You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

Fair call MRC and I certainly don't want to come across as a condescending prick but what would it be replaced with? Corn, wheat, sorgum, cotton, wool.. they are all declining yields mate. So what else oil or gas ? Or maybe other non-precious metals?

It really doesn't matter, the reality of economic downturn is NOW!

Exactly, I am unsure what it will be replaced with at this point, just pointing out risks to the gold hypothesis for long-term holders. It is obviously a situation that will have to be tracked and of course in the change-over period if there was to be one, could see a temporary gold explosion for those astute enough to cover on such a situation.

The reality of an economic downturn is now, but is perhaps deflation once again a bigger concern than inflation?

FWIW, I recently closed out my gold long I had been holding since around 850s.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Exactly, I am unsure what it will be replaced with at this point, just pointing out risks to the gold hypothesis for long-term holders. It is obviously a situation that will have to be tracked and of course in the change-over period if there was to be one, could see a temporary gold explosion for those astute enough to cover on such a situation.

The reality of an economic downturn is now, but is perhaps deflation once again a bigger concern than inflation?

FWIW, I recently closed out my gold long I had been holding since around 850s.

Inflation has many fronts, there are goods, services, property and the financial sectors, all different in thier own aspects but of course join up in flationary senses at times. We have had huge deflation in stocks across the world and also with interest rates. With gold we are talking about the value base of money itself. Very low interest rates are not having the intended expectation, real money for business or between banks has become very difficult. In the last few weeks the yeilds oferred for bonds have not been suffcient to draw money in. So the Fed as one example are literally buying them with thier own paper money. This cannot continue much longer, they are eating themselves up, so the word is out that yields must rise to attract the cash. The same with interest rates, they must go up before banks will lend. There is much more to the story than this but it is these basic fundamentals that are leading back to inflation in the money area. Gold is very much a part of the money area, and that is because of historic sentiment and perceptions that it at least keeps pace with real value, paper money does not. Another aspect is that gold is but a very small part (or percentage)of the entire monetary system. As you read some posts back the demand in tonnage for gold is unprecedented, just a plain fact. The IMF's 400 tonnes is less than a third of the demand in the last 12 months. Interestingly the US senate's decision to allow the IMF to sell that 400 tonnes made no difference to the gold price, I think it was already factored in. It perhaps did stop gold from going higher as expected this morning but that is all, a bullish sign indeed.

For me the gold I have provides some confort from the current ravages of the finacial position at the moment. Each decision is for the self and I know that gold is going to go up a lot more, not on any whim but on many years of research for the benefit of my family.

Cheers and a goodweekend to all.

explod

Gold is an accepted universal storage of value, I think no one will deny this. The issue here is how much is its value worth? Currently if you measure it against the US$, it is worth about 940. Is US$940 a good reflection of gold's value?

It depends. If I am holding a lot of gold bought when it was selling at about US$300, I would tell you it is worth a further 300% taking it to about 2800. Why? And how? Well, I have in my hand a solid proof - my hoard of gold and I can show you if I were to sell it in the open market I can fetch about US$900 easy and give me a return of 300%. Since I have proven it is possible to make 300% back when I bought this gold, there is no reason to argue against this point that its value in time will increase by a further 300%. This is a perfectly logical and sensible argument.

But let's think a little further, back when gold was fetching US$300, the US$ was worth a lot more than the current US$ due to inflation. Moving into the future where gold were to gain a further 300% measured in terms of US$, how much does a US$ worth by then?

The trouble here seems to be I am trying to argue for gold's value against a moving target, ie, the "value" of US$. Of course I can further measure the US$ or gold against some other substance of value such as oil, silver, etc... still it doesn't seem to make much sense because in my eyes, my gold, regardless of what I use to measure it against, will always worth more than what others or the market is willing to pay.

So which comes first? Do you mark to market or do you adhere to an invisible absolute value for gold?

Beauty lies in the eyes of the beholder. So is gold. Subject to what others are willing to pay for it, it may worth US$3000 or it may go back to its low of US$300... I don't know. But as long as I refuse to sell at any price, it is priceless, and I won't care what others are saying.

~~~~~~~

Next, the US$ and gold standard. One of the major reasons gold standard is abolished is because the rule keeper decided to break the rules because it could no longer afford or keep the "value" of the currency it promised... because it was broke. When the US found out the rest of the world did not believe the US$ really worth the amount of gold it claimed to represent, due to the abuse of of power by the US$ safe-keeper (who else?), they did the right thing for themselves and passed on the crap to the rest of the world who agreed to go along with them initially. They abandoned the gold standard and the rest of the world got the shaft.

They did it back then and they are doing it now. Due to their self serving and selfish attitude. Still remember the famous "deficits don't matter" utterance? Right now QE is another perverse form of "deficits don't matter"... and guess what the rest of the world is telling the Yanks?

"Up you!". That is exactly what the BRIC are trying and are doing! They are trying hard to stop being screwed yet one more time. No more free lunch for the Yanks and the US$.

Right now they can't actually reduce and remove the hegemony of the US$ because like it or not, it is still the reserve currency. The world of trades needs a universal medium of exchange. Gold? Too rigid and too disadvantageous to those who don't hold a large cache of gold (China for eg), so gold will probably not be allowed to get back into the reserve currency valuation method because if it does, it has the effect of yet again letting the USA getting away with their irresponsibility, assuming they still hold their hoard of gold. I doubt if the BRIC will let that happen.

It will take at least 2 years to shrink the influence of the US$ in the current global financial system according to some experts. Before then, the US$ will be "kept" at a certain value so it won't cause unnecessary problem to the rest of the global currencies and their respective issuing economy - EUR/EU and Yen/Japan for example because the "issuer" of these currencies are themselves captives of the vagaries of the US$ volatility. If their currency goes up too much against the US$, the competitiveness of their exports will suffer. If it is too low, the other equally sensitive currency will bear the brunt of shifting speculation...

So the best solution? Keep the US$ at a narrow range, probably at the current level and until the global economy begins to actually recover, the US$ probably won't be going any where in a hurry.

That goes for gold too.

ps: as for gold's eventual rise to US$10,000, well, never can tell, but based on observation, it seems whenever gold is within reach of its target of US$1000, some invisible hand would be triggered into action, and... gold would be capped at where everyone feels it should be.

At below 1000.

So far, it has tried 4 attempts and failed. May be it will change next week, but I sure won't hold my breath betting it will happen.

It depends. If I am holding a lot of gold bought when it was selling at about US$300, I would tell you it is worth a further 300% taking it to about 2800. Why? And how? Well, I have in my hand a solid proof - my hoard of gold and I can show you if I were to sell it in the open market I can fetch about US$900 easy and give me a return of 300%. Since I have proven it is possible to make 300% back when I bought this gold, there is no reason to argue against this point that its value in time will increase by a further 300%. This is a perfectly logical and sensible argument.

But let's think a little further, back when gold was fetching US$300, the US$ was worth a lot more than the current US$ due to inflation. Moving into the future where gold were to gain a further 300% measured in terms of US$, how much does a US$ worth by then?

The trouble here seems to be I am trying to argue for gold's value against a moving target, ie, the "value" of US$. Of course I can further measure the US$ or gold against some other substance of value such as oil, silver, etc... still it doesn't seem to make much sense because in my eyes, my gold, regardless of what I use to measure it against, will always worth more than what others or the market is willing to pay.

So which comes first? Do you mark to market or do you adhere to an invisible absolute value for gold?

Beauty lies in the eyes of the beholder. So is gold. Subject to what others are willing to pay for it, it may worth US$3000 or it may go back to its low of US$300... I don't know. But as long as I refuse to sell at any price, it is priceless, and I won't care what others are saying.

~~~~~~~

Next, the US$ and gold standard. One of the major reasons gold standard is abolished is because the rule keeper decided to break the rules because it could no longer afford or keep the "value" of the currency it promised... because it was broke. When the US found out the rest of the world did not believe the US$ really worth the amount of gold it claimed to represent, due to the abuse of of power by the US$ safe-keeper (who else?), they did the right thing for themselves and passed on the crap to the rest of the world who agreed to go along with them initially. They abandoned the gold standard and the rest of the world got the shaft.

They did it back then and they are doing it now. Due to their self serving and selfish attitude. Still remember the famous "deficits don't matter" utterance? Right now QE is another perverse form of "deficits don't matter"... and guess what the rest of the world is telling the Yanks?

"Up you!". That is exactly what the BRIC are trying and are doing! They are trying hard to stop being screwed yet one more time. No more free lunch for the Yanks and the US$.

Right now they can't actually reduce and remove the hegemony of the US$ because like it or not, it is still the reserve currency. The world of trades needs a universal medium of exchange. Gold? Too rigid and too disadvantageous to those who don't hold a large cache of gold (China for eg), so gold will probably not be allowed to get back into the reserve currency valuation method because if it does, it has the effect of yet again letting the USA getting away with their irresponsibility, assuming they still hold their hoard of gold. I doubt if the BRIC will let that happen.

It will take at least 2 years to shrink the influence of the US$ in the current global financial system according to some experts. Before then, the US$ will be "kept" at a certain value so it won't cause unnecessary problem to the rest of the global currencies and their respective issuing economy - EUR/EU and Yen/Japan for example because the "issuer" of these currencies are themselves captives of the vagaries of the US$ volatility. If their currency goes up too much against the US$, the competitiveness of their exports will suffer. If it is too low, the other equally sensitive currency will bear the brunt of shifting speculation...

So the best solution? Keep the US$ at a narrow range, probably at the current level and until the global economy begins to actually recover, the US$ probably won't be going any where in a hurry.

That goes for gold too.

ps: as for gold's eventual rise to US$10,000, well, never can tell, but based on observation, it seems whenever gold is within reach of its target of US$1000, some invisible hand would be triggered into action, and... gold would be capped at where everyone feels it should be.

At below 1000.

So far, it has tried 4 attempts and failed. May be it will change next week, but I sure won't hold my breath betting it will happen.

Attachments

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

A very insightful post there Haunting, my best information says 2012 before the crunch will have to hit. And I too believe they will keep it controlled as long as possible. I still think they will let it have a bit of a run up to 1200 to 1500 to give them steam to knock it back down again. They want audience attention to then stamp it out. The wall of worry is a key. But in the very long run gold will have its steady share of gain against the ever diluting dollars IMHO.

ps: And for some time when euphoria really hits that will translate to all currencies. Getting out at the right time will be the trick for real gain.

Interesting times indeed.

ps: And for some time when euphoria really hits that will translate to all currencies. Getting out at the right time will be the trick for real gain.

Interesting times indeed.

- Joined

- 25 May 2006

- Posts

- 851

- Reactions

- 2

Haven't the charts, analysis, opinions, thoughts, and the stars been indicating a big move up, each and every week, for the past few months now?:

Just seems as though those that follow gold are always spouting for some big move which never seems to come. Yet, no matter what seems to happen in the world markets, in sentiment, and in the economy - gold doesn't seem to want to break $1000 again. How can any of you ignore that? How can so many people place such blind faith in a blooming unproductive yellow rock! It boggles the mind, and I despite how hard I try - I just cannot understand it. Then again, I don't understand those bible nuts either:

As horrible as it sounds, I really would just burst into laughter if gold were only at $300 in 2 years time

A very interesting post Nyden...

Gold at $300 in 2 years? Maybe! Once everyone works out that it is over priced and rated. But what's the bling worth? $2-3 hundred? For sure...

I really don't think it is blind faith, more like the Gold supporters actually know that the Global Financial System is a massive Ponzi scheme, and the day of reconning is somewhere close... You can't blame them for that.

But, the US is so resilient, they are working on a comprehensive plan to save the world from their regulation/overseeing of their financial system (stuff ups)and instruments. If they can sell this to the average punter, Gold may sure plummet. I will consider selling my position before the spin takes hold.

Who knows, It may actually work!~ But I doubt they will fully implement their stratergies. Maybe just another smoke and mirrors job.

Check out this link if you are interested:

http://www.moneyandmarkets.com/washington-moves-to-muzzle-wall-street-3-34257

PS: I don't get the Bible nuts either...

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

But, the US is so resilient, they are working on a comprehensive plan to save the world from their regulation/overseeing of their financial system (stuff ups)and instruments. If they can sell this to the average punter, Gold may sure plummet. ..

the US debt is so great per capita that you have to be jocking if you think their resilience will save them in any shape. If you think about the bigger picture their stock market (the Dow) is built on easy money (credit) and that goes back to about 1985. Thier GDP up till the last count last year was 75% consumption, consumption based on loose lending to the sheeple, only too happy to buy the extra investment home, the boat and the holiday. If you have studied economics in any fashion you will know the US is stuffed and no miracle will save them from many years of pain.

This also applies to most other western economies and we will not escape the entire wrath in Australia either.

Gold among other tangibles will be one of the few things to save those who have the common sense to be realistic. IMVHO of course.

PS: not singling you out in this last comment Gundini, but the comments of some posters worry me at times to think they are investing in this dagerous market with limited economic knowledge.

I do not peddle books or push anyones barrow but two books well worth reading if you really want to know, and web references from the books are invaluable too: are

"Financial Armageddon, Michael Panzer, Kaplan 2007" and "Conquer the Crash and prosper, Robert Prechter Jr., Wiley 2002" the latter dated but the basic fundamentals of large corporates and banks is very good grounding indeed, and what he forsaw turned out to be spot on.

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Yes, oil was irrationally sold down. However, as oil, and all other commodities are productive; it only takes a whiff of a recovery, or even the potential for recovery to completely ignite those markets. As we're seeing now.

Oil was sold down because demand vanished - economics 101 - just check the figures for global trade the last year or so, gone off a cliff. Oil is back to break even for producers.

You talking about the 'green shoots, second half' recovery? The one where the US has to find an extra 2 TRILLION paper IOU's to get someone to give to them, or recently, print!

Gold just may be smashed down as well; perhaps not in the same drastic fashion as everything else we've seen - but what do you really think is going to happen when the world recovers, and gold loses its luster as a dooms-day hedge?

'when the world recovers'? You mean if the world recovers? The cycle theory is busted, we are at the start of Japanese stagnation on a global scale?

California, the 5th largest economy in the world, is bankrupt! Federal income tax receipts for April were a shocker, creating a net deficit for the first time in several decades!

Unemplyment - the real figures are somewhere around 15%! The Fed are now paying the unemployed $2000 a month benefits trying to prime the economy, as compared to normal benefits of around $500/m! I'm sure they all go out and buy the latest flat screen TV or a second investment property?

Income is falling while debt & unfunded liabilities is rising at an parabolic rate. The real game on Wall St is to get as much of the billions getting handed out before the hole jalopy comes crashing down. One estimate was that $50 billion was going to be 'collateral' wastage!! by scammers and corporate looters!

The reason, or excuse for holding gold seems to be ever-changing in certain circles as well, and the can-hoarding gold nuts all seem to lap it all up, without any doubt whatsoever. First, it was an "insurance policy" - for when the entire financial system collapses (when is that happening, by the way?). Second, it was a hedge against a guaranteed-to-collapse USD (how'd that go fellas?) And now, of course, it's a hedge against the imminent hyperinflation the world will face any day now.

The show aint over yet, not by a long way! The 'insurance policy' is still current and there is a sizable client base taking out new policies every day - ie check the ETF's etc. The US gives the OK for the IMF to sell it's gold - gold barely flinched.

The USD - China has suddenly gotten a bad case of USD indigestion recently, something to do with someone printing more of them (helicopter Ben has come through with his promise), hence diluting the value of existing USD's??

Bond yields say that creditors want a higher return for the junk now.

To be fair, I don't think there's anything wrong with having a little gold exposure in a balanced portfolio. However, what seems to illustrate my point of loony blind-faithed gold bugs, is how many people seem to have most of their money, and all of their portfolio in gold, or gold stocks! What if gold doesn't skyrocket - is that a question that's even considered? Or is it pushed into the back of the mind by the seemingly endless supply of gold-supporting articles about the end of the world?

"how many people seem to have most of their money, and all of their portfolio in gold, or gold stocks!"

This is interesting? Is this data published by the ASX or someone? Or are you assuming?

PS - just aboout everything the 'gold bugs' have been saying for the last few years has come true - why start to doubt them now? The game continues........

"Financial Armageddon, Michael Panzer, Kaplan 2007" and "Conquer the Crash and prosper, Robert Prechter Jr., Wiley 2002" the latter dated but the basic fundamentals of large corporates and banks is very good grounding indeed, and what he forsaw turned out to be spot on.

You may be suprised to know that Prechter's opinion on gold has changed & he thinks that it will go down to $680 now.

He published a market forecast in May & has repeated all the thoughts in this thread, i.e inflation, debt, money printing but yet it has failed to breach it's high which is why he is bearish on gold.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

You may be suprised to know that Prechter's opinion on gold has changed & he thinks that it will go down to $680 now.

He published a market forecast in May & has repeated all the thoughts in this thread, i.e inflation, debt, money printing but yet it has failed to breach it's high which is why he is bearish on gold.

Yes, Prechter was way out in his timing of the crash too, thought it would be 2003. The point of my references though is their take on fundamentals and how companies cook the books to shareholders and the community for their own self interest, among a lot of other useful and alternative ways of looking at the markets and financials.

As for the gold price, it is really anyones guess what a market will do in fact. We can just measure the best for ourselves and invest accordingly. For me gold has a long way to go yet and maybe a correction down to 680 could occur. In the long run though paper money as it is being diluted must lose value, tangibles such as land, food, oil, gas, and among other things, gold will and cannot be diluted, those things are in fact becoming more scarce and as a result must go up in value. It is simple ABC to go that way to at least hold onto ones savings in my humble view.

Is the USA still in charge of this world? In military term, a cautious yes if measured by fire power and technologically advanced weaponry. But in terms of fighting a conventional war, as in Afghan, Iraq and in some part of Africa, I don't think so. The most powerful weapon in a conventional warfare is a soldier that is not afraid of dying, the suicide bomber for example. If the threat and fear of death cannot stop such soldier, bullets and bombs will definitely not do.

What about politically? After 8 years of GWB's reign of "shock and awe" warfare and "if you are not with me, then you are against me" kind of global political bullying, I am not sure if the USA is still being looked up, listened to as the most respected nation in this globe - international prestige and respect take a long time to build up and are easy to lose, even for a superpower. If you don't believe this, try some recall or google - in the last few months, how many foreign dignities had been making a beeline to the USA visiting Obama, paying respect and talk politics? On the other hand, in the last few months, how many US top officials had been making a bee line to China - Pelosi, Clinton, TimG, does this observation mean something?

Economically? Well, you don't need me to point out to you the many posts that are fairly critical on the US economic front, right? The US economy is in trouble and everyone can see that.

But what about the future? What about say after the US economy has "recovered"? Will the USA still be in charge economically?

Do you still believe the global economy will not be able to recover without the US recovering first? In other words, do you believe the global economies are still in the process of decoupling?

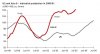

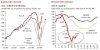

Here are some charts and graphs from an Asian bank presenting the argument that as far as Asia is concerned, they have moved on whilst the US+EU economies are still mired in green shoots spotting.

China for example, is not talking about green shoots, they are actually nursing a slightly "wounded" tree but is still growing strongly, providing shades to her trade partners in the region and elsewhere - Australia for example.

So ask this very important question - does the Australian economy need the US economy to recover first? Does the US consumption engine a key driver for Australian economic growth? If you can leave every other matter aside and just focus on economic matter, the answer is there and is quite obvious.

What about politically? After 8 years of GWB's reign of "shock and awe" warfare and "if you are not with me, then you are against me" kind of global political bullying, I am not sure if the USA is still being looked up, listened to as the most respected nation in this globe - international prestige and respect take a long time to build up and are easy to lose, even for a superpower. If you don't believe this, try some recall or google - in the last few months, how many foreign dignities had been making a beeline to the USA visiting Obama, paying respect and talk politics? On the other hand, in the last few months, how many US top officials had been making a bee line to China - Pelosi, Clinton, TimG, does this observation mean something?

Economically? Well, you don't need me to point out to you the many posts that are fairly critical on the US economic front, right? The US economy is in trouble and everyone can see that.

But what about the future? What about say after the US economy has "recovered"? Will the USA still be in charge economically?

Do you still believe the global economy will not be able to recover without the US recovering first? In other words, do you believe the global economies are still in the process of decoupling?

Here are some charts and graphs from an Asian bank presenting the argument that as far as Asia is concerned, they have moved on whilst the US+EU economies are still mired in green shoots spotting.

China for example, is not talking about green shoots, they are actually nursing a slightly "wounded" tree but is still growing strongly, providing shades to her trade partners in the region and elsewhere - Australia for example.

So ask this very important question - does the Australian economy need the US economy to recover first? Does the US consumption engine a key driver for Australian economic growth? If you can leave every other matter aside and just focus on economic matter, the answer is there and is quite obvious.

Attachments

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

PS - just aboout everything the 'gold bugs' have been saying for the last few years has come true - why start to doubt them now? The game continues........

Except the price of gold.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Except the price of gold.:

Most other investments have gone down 30 or 40% in the last few years, not gold, energy or property. Though the old oil took a bit of a hit too.

Cant beat you T. H., he he, the old PPP alive and well.

What a waste for my post 2000

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Most other investments have gone down 30 or 40% in the last few years, not gold, energy or property. Though the old oil took a bit of a hit too.

Cant beat you T. H., he he, the old PPP alive and well.

What a waste for my post 2000

Nah I don't buy that. The gold bugs are seething that the world hasn't collapsed into a pile of **** and gold isn't at $5000 AUD - $20,000 USD.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Nah I don't buy that. The gold bugs are seething that the world hasn't collapsed into a pile of **** and gold isn't at $5000 AUD - $20,000 USD.

Nah all right, not yet, the October crash aint nothing to where we are going and yes as in October gold will probably go with it as well, in fact 2000 dow probably does equal 680 gold........for awhile. We will be prepared this time......maybe

And if you feel like that one should not buy anything.

And the sh't on my vegie patch does wonders, its a tangible old Son.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

And if you feel like that one should not buy anything.

Nah nah nah!

Quite the opposite. The problem with a love affair with a trading instrument, which gold is just another of many, is that you wastes valuable time & money waiting for it to reward you for your dedication. And happily ignore its misgivings.

We all have a limited amount of time on earth. falling in love with the gold idea is wasting that valuable time. I have said it many a time and had many a barney with the latest bug. It may be going to $300000 but I think equity traders will still outperform gold bugs because they are making money moving with the swings and round-a-bouts and it doesn't exclude getting into gold tomorrow.

What is the opportunity cost of your waiting?

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Nah nah nah!

Quite the opposite. The problem with a love affair with a trading instrument, which gold is just another of many, is that you wastes valuable time & money waiting for it to reward you for your dedication. And happily ignore its misgivings.

We all have a limited amount of time on earth. falling in love with the gold idea is wasting that valuable time. I have said it many a time and had many a barney with the latest bug. It may be going to $300000 but I think equity traders will still outperform gold bugs because they are making money moving with the swings and round-a-bouts and it doesn't exclude getting into gold tomorrow.

What is the opportunity cost of your waiting?

Do agree old pal, equity trading is the best, but its too is time consuming and stressful to an old codger, have been down that track and with a criteria generated computer progam got good results. Prefer my garden and handyman work and let the long term holdings work for themselves. Of course one cannot put a value on the arguments and stirrings of the threads and you come at it beautifully T/H.

Gold is in the blood, my Great Grandfather and his brothers left The good Mother country to chase gold in the 1860's around Avoca (live now at the cemetary at Redbank), in central west Victoria. Finished up farmers and did well, they had dozens of children between them who helped open up this country and represented in both the great wars. All means to an end and providence my Son.

>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

Nah nah nah!

Quite the opposite. The problem with a love affair with a trading instrument, which gold is just another of many, is that you wastes valuable time & money waiting for it to reward you for your dedication. And happily ignore its misgivings.

We all have a limited amount of time on earth. falling in love with the gold idea is wasting that valuable time. I have said it many a time and had many a barney with the latest bug. It may be going to $300000 but I think equity traders will still outperform gold bugs because they are making money moving with the swings and round-a-bouts and it doesn't exclude getting into gold tomorrow.

What is the opportunity cost of your waiting?

well said!

- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

In the last few weeks the yeilds oferred for bonds have not been suffcient to draw money in. So the Fed as one example are literally buying them with thier own paper money.

May want to check the latest bid/cover ratios and foreign participation in US bond auctions. As reflected in the falling yields.

From my understanding, it's quite the opposite to what you are saying over the last couple weeks.

Though, some pretty big auctions coming up yet.

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

Do agree old pal, equity trading is the best, but its too is time consuming and stressful to an old codger, have been down that track and with a criteria generated computer progam got good results. Prefer my garden and handyman work and let the long term holdings work for themselves. Of course one cannot put a value on the arguments and stirrings of the threads and you come at it beautifully T/H.

Gold is in the blood, my Great Grandfather and his brothers left The good Mother country to chase gold in the 1860's around Avoca (live now at the cemetary at Redbank), in central west Victoria. Finished up farmers and did well, they had dozens of children between them who helped open up this country and represented in both the great wars. All means to an end and providence my Son.

I'm a bit of green-thumb myself explod.

I don't see gold as a waste of time but I do see the fraudulently over-valued derivatives games as a house of cards.

Notice the media have come out with the "green shoots" argument recently. Well explod I'm sure you would probably agree. You would never want to quantitative ease to much "fertilizer" on that vegie patch.

Similar threads

- Replies

- 1

- Views

- 527

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K