- Joined

- 12 May 2007

- Posts

- 342

- Reactions

- 0

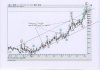

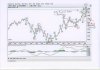

a, b, c 50% correction complete, 933 reached... and now a breakdown below the lower support of the wedge, on high volume. .. so this doesn't look good.. at all.. I had a little long going in the low 30's which I exited.. just before it plunged from 929 to 922 in one second..

GATA meeting began last night, sessions in progress today and tomorrow in Washington DC, that's heavy stuff and they will be trying for some publicity. Needless to say with all sorts of accusations being thrown around, the Feds will not want the gold price shooting up on the day..

GATA meeting began last night, sessions in progress today and tomorrow in Washington DC, that's heavy stuff and they will be trying for some publicity. Needless to say with all sorts of accusations being thrown around, the Feds will not want the gold price shooting up on the day..