RichKid

PlanYourTrade > TradeYourPlan

- Joined

- 18 June 2004

- Posts

- 3,031

- Reactions

- 5

Re: GOLD Where is it heading?

Wavepicker,

Thanks for one of the best posts I've read on this thread and certainly the best chart and commentary on gold that I've seen on EW recently, great proportions. Thanks very much, looks like a high probability count and 'prediction' that you've got there.

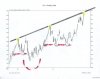

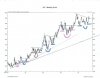

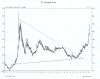

wavepicker said:I have provided a 5 year log chart of gold(just for refernce) based on my interpretation of the Elliott Wave Principle. I have been wrong on many occasions before, and this chart should not be assumed to be 100% correct. This same chart was sent to tech/a some weeks ago when I said to him I beleive we were close to a top ( $660 level) where I liquidated my position...........................

................

Once again, all the above is just my opinion- based on the way I see it to date. I could be very wrong

Cheers

Wavepicker,

Thanks for one of the best posts I've read on this thread and certainly the best chart and commentary on gold that I've seen on EW recently, great proportions. Thanks very much, looks like a high probability count and 'prediction' that you've got there.