You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

There's several gold newsletters out there that are not bullish after the second attempt at the big 1K, and the XAU is not looking like a decision has been made on the part of gold equity investors to commit or capitulate - yet.I thought mostly everyone was bullish on gold UF haven't seen any real bearish comments

Gold equities rode the last bear sell off with the pleb's so unless gold absolutely explodes this time due to some dramatic black swan event, not too hard to guess which, then I will wait for some tradeable confirmation that the US (and therefore the global economy?) is indeed going down the s bend and that the world will be looking for an alternative measure of wealth any time soon? A time of financial flux until the next bombshell explodes.....

For eg, I own NEM, but from the chart it's hardly showing the effects of a raging bull market, even though gold is only $100 off the all time high, even worse for the inflation adjusted figure ie another 60-70% to go!

Then again, it's still 140% better than the Dow Dogs

Attachments

doctorj

Hatchet Moderator

- Joined

- 3 January 2005

- Posts

- 3,271

- Reactions

- 8

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

There's several gold newsletters out there that are not bullish after the second attempt at the big 1K

I count 3 ~ your not including the July 08 $978 (approx) as a crack at 1K :dunno:

Surly a triple rejection is a bad thing....the perfect storm for gold is waning...for example

Gordon Brown is clearing the way (for the yanks) for Iran to have Nukes.

http://www.telegraph.co.uk/news/wor...-nuclear-power-if-it-works-with-the-West.html

Bob Hoye and Ross Clark on Gold, Gold Indices and Gold:Oil ratio.

Bob Hoye one of my most respected analysts.

http://www.321gold.com/editorials/hoye/hoye031609.pdf

Bob Hoye one of my most respected analysts.

http://www.321gold.com/editorials/hoye/hoye031609.pdf

Gold is playing silly buggers tonight.

On the hourly chart, it exited the lower trendline during 0200-0300 but managed to close back inside the channel just before the 3am candle! Also came close to my 38.2% fib line (from 681-1006),not that 23.6% was too well respected.

Will gold respect the trend line after closing just inside it and now begin a new leg up? If so the weekly stochastic will present hugely bullish divergence!

If not then down we go, my first target 850.

Once again, strong correlation between USD/JPY and PoG tonight from what I have seen. USD already touched 97.75 (from 98.6+) against JPY earlier in the session, took a few hours for that to move into gold.

On the hourly chart, it exited the lower trendline during 0200-0300 but managed to close back inside the channel just before the 3am candle! Also came close to my 38.2% fib line (from 681-1006),not that 23.6% was too well respected.

Will gold respect the trend line after closing just inside it and now begin a new leg up? If so the weekly stochastic will present hugely bullish divergence!

If not then down we go, my first target 850.

Once again, strong correlation between USD/JPY and PoG tonight from what I have seen. USD already touched 97.75 (from 98.6+) against JPY earlier in the session, took a few hours for that to move into gold.

Attachments

- Joined

- 15 June 2008

- Posts

- 184

- Reactions

- 0

Wake up Sinner. Looks like the Fed has helped things along a little. In USD terms for now anyhow.

http://www.marketwatch.com/news/sto...732-2AD2-4F2F-833A-B7FFFC85451D}&siteid=yhoof

http://www.marketwatch.com/news/sto...732-2AD2-4F2F-833A-B7FFFC85451D}&siteid=yhoof

Attachments

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Yep, the black swans are landing! Only now the general public is learning about the massive Madoff US (and the world for that matter!) economy based on foreigners continued support for unproductive debt driven consumerism. Watch the rat's desert the sinking ship.

This bloke calls for $3500 gold.

The only problem for us is the Aussie going burko, although I don't think it's supported by fundamentals as our recession is only just starting, and we are one of the biggest private net debt holders in the world.

This bloke calls for $3500 gold.

http://www.abc.net.au/rn/breakfast/stories/2009/2520173.htmA few people were sounding the alarm about the US sub-prime mortgage market well ahead of the crash. One was the leading Asia-based equity strategist Christopher Wood, who told his clients back in 2005 to sell all their exposure to US mortgage-backed securities.

The only problem for us is the Aussie going burko, although I don't think it's supported by fundamentals as our recession is only just starting, and we are one of the biggest private net debt holders in the world.

Wake up Sinner. Looks like the Fed has helped things along a little. In USD terms for now anyhow.

http://www.marketwatch.com/news/sto...732-2AD2-4F2F-833A-B7FFFC85451D}&siteid=yhoof

This is the problem with charts. When fundamentals kick in they are useless, and you get a $50 jump in minutes.

Lucky we just discussed quantitative easing. We see it now in action, USD down over 4% less than 2 days.

So at least we know why the US dollar dropt yesterday.

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Thanks CapnBirdseye, by then I was well passed out, dreaming of sunshine and butterflies.

Err what? The chart worked perfectly in terms of both fundamentals and technicals.

My confidence in gold fundamentals would not have convinced me to go long gold last night, but the technicals did!

So projack, did you go long on gold last night? My current profit on this position is 42 points at 100USD per point and I would have just has happily gone short on a break down from 881.

I have included below the 5m chart continuing from where my last chart finished. We can see buy signal developing on RSI and stochastic. Thankyou technical analysis for allowing me to position before the "$50 jump in minutes".

This is the problem with charts. When fundamentals kick in they are useless, and you get a $50 jump in minutes.

Lucky we just discussed quantitative easing. We see it now in action, USD down over 4% less than 2 days.

So at least we know why the US dollar dropt yesterday.

Err what? The chart worked perfectly in terms of both fundamentals and technicals.

My confidence in gold fundamentals would not have convinced me to go long gold last night, but the technicals did!

Date: 19 MAR 2009

Market: Spot Gold CFD

Level: 887.02

Stop (Not Guaranteed): 881.02

So projack, did you go long on gold last night? My current profit on this position is 42 points at 100USD per point and I would have just has happily gone short on a break down from 881.

I have included below the 5m chart continuing from where my last chart finished. We can see buy signal developing on RSI and stochastic. Thankyou technical analysis for allowing me to position before the "$50 jump in minutes".

Attachments

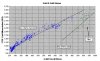

This chart is SPDR GLD and 30y bond yield (which moves inverse to bond price, i.e. bonds up yields down).

Goldbugs are suggesting a flood exit from bonds i.e. "bond bubble". Even Marc Faber is short bonds and I like him. In my RYJUX thread I suggested it might be a good time to get in short too (double short in fact). Now I am not so sure: gold is forecasting bond strength now.

i.e. we should see a drop in yield from here.

(Although if you are a pairs trader you would go short gold and short bonds here)

Hi guys,

I would like to give myself a big pat on the back for the above post and not entering RYJUX too early.

See below

BOND REPORT

Treasurys skyrocket as Fed set to buy U.S. debt

Yields reverse all of 2009's climb

By Deborah Levine, MarketWatch

Last update: 3:45 p.m. EDT March 18, 2009Comments: 51NEW YORK (MarketWatch) -- Treasury prices soared Wednesday, sending yields plummeting by the largest amount since 1987 after the Federal Reserve surprised bond investors by saying it would buy $300 billion in longer-term Treasury securities over the next six months.

Yields on the benchmark 10-year note , which move in the opposite direction from their prices, declined 50 basis points to 2.52%, the biggest drop since the stock market crashed in October 1987.

Thanks CapnBirdseye, by then I was well passed out, dreaming of sunshine and butterflies.

Err what? The chart worked perfectly in terms of both fundamentals and technicals.

My confidence in gold fundamentals would not have convinced me to go long gold last night, but the technicals did!

So projack, did you go long on gold last night? My current profit on this position is 42 points at 100USD per point and I would have just has happily gone short on a break down from 881.

I have included below the 5m chart continuing from where my last chart finished. We can see buy signal developing on RSI and stochastic. Thankyou technical analysis for allowing me to position before the "$50 jump in minutes".

Hi Sinner

Happy to here you made a good trade on this spark. I’m not an expert on charts and never will. I don’t have the expertise and time on short trades so I don’t do it. I just go with the trend, if the fundamentals support it, and assess it time to time. Not expecting huge returns either, but want to protect what I already have. I don’t trust the mainstream media on financial matters either; just trying read what’s between the lines.

Anyway somehow I had the feeling POG would of go down further, if the announcement wait till Monday, and tiger you a short trade, but as said I’m not an expert and wont trade on gut feelings.

- Joined

- 27 February 2008

- Posts

- 4,670

- Reactions

- 10

Gold hooting along ......... still on that long sinner ?

Halved it at 936 nun. Sustained gains can be held by my gold miners in the morning. Would rather put the capital to use elsewhere than be long gold for the long runs up, especially considering miners are underperforming and plenty of my portfolio is already long gold

Short gold (delta hedge) long gold miners n physical generally

Not all of the decisions I've made have been great. Recently ran a list of the ASX gold sector products I've invested in.

SBM in at 305 out at 305 (now >400)

IGR in at 135 out at 130 (now >200)

NCM in at 3400 out at 3100 (now >3300)

TRY in at 760 out at 680 (now >1200)

RMS in at 450 out at 595 (+30%, still holding RMSOC, will go long RMS again at 0.55)

IAU in at 185 33% out at 300 (now 290)

GOLD at 11900 out at 11200 (now >13600)

Thankfully the losses were on generally small lots (except IGR) and the capital was returned to investments which performed far better and made up for those losses severalfold.

Goes to show the importance of timing.

Obviously the gains would have been real nice but thems the breaks when you've got rules gotta stick to em.

Short gold (delta hedge) long gold miners n physical generally

Not all of the decisions I've made have been great. Recently ran a list of the ASX gold sector products I've invested in.

SBM in at 305 out at 305 (now >400)

IGR in at 135 out at 130 (now >200)

NCM in at 3400 out at 3100 (now >3300)

TRY in at 760 out at 680 (now >1200)

RMS in at 450 out at 595 (+30%, still holding RMSOC, will go long RMS again at 0.55)

IAU in at 185 33% out at 300 (now 290)

GOLD at 11900 out at 11200 (now >13600)

Thankfully the losses were on generally small lots (except IGR) and the capital was returned to investments which performed far better and made up for those losses severalfold.

Goes to show the importance of timing.

Obviously the gains would have been real nice but thems the breaks when you've got rules gotta stick to em.

- Joined

- 27 February 2008

- Posts

- 4,670

- Reactions

- 10

cool m8 and fair enough , no point having a plan if one forgets what it is when things get tough

cheers

cheers

Just about time to wholly exit this long so I can recycle the capital.

Total risk: 600USD

Total reward: 4900USD (887-936), then switched from 1 big contract to 5 minis 900USD (936-954) = 5800USD.

In the meantime I've been scalping the SP500 to provide some free money for a free play on BEPPA.

All done for the week as I'm not working tomorrow night, will get out while I am ahead.

Might take some time off from the scalping/trading again, it's just too stressful.

EDIT: Worth pointing out this sort of trade is not the norm for me, last nights price action was crazy volatile!

Total risk: 600USD

Total reward: 4900USD (887-936), then switched from 1 big contract to 5 minis 900USD (936-954) = 5800USD.

In the meantime I've been scalping the SP500 to provide some free money for a free play on BEPPA.

All done for the week as I'm not working tomorrow night, will get out while I am ahead.

Might take some time off from the scalping/trading again, it's just too stressful.

EDIT: Worth pointing out this sort of trade is not the norm for me, last nights price action was crazy volatile!

Similar threads

- Replies

- 1

- Views

- 533

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K