wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,331

- Reactions

- 14,013

Can you explain, apart from sheer randomness, why a gap should fill?Hi Shark,

M8, A Gap is still a Gap regardless of the reasons - in fact a Gap caused by a Dividend probably caries more weight than a Gap caused by a rogue trade, or a sell-off/spike caused by rumours, or as you mentioned, an unexpected news event.

I will mention however, that an Ex Div Gap probably won't take long to fill, unless there are other underlying issues.

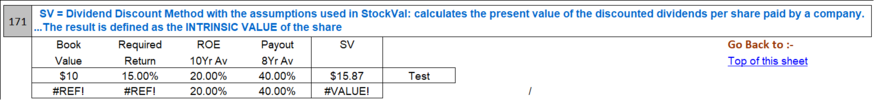

see pages 203 to 212

Cheers.

DrB