Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,834

- Reactions

- 10,664

The current decline in gold seems to be coming from a rotation out of safe-havens, with riskier assets, like equities, rallying on news of a potential Biden-Putin meeting this week. If it begins to look like a more diplomatic solution can be reached, the precious metal might be at risk of a significant pullback.Most of my gold stocks down today.

WAF down 5%, SSR down 4%, Tie down 5%, despite the increase in gold since last Fridays close.

Methinks that the Big Banks will have had their instructions from the FED to bring in the paper shorts and cause a sell down of gold in US tonite.

Mick

US not trading tonight, as far as I know, Presidents DayMost of my gold stocks down today.

WAF down 5%, SSR down 4%, Tie down 5%, despite the increase in gold since last Fridays close.

Methinks that the Big Banks will have had their instructions from the FED to bring in the paper shorts and cause a sell down of gold in US tonite.

Mick

The current decline in gold seems to be coming from a rotation out of safe-havens, with riskier assets, like equities, rallying on news of a potential Biden-Putin meeting this week. If it begins to look like a more diplomatic solution can be reached, the precious metal might be at risk of a significant pullback.

However, reports suggest that the meeting has only been agreed by Biden in principle, subject to Russia not invading Ukraine before then. With gold prices hovering just below 1900, if the potential for a peaceful agreement does breakdown, we could still see a strong rally above this key resistance level.

All trading carries risk, but it will be worth keeping an eye on gold as the situation develops.

Unless Taiwan does something to provoke it, China is not ready to have any action against Taiwan any time soon. Both Xi and US senior military officers (past and present) openly said it.Now the winter olympics rock show is over China will start buzzing Taiwan again, so we may have two things to worry about. I wouldn't be surprised if that was the deal Vlad and Xi agreed on before the olympics. Just hold off until we get the last ski bunny off the pistes.

Unless Taiwan does something to provoke it, China is not ready to have any action against Taiwan any time soon. Both Xi and US senior military officers (past and present) openly said it.

China will only take over Taiwan when it's chip industry can survive boycott and it's economy can live without the west. Not yet.

I thought it was interesting how the SLV market was reacting to the 200 day SMA, so for interest, have a look;

View attachment 137985

this is also a good read with commentary from mltiple Analysts, covering both Gold and Silver

https://www.lbma.org.uk/articles/forecast-survey-2022

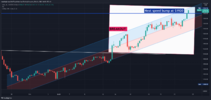

View attachment 137987

Yep - POG got a speeding fine for not slowing down at $1920:Gold prices are surging past $1920 with safe-haven assets rallying on reports that Putin has authorised a special military operation in Donbas.

Could we now see the rally extend to to the $1950/60 resistance zone as the market braces for the potential economic and political consequences that may follow?

All trading carries risk, but this is definitely going to be worth watching heading into the end of the week.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.