- Joined

- 5 June 2007

- Posts

- 1,045

- Reactions

- 1

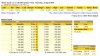

Just looking at some of the transactions in your portfolio.

I’m probably not understanding something here Trader Paul, if you could clarify for me.

but the volume figures would be a reason why these trades couldn't be done with real money?

Hi Timmy,

..... and these trades may well have been done with real money,

at that time ..... just because a limited number were actually traded,

does not mean, that there were not more available to trade, at that time.

have a great day

paul

=====