- Joined

- 9 March 2012

- Posts

- 49

- Reactions

- 0

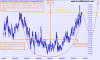

Gold is real money.

Very interesting takes coming through now but the punch line is at the end of this short article.

http://www.marketoracle.co.uk/Article35347.html

Good information. CNBC recently discussed this (can't recall the name) and the advise was buy the real metal rather than ETF's.