explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,197

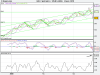

In current trade the Aussie dollar is down 1%. The old Aussie has had a strong run of late against the $US but the interesting aspect is that the move against other currencies has reversed and this has been lifting our local gold price; now $1064

And the big one, caused a great deal of reaction yesterday in the press so will probably be kept below 1000 I think behind the scenes the PPP and general US establishment will accumulated and go long, this will give it a strong break up but when all eyes are apon there will be an enormous correction, for the benefit of the new audience.

Will be interesting to see what pans out.

The birthday cake tastes nice though, thanks to the Barret Clan for that.

Gut feeling goes a long way. It is intuition, a tool based on our total experience.

The term PPP from my point of view is merely the whole US thingo trying to protect appearances, as said the other day, it's political, it's the US presidential election, it is fooling the M..gs, oops (meant to read sheeple) and US$1000 was going to be a huge stumbling block.

On my Gann chart, late April into early May is the next strong period for gold (as measured over the last 30 years), so I expect it to consolidate sideways for 3 or 4 weeks from here.