- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

Are too mate .....

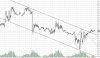

I 'm waiting for an retest of the 872/3 area if it has the legs , might have seen it , but a little unconvincingly , under that is 851 , that's a nasty spot for a volatile swing . So I'll look and see if 872's can be tackled or whether the ball's been picked up . Below 851 I have 792 , horrid stuff , but it could happen . Then we have to consider whether it would sit there in a cycle range bound , but that is all presumption of where it could go .

What is missing are the drivers that could move it there . At present all I see is everyone gearing up for hyperinflation and a lot of rhetoric .

I understand your point ithatheekret re the drivers to make it move. I must say that I don't bother looking any more for reasons that might propogate an instruments movement because I have had a plain terrible track record after attempting to do so in the past.

Having said that I find it just plain amazing sometimes when the technicals are hinting at the possibility of a certain move but there is just no fundemental logic behind it. Sometimes this rationale has even persuaded me not to take certain trades in the past, only to have the market end up moving just as the technical were hinting after a snap announcement which coincided with the timing of the technicals.

I think one has to look to their strengths, and have complete faith in them and build contingencies around their trading plan as things ofcourse do go wrong. My strengths are certainly not in FA, probably never will be. For others it's the other way around, and yet for a select few they are gifted enough to exploit the best of both worlds in their trades.

Cheers