverage to POG, less inflationary costs.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.