- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

that in most cases have hedged their sales months ahead

More than doubled.Edit: Has ripple just doubled in the last few days?

I kept gold and even increased exposure yesterday, but noted today (in the US) BTC up 4.5% whereas all others are in red from oil to gold and stocksTransferring from gold-physical thread to this trading one. Physical holders are all bulls.

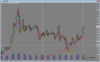

I'm comfortable looking for a long setup at this level 1750 - 1770. Price went through 200sma in Mar20 and rallied quickly. I'm hoping to see same thing at this level and will be looking for it on the 4hr chart.

Get into it and I'm holding for $200 - $300 move. It may take me a couple of attempts using only $10-$20 risk.

I was very tempted to buy into the BTC dip last week but very concerned by lack of security and won't hold a CFD for months.

If this issue with China goes pear shaped and ramps up, gold and silver may well be a safe haven for some currency hedging, the Aussie $ could get hammered in a major trade war with China.Desperate times. Purchased more SVL yesterday, the capping should break down soon IMHO, of course timing is hard to decide, just have to hang on to what you feel is safe in the longer term.

TRADING ALERT: Bullion Banks Using Today’s Orchestrated Takedown In Gold To Cover Shorts | King World News

Gold was yesterday well into overbought territory and a correction was imminent. Below is is a continuation of the chart I posted elsewhere on November 30 which proposed where gold might head:The gold price is now at a very interesting level. As you know I've been bullish gold for quite some time. I've taken some licks Aug - Nov20 but bought near the Nov low and still holding some of it. I may sell the remainder at this level and watch what happens to determine the next trade. It may be a short back down to 1890 or another long if price finds more demand here.

View attachment 117857

Some think the big dipper overnight was US election-based. POG was going to correct any day, and I rate it more as a coincidence.

Some think the big dipper overnight was US election-based. POG was going to correct any day, and I rate it more as a coincidence.Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.