- Joined

- 28 May 2020

- Posts

- 7,154

- Reactions

- 13,942

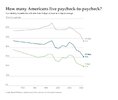

I doubt tariffs are going to affect the American consumer one way or the other, they are already fcuked.Tariffs haven't really hit yet. April 2nd. Yet they are already wiped out.

The figures aboive would have been exactly the same if Biden had won and there was no tariff war.

Mick