explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

I don't quiet get it.

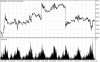

Moved through resistance (which becomes support). Hence, I am long, and this is where my stop is placed...........

?

Moving through resistance does not always at that point become support. It usually requires a couple of retracements to bounce off that point/level before one can regard it as support.

Anyway the break out of the flag/pennant looks like it could be a goer, as we speak. Glad I loaded up on some more of them SBM. Me glass of red tastes goodo.