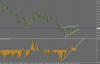

The pair confirmed on Friday a strong closing well above the 200 days line, now again support at 1,5341! The weekly as well as the monthly closings were positive supporting further strength.

The indicators of the daily chart are again well positive as well as those of the weekly one supporting higher levels; only those of the monthly chart remain below the line. The indicators of the s/t charts are still in positive territory supporting further strength; however, in the s/t have overbought conditions while showing potential negative reversals. The hourly RSI went however well above the 75% level, well into the range of a bullish scenery, failing however to form divergences.

I suggest waiting for a possible retracement toward the 200 hours line, now found at 1,5357, to buy!!

The indicators of the daily chart are again well positive as well as those of the weekly one supporting higher levels; only those of the monthly chart remain below the line. The indicators of the s/t charts are still in positive territory supporting further strength; however, in the s/t have overbought conditions while showing potential negative reversals. The hourly RSI went however well above the 75% level, well into the range of a bullish scenery, failing however to form divergences.

I suggest waiting for a possible retracement toward the 200 hours line, now found at 1,5357, to buy!!