You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 6 September 2008

- Posts

- 7,676

- Reactions

- 68

- Joined

- 9 April 2010

- Posts

- 174

- Reactions

- 3

"Buy PHYSICAL Gold. NOW: The Discount of a Lifetime:

Or Why You Must Abandon the Fake Paper Gold Market"

- Gordon Gekko

http://www.gekkosblog.com/

__________________

(I'm looking to buy physical at 1200, 1000, and I'll be all in at 800. Wish me luck!)

-

Or Why You Must Abandon the Fake Paper Gold Market"

- Gordon Gekko

http://www.gekkosblog.com/

__________________

(I'm looking to buy physical at 1200, 1000, and I'll be all in at 800. Wish me luck!)

-

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

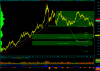

In my view, we are obviously bracketing here for now. Markets bracket before trending. If we don't scare some shorts in an uptrend (1st target 1441.6), then the next bracket isn't that far way, the center being 1250 ish....

FWIW, the range of late, has a 100% extension equal to 1182 ish...so a little confluence there.

Cheers,

CanOz

FWIW, the range of late, has a 100% extension equal to 1182 ish...so a little confluence there.

Cheers,

CanOz

Attachments

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

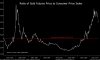

Gold Ties to Inflation Point Toward $800 Price: Chart of the Day

2013-04-17 04:00:01.0 GMT

2013-04-17 04:00:01.0 GMT

By David Wilson

April 17 (Bloomberg) -- Gold has room to fall much further

when the pace of inflation is taken into account, according to

Duke University Professor Campbell R. Harvey, a co-author of a

study on the precious metal.

The CHART OF THE DAY shows how he drew the conclusion: by

tracking the ratio of gold’s price in New York futures trading

to the consumer price index, compiled by the Labor Department.

Gold for June delivery settled yesterday at $1,387.40 an

ounce, equivalent to 5.97 times the value of the March CPI. The

ratio is far above the monthly average of 3.35 since 1975, when

futures were introduced on the Comex, even though the metal’s

price has dropped 13 percent this month.

“People are talking about this huge selloff in gold,”

Harvey, part of the Durham, North Carolina-based university’s

Fuqua School of Business and also a research associate at the

National Bureau of Economic Research, said yesterday in an

interview. “It’s not really that substantial.”

For the gold-CPI ratio to reach its historical average, the

precious metal would have to fall below $800 an ounce. That may

occur over time, Harvey said, especially as more investors sell

shares of exchange-traded gold funds.

“You don’t need a lot of action on the demand side to have

big changes in price,” he said, because the supply of gold is

relatively constant.

Harvey and Claude Erb, a former commodity-fund manager at

Trust Co. of the West in Los Angeles, included the ratio in a

research paper published in June. An updated version of the

study was made available two days ago on the Social Science

Research Network, an online archive.

For Related News and Information:

Precious-metal prices and rates: MTL <GO>

Gold market strategy: TNI GLD STRATEGY <GO>

Commodity-related top stories: TOP CMD <GO>

Charts, graphs home page: CHART <GO>

--Editors: Jeff Sutherland, Michael P. Regan

To contact the reporter on this story:

David Wilson in New York at +1-212-617-2248 or

dwilson@bloomberg.net

To contact the editor responsible for this story:

Chris Nagi at +1-212-617-2179 or

chrisnagi@bloomberg.net

Attachments

errrrr yes but.... the BLS has altered the way in calculates the CPI significantly across that time! Hedonic indexing and substitution are the norm now, not to mention other little statistical tricks to keep it as low as possible. Its not exactly what you call a constant data series, it is a little bit intellectually dishonest to base anything much on it.

.... errrr and, GOLD IS NOT AN INFLATION HEDGE! It never has been, it is a crisis hedge, it only rises in value when the system comes under pressure and safe returns are hard to find. Over the decades real estate has been a better inflation hedge... 99% of the time that is true, it is only when you get the sort of mess that we have today that its value comes to the fore.

That is crap "research" really, very shallow.

.... errrr and, GOLD IS NOT AN INFLATION HEDGE! It never has been, it is a crisis hedge, it only rises in value when the system comes under pressure and safe returns are hard to find. Over the decades real estate has been a better inflation hedge... 99% of the time that is true, it is only when you get the sort of mess that we have today that its value comes to the fore.

That is crap "research" really, very shallow.

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

That is crap "research" really, very shallow.

LOL, spoken like a true Gold Bug...if the research doesn't fit the view....

I just posted it because it was on topic, i hold NO VIEW.

CanOz

- Joined

- 5 October 2011

- Posts

- 896

- Reactions

- 0

Interesting?

http://www.zerohedge.com/news/2013-04-17/us-mint-sells-record-63500-ounces-gold-one-day

fits with what most are saying about bullion being in huge demand.

http://www.zerohedge.com/news/2013-04-17/us-mint-sells-record-63500-ounces-gold-one-day

fits with what most are saying about bullion being in huge demand.

nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

Afternoon: Mr Z

Okay, there was no bubble. The price reached a point where support dwindled and then dissipated causing gold to track sideways in a volitile range subject to the optimism of buyers or pessimism of sellers. Then a major player sold down 50% of his holding (took profits, deployed his capital elsewhere?) and the big banks tested their "sell down gold program". It tested well, so the big banks announced that they were out of gold, recommended to their clients to get out of gold, provided a basis for getting out (long term price drop due to recovering economy) then unleashed their program on an unsuspecting market.

See above, no bubble just a huge market rout conducted in a manner to maximise profits for the big banks.

I suspect US$2,000.00 per ouncet will be a long time comming, mainly because I can't see too many people willing to bet against the big banks. All they have to do is turn their program on again one night and repeat the exercise pushing, the market down to their previously stated level for 2014.

As mentioned before, I don't trade gold. I stick to equities and trade a short list where there is liquidity, spread and recuring opportunity. I know the ones I trade fairly well but that doesn't stop me from being surprised from time to time. Oh... and I'll leave the postulating to others.

...click goes the punch clock...

Your comments are without basis until you postulate a theory as to why a bubble existed in the first place! No bubble no pop! A 26% retracement is no where near a pop, if we had 70, 80, 90% then maybe you would have an argument but then you still need to work out why it occurred. Granted with those levels of price drop the whys should be obvious to blind Freddy, but then that is the point, the fundamental flaws are always obvious to blind Freddy post bubble YET you have not even attempted to point out why there may have been a bubble in the first place.

Okay, there was no bubble. The price reached a point where support dwindled and then dissipated causing gold to track sideways in a volitile range subject to the optimism of buyers or pessimism of sellers. Then a major player sold down 50% of his holding (took profits, deployed his capital elsewhere?) and the big banks tested their "sell down gold program". It tested well, so the big banks announced that they were out of gold, recommended to their clients to get out of gold, provided a basis for getting out (long term price drop due to recovering economy) then unleashed their program on an unsuspecting market.

...

So tell me why gold is divorced from its fundamental drivers? Until you can answer that question there is no basis for a bubble call. Notice the flood of people telling why it is/was in a bubble?... anyone... anyone?

See above, no bubble just a huge market rout conducted in a manner to maximise profits for the big banks.

or pessimistic?...

Oh yeah and 2K.... conservative to say the least ... if gold goes by its past patterns, which it pretty well is now, it will end the next major rally circa 4K..... but that is a purely technical projection given past data, it could always get "irrational"

I suspect US$2,000.00 per ouncet will be a long time comming, mainly because I can't see too many people willing to bet against the big banks. All they have to do is turn their program on again one night and repeat the exercise pushing, the market down to their previously stated level for 2014.

As mentioned before, I don't trade gold. I stick to equities and trade a short list where there is liquidity, spread and recuring opportunity. I know the ones I trade fairly well but that doesn't stop me from being surprised from time to time. Oh... and I'll leave the postulating to others.

LOL, spoken like a true Gold Bug...if the research doesn't fit the view....

I just posted it because it was on topic, i hold NO VIEW.

CanOz

Call me a goldbug at your peril! I aint no such thang boy!

Fact is it is crap research, you take a look for yourself, the US CPI has been stuffed around no end since the 70's, basically it has been invalidated for any long term comparison.

Add to that the fact that if you do a simple correlation study you will find that there is little correlation between inflation and rising gold prices. We had a 25 year gold bear market and there was inflation across the whole of that period, yet gold went $8xx to $250. You will not find many goldbugs pointing that out!

Re: Afternoon: Mr Z

Yes, well. I will be here to remind you

You assign too much power to the banks in determining the price of gold, a mistake that makes you sound just like a goldbug These episodes are short term events for fun and profit... normally... mind you this smells a little desperate.

These episodes are short term events for fun and profit... normally... mind you this smells a little desperate.

I suspect US$2,000.00 per ouncet will be a long time comming, mainly because I can't see too many people willing to bet against the big banks. All they have to do is turn their program on again one night and repeat the exercise pushing, the market down to their previously stated level for 2014

Yes, well. I will be here to remind you

You assign too much power to the banks in determining the price of gold, a mistake that makes you sound just like a goldbug

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

It's rather odd how gold is the inflation hedge yet as you say, the moment inflation was mentioned, gold started getting caned because inflation meant higher interest rates and gold pays no interest!

Oh but now deflation is the problem, with deflation there is no reason to own gold because real assets like gold will deflate go down, that's deflation.

Economics has always been a bit of mystery to me.

Maybe if your currency is up against a basket of others like the US and gold is down against the US(benchmark) then you should buy gold. It's not like that is the case now though is it!

Hey the AU must be going to 150 against the US. Yeah it's going up isn't it.

Oh but now deflation is the problem, with deflation there is no reason to own gold because real assets like gold will deflate go down, that's deflation.

Economics has always been a bit of mystery to me.

Maybe if your currency is up against a basket of others like the US and gold is down against the US(benchmark) then you should buy gold. It's not like that is the case now though is it!

Hey the AU must be going to 150 against the US. Yeah it's going up isn't it.

Re: Afternoon: Mr Z

Just another small point that you will not be aware of since you don't follow gold. Bubbles tend to pop with an over supply, yet we have a stock shortage as physical buyers have cleaned the shelves across the world. Every dealer that I have seen report so far has said --> running out of metal FAST. Now don't you find that a little strange if it truly where a bubble.... just sayin, should the shelve be overloaded with the crap that no one wants anymore?

Okay, there was no bubble....

Just another small point that you will not be aware of since you don't follow gold. Bubbles tend to pop with an over supply, yet we have a stock shortage as physical buyers have cleaned the shelves across the world. Every dealer that I have seen report so far has said --> running out of metal FAST. Now don't you find that a little strange if it truly where a bubble.... just sayin, should the shelve be overloaded with the crap that no one wants anymore?

It's rather odd how gold is the inflation hedge...

No it isn't {sigh} its a crisis hedge damn it! It is insurance.... jeeez

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

Insolently I have just sold my last house cause it really is a bubble and with miners tanking Ausi economy aint going nowhere that means banks, houses everything. I am seriously considering going to the Perth mint in a few months and buying the real deal!

Think I'll live in a tent with my gold for a pillow at night and a napsack in the day, I won't shower and will dress like a bumb.

Anyone got a room? I'm good company

I will look happy to see you but don't get too excited that will just be my sorn off if I see you reaching for my sack.

Think I'll live in a tent with my gold for a pillow at night and a napsack in the day, I won't shower and will dress like a bumb.

Anyone got a room? I'm good company

I will look happy to see you but don't get too excited that will just be my sorn off if I see you reaching for my sack.

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

No it isn't {sigh} its a crisis hedge damn it! It is insurance.... jeeez:

That's right, I forgot.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

al

Rubbish anyone worth his salt understands that important essentials are renoved from the CPI calculation.

And in the US now they are so bad that they revise down the previous months figures and get away with it because few notice and those that do are not heard.

And on unemployment if a person has not been able to get a job after 12 months they are taken off the figures. (Without checking it) officially is about 7% but in fact some established comentators say it is more like 22%.

Oh, and we do know that 65 million are on food stamps.

Could go on but cooking dinner. Will do some real stuff later

LOL, spoken like a true Gold Bug...if the research doesn't fit the view....

I just posted it because it was on topic, i hold NO VIEW.

CanOz

Rubbish anyone worth his salt understands that important essentials are renoved from the CPI calculation.

And in the US now they are so bad that they revise down the previous months figures and get away with it because few notice and those that do are not heard.

And on unemployment if a person has not been able to get a job after 12 months they are taken off the figures. (Without checking it) officially is about 7% but in fact some established comentators say it is more like 22%.

Oh, and we do know that 65 million are on food stamps.

Could go on but cooking dinner. Will do some real stuff later

Similar threads

- Replies

- 1

- Views

- 544

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K