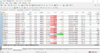

Just used last day trade for today to go short as current uptrend was in overbought condition.

Looks like Buying Climax BCLX .

setting up new shorter term TR?

Just got stopped out for BE on bounce off top trend line.

Next Day trades can be taken at 12:01 am.

1 st Week of Demo ends tonight 11:59 pm

Just moved Swing trade S/L to $1326 for Risk = $55 down from $100

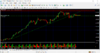

Looks like Buying Climax BCLX .

setting up new shorter term TR?

Just got stopped out for BE on bounce off top trend line.

Next Day trades can be taken at 12:01 am.

1 st Week of Demo ends tonight 11:59 pm

Just moved Swing trade S/L to $1326 for Risk = $55 down from $100