- Joined

- 12 May 2007

- Posts

- 342

- Reactions

- 0

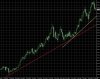

some potential resistance levels on the daily,

the yellow.. potential support in the mid 70s for the next day or two

.. =0.38ret at 875.6.. A?

..and the red.. now at 840 but in another 10 closes it would be around that 0.5ret at 856.9..

the yellow.. potential support in the mid 70s for the next day or two

.. =0.38ret at 875.6.. A?

..and the red.. now at 840 but in another 10 closes it would be around that 0.5ret at 856.9..