- Joined

- 8 April 2008

- Posts

- 871

- Reactions

- 0

.......... Its never just natural price action that happens in other markets .....

You are absolutely right TH. I was starting to get a bit carried away myself by all the conspiracy theory crap until I saw your chart showing all that natural price action from start to finish. And to reinforce my new found wisdom I decided to take a look at some of those other markets guided by this piece from Bloomberg [bold emphasis is mine]:

Commodities Join Global Stocks Falling in Week as Gold Drops 7%

By Whitney Kisling & Debarati Roy - Apr 20, 2013 7:28 AM GMT+0700

http://www.bloomberg.com/news/2013-...-stocks-falling-in-week-as-gold-drops-7-.html

Commodities Retreat

The S&P GSCI Index fell to the lowest level since July during the week, led by silver, gold, lead and copper amid signs of surplus in the commodities and concern that China’s economy will slow. Silver, down 24 percent, is the worst performer this year. Gold slid 13 percent over April 12 and April 15, the biggest two-day retreat since 1980. Both of the precious metals entered a bear market this month joining sugar, soybeans and coffee.

Commodities are on the brink of a great rotation in price performance and market leadership, Barclays Plc said in a report on April 19. Gold and silver will be among the weakest over the next few years, according to the London-based bank.

“Excess supply is the biggest issue so this was a necessary correction like we saw in gold,”Michael Strauss, who helps oversee about $25 billion of assets as chief investment strategist at Commonfund Group in Wilton, Connecticut, said in a telephone interview. “It will take a strong economic cycle to push prices higher.”

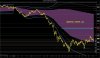

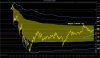

So it all make sense now. Gold being just another commodity has dropped in price like sugar, soybeans and coffee which are in their own bear markets due to excess supply. And below are some price charts for comparison:

I mean it's just so obvious now. Even a kid with kindergarten level pattern recognition skills can see the incredible similarities in the natural price action between these charts.

I'm so convinced that I need to quit blethering on here and get myself down to the supermarket before they all run out of sugar, soybeans and coffee. After all there have recently been big queues at the gold bullion dealers because people are taking advantage of the low bear market prices in gold and silver to stock up. And if this can happen to commodities like gold and silver I bet it's also going to happen to commodities like sugar, soybeans and coffee. I might also drop into Starbucks on the way and see how big the queue is there. I mean this natural price action observation is just brilliant. It explains everything.