- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

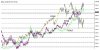

Consequently, I have advocated for awhile that the USD will strengthen a bit in the near future and that equates to some easing in demand for gold.

Interesting you say that, Wavepicker is of the same opinion but there dose not seem to be a reason put forward as to why?

Can you give a take on this rationale?

Refer to the following post I made a while ago:-

https://www.aussiestockforums.com/forums/showpost.php?p=274158&postcount=3716