Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,975

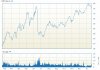

That's a reasonable point, Aussiest. Pretty hard to see RIO collapsing though.Well, put it this way: take a look at BNB and ABC Learning. You've got to work out for yourself whether you can see RIO going this way.

I don't hold RIO but if I did, and it was part of a two year plan, I wouldn't be selling at this stage. That's just a personal view, not advice, yada yada.

In January 08 I sold my whole p/f. When I began to re-enter the market, I was able to buy again some of the stocks I'd sold at a much lower price.

So that's maybe something you could consider with your RIO.

This will be an unpopular comment, but with a long term view like 2 years and a stock as substantial as RIO, I'm not sure I'd be having a set stoploss.

For a speccie stock, yes absolutely, but a discretionary approach here doesn't seem unreasonable to me.