ERA has had some legacy contracts signed in early 2000 with very low spot price at that time, nevertheless the sp has reached $28 during March 2007. Now most of those contracts are nearing to end soon (probably this year) and will roll out their current portfoilio and will be replaced with new contracts reflecting current prices.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ERA - Energy Resources of Australia

- Thread starter RichKid

- Start date

Lucky_Country

Formerly known as ijh

- Joined

- 30 June 2006

- Posts

- 738

- Reactions

- 0

Exactly so just imagine what the share price will be when they announce the finish of these existing contracts not long too go now some may even have already expired.

Jabiluka would be the icing on the cake and a serious increase in dividends !

Jabiluka would be the icing on the cake and a serious increase in dividends !

chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

I'm glad I've stirred up some healthy debate!

Kennas, I can't imagine Peter Garrett and the new federal government allowing U mining in Kakadu, even if the locals sign off. You can't tell me he wont be looking to prove himself on a key-note issue after rightly being called a sell-out. Politically the ramifications would be disasterous IMO. Especially as ERA's environmental record is appalling. Same with BHP's Cannington mine FWIW. Similar problems. Paid their way out of losing export licenses in QLD etc. usual story...

An attitude of assuming the locals will just "roll over", I think ignores the history that those people have with the mining companies. They feel they have been totally shafted, and I dare say would make anything as difficult as possible (which is what has happened). I'm not sure the closure of Ranger will have the impact you say as the Mirrar people have never been happy with the employment rights anyway, as far as I'm aware. And they appear more interested in environmental/ rehab employment and training, which they aren't getting, so I can't see them doing any favours any time soon.

IJH, why will ERA go to $28? If it will, why has it put in a lower high? Why will U go to a certain price? Did someone say it would? I take forecasts with a grain of salt. Supply/ demand is out of the window, ability to pay is king, and is reducing world wide.

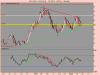

You don't think higher U prices are factored into the SP? Not with a P/E of about 80? Hmmm.... I guess the point is, being long on a downtrend is pretty risky. What happens if it does look as though it will get near my targets? What will you do? If this moves against me, I'm out, no biggie. The chart reminds me of ZFX, and the comments are quite similar. Impossible etc etc.

Fib level right on that potential C move. Hmmmm...

Cheers.

Kennas, I can't imagine Peter Garrett and the new federal government allowing U mining in Kakadu, even if the locals sign off. You can't tell me he wont be looking to prove himself on a key-note issue after rightly being called a sell-out. Politically the ramifications would be disasterous IMO. Especially as ERA's environmental record is appalling. Same with BHP's Cannington mine FWIW. Similar problems. Paid their way out of losing export licenses in QLD etc. usual story...

An attitude of assuming the locals will just "roll over", I think ignores the history that those people have with the mining companies. They feel they have been totally shafted, and I dare say would make anything as difficult as possible (which is what has happened). I'm not sure the closure of Ranger will have the impact you say as the Mirrar people have never been happy with the employment rights anyway, as far as I'm aware. And they appear more interested in environmental/ rehab employment and training, which they aren't getting, so I can't see them doing any favours any time soon.

IJH, why will ERA go to $28? If it will, why has it put in a lower high? Why will U go to a certain price? Did someone say it would? I take forecasts with a grain of salt. Supply/ demand is out of the window, ability to pay is king, and is reducing world wide.

You don't think higher U prices are factored into the SP? Not with a P/E of about 80? Hmmm.... I guess the point is, being long on a downtrend is pretty risky. What happens if it does look as though it will get near my targets? What will you do? If this moves against me, I'm out, no biggie. The chart reminds me of ZFX, and the comments are quite similar. Impossible etc etc.

Fib level right on that potential C move. Hmmmm...

Cheers.

Lucky_Country

Formerly known as ijh

- Joined

- 30 June 2006

- Posts

- 738

- Reactions

- 0

Chops I agree with some of your commentry my reason for liking ERA that it already is a producer and producing U308 for 3rd parties that cant meet their contractual agreements.

ERA is also expanding Ranger resources and increasing mine life.

ERA is due too end its hedging contracts this year by my understanding wich will triple its revenue income as its currently selly U308 at $16.90 too be exact.

Jabiluka is by far no done deal but is a great orebody worth billions and hopefully they can work something out with the traditional owners that benefits both parties in its development.

So basically ERA is a producer, selling cheaply but not for much longer increasing resources and forecast of slightly higher spot pricesand have a gem in Jabiluka.

ERA is also expanding Ranger resources and increasing mine life.

ERA is due too end its hedging contracts this year by my understanding wich will triple its revenue income as its currently selly U308 at $16.90 too be exact.

Jabiluka is by far no done deal but is a great orebody worth billions and hopefully they can work something out with the traditional owners that benefits both parties in its development.

So basically ERA is a producer, selling cheaply but not for much longer increasing resources and forecast of slightly higher spot pricesand have a gem in Jabiluka.

Lucky_Country

Formerly known as ijh

- Joined

- 30 June 2006

- Posts

- 738

- Reactions

- 0

Positive quarterly from ERA average sales price us$25.06 up from us$18.34 hopefully this is because of the long term contracts are slowly expiring.

Production up because of high grade ore being mined and further pit extensions planned .

Well finish of contracts and restart of Jabiluka they could really put a rocket under the sp.

Production up because of high grade ore being mined and further pit extensions planned .

Well finish of contracts and restart of Jabiluka they could really put a rocket under the sp.

Lucky_Country

Formerly known as ijh

- Joined

- 30 June 2006

- Posts

- 738

- Reactions

- 0

ERA in todays West Australian Times 2 brokers covering the company.

One with a buy the other a hold seems too be back on everyones radar after a bit of a soft spell.

Increased production contacts seem too be disolving and getting higher prices Uranium prices firming and increasing.

Has done extemley well during this correction and set up well for the next rally.

One with a buy the other a hold seems too be back on everyones radar after a bit of a soft spell.

Increased production contacts seem too be disolving and getting higher prices Uranium prices firming and increasing.

Has done extemley well during this correction and set up well for the next rally.

- Joined

- 4 March 2008

- Posts

- 42

- Reactions

- 0

Any thoughts on the current direction of the ERA SP? Seems to have broken from its uptrend..........................

ERA seems a very safe investment IMO.

2007 revenue $350 profit after tax around $70 mil

which means when it gets $25 it makes a small profit it only makes $5 of the sell price as profit - now looking forward when its selling at $75

costs should to the same now $1 billion in revenues and small costs.

Whos to say it may get more than $75

Add in Jabiliku at some stage (even if it is 10 years from now) and there is lots of upside.

Its only a shame we don't know when the old contracts roll-over ?

Anyone can shed light on this.

ERA says it can not divulge this for commercial reasons.

I don't quite get that & think the market should know this for the transparency benefit is important - and I don't see ERA getting lower prices for future sales if this info is revealed

Cheers,

Peteai

2007 revenue $350 profit after tax around $70 mil

which means when it gets $25 it makes a small profit it only makes $5 of the sell price as profit - now looking forward when its selling at $75

costs should to the same now $1 billion in revenues and small costs.

Whos to say it may get more than $75

Add in Jabiliku at some stage (even if it is 10 years from now) and there is lots of upside.

Its only a shame we don't know when the old contracts roll-over ?

Anyone can shed light on this.

ERA says it can not divulge this for commercial reasons.

I don't quite get that & think the market should know this for the transparency benefit is important - and I don't see ERA getting lower prices for future sales if this info is revealed

Cheers,

Peteai

- Joined

- 22 July 2006

- Posts

- 852

- Reactions

- 1

ERA seems a very safe investment IMO.

2007 revenue $350 profit after tax around $70 mil

which means when it gets $25 it makes a small profit it only makes $5 of the sell price as profit - now looking forward when its selling at $75

costs should to the same now $1 billion in revenues and small costs.

Whos to say it may get more than $75

Add in Jabiliku at some stage (even if it is 10 years from now) and there is lots of upside.

Its only a shame we don't know when the old contracts roll-over ?

Anyone can shed light on this.

ERA says it can not divulge this for commercial reasons.

I don't quite get that & think the market should know this for the transparency benefit is important - and I don't see ERA getting lower prices for future sales if this info is revealed

Cheers,

Peteai

Not sure about whether ERA is necessarily a safe investment (although I guess that depends on what you consider to be safe)..... This stock has been extremely volatile and is unlikely to be taken over due to Rio's ownership, therefore doesn't attract a possible takeover premium.

Without knowing their long term contracts in place, it's a bit difficult to gauge. However, just doing a quick valuation method (sustainable cash flow with 75% increase year one, 55% y2, 40% y3, 15% y4 and 12% in perpetuity, 12.5% discount rate, capex at 1.2 * D&A), fair value comes up at about $18 a share, so I would say it is between appropriately priced to a bit expensive....

Not exactly a yield stock either, so for me on a risk reward basis it doesn't seem that attractive.....

T/A wise, long term (5 year chart) shows a healthy uptrend in place, although it looks like it is in a consolidation phase ATM. Short term, looks like heading lower after a break through 20.50 support, with next support at 17.50 - 18.

Cheers

Attachments

- Joined

- 4 March 2008

- Posts

- 42

- Reactions

- 0

Many thanks peteai and reece for sharing your information withe a newbie like myself...................................

Not sure about whether ERA is necessarily a safe investment (although I guess that depends on what you consider to be safe)..... This stock has been extremely volatile and is unlikely to be taken over due to Rio's ownership, therefore doesn't attract a possible takeover premium.

Without knowing their long term contracts in place, it's a bit difficult to gauge. However, just doing a quick valuation method (sustainable cash flow with 75% increase year one, 55% y2, 40% y3, 15% y4 and 12% in perpetuity, 12.5% discount rate, capex at 1.2 * D&A), fair value comes up at about $18 a share, so I would say it is between appropriately priced to a bit expensive....

Not exactly a yield stock either, so for me on a risk reward basis it doesn't seem that attractive.....

T/A wise, long term (5 year chart) shows a healthy uptrend in place, although it looks like it is in a consolidation phase ATM. Short term, looks like heading lower after a break through 20.50 support, with next support at 17.50 - 18.

Cheers

Thanks for the analysis Reece it's made me think I should brush up on a some Excel.

However I think it understates the upside in ERAs profit growth. Once ERA gets $75 per pound, ERAs profit should be $700mil or more. That is a 1000% increase in profit. Some are saying that the old contracts will largely end in the next couple of years but who knows. If you could adjust the spread sheet to take as variables

A: the years the legacy contracts run and

B: the end prices

It would be a interesting model for ERAs value.

Also Kelpie you may consider yourself a newbie, but I welcome your opinion - let me know if I'm talking rubbish

Cheers,

Peteai

- Joined

- 22 July 2006

- Posts

- 852

- Reactions

- 1

Thanks for the analysis Reece it's made me think I should brush up on a some Excel.

However I think it understates the upside in ERAs profit growth. Once ERA gets $75 per pound, ERAs profit should be $700mil or more. That is a 1000% increase in profit. Some are saying that the old contracts will largely end in the next couple of years but who knows. If you could adjust the spread sheet to take as variables

A: the years the legacy contracts run and

B: the end prices

It would be a interesting model for ERAs value.

Also Kelpie you may consider yourself a newbie, but I welcome your opinion - let me know if I'm talking rubbish

Cheers,

Peteai

Hi Petai

Yes, I agree it was on the conservative side of the equation....

But there are a couple of reason's why I don't think that the NPAT of 700 mil will be seen any time soon:

1. The royalties they pay would be tied to the revenue received - don't know what basis of the royalty is, but it's pretty clear it moves with the revenue.

2. Long term U price - it's had quite a rise in the last couple of years. I understand the economics concerned, but what would happen if the price of U would fall?

As previously said, as they don't disclose the long term contracts, it's impossible to model it predictably. If you wanted to, you could model the flows on the U price, it wouldn't be that difficult. However, I think what I previously attached is a conservative view of what the outcome could be.

Cheers

You could be more scientific, but I think what I supplied gives you the "back of the envelope" calculation.

Hi Petai

Yes, I agree it was on the conservative side of the equation....

But there are a couple of reason's why I don't think that the NPAT of 700 mil will be seen any time soon:

1. The royalties they pay would be tied to the revenue received - don't know what basis of the royalty is, but it's pretty clear it moves with the revenue.

2. Long term U price - it's had quite a rise in the last couple of years. I understand the economics concerned, but what would happen if the price of U would fall?

As previously said, as they don't disclose the long term contracts, it's impossible to model it predictably. If you wanted to, you could model the flows on the U price, it wouldn't be that difficult. However, I think what I previously attached is a conservative view of what the outcome could be.

Cheers

You could be more scientific, but I think what I supplied gives you the "back of the envelope" calculation.

Hi Reece55,

Yes NPAT of $700Miil may not happen but it is quite possible.

I'm just regarding this as a safe stock because there seems to me a lot more upside than down side.

e.g If the U price drops to $50 by the time ERAs old contracts end it still ends up with a profit of about $400mil (they pay about 5% royalty I believe)

Thats a major increase tin profit - While many othe U companies would have major drops in profit Also if the credit crisis continues it will probably cause a lot of problems for ERA competitors (financing mines etc) while the nuclear power stations would still be running. Add to that the possibilty of Jabiluka, that the secondary U supply reduces while China plans to build 60GW of nuclear capacity by 2020 etc

IMO there is much more upside that down side. Sure if many things go wrong for ERA the value would reduce. These are just my views & I welcome debate.

Cheers,

PETEAI

ERA - Valuation

I have been considering how ERAs long term contracts should be treated in valuing the company. The sales made last year are what affects the last profit reported. But the contracts being made today (largely around the U long term price ?_- and these contracts are more than projections they are effectively guaranteed cash flows. This info would be extremely useful in valuing the company - the problem ,of course, is that these contracts are kept secret.

ERA says they are kept secret for commercial reasons.

I'm not sure how much ERA loses by making this info public but it strikes me as being totally against the princiiple of transparency.

Does anyone have opinions on this ?

Cheers

Peteai

I have been considering how ERAs long term contracts should be treated in valuing the company. The sales made last year are what affects the last profit reported. But the contracts being made today (largely around the U long term price ?_- and these contracts are more than projections they are effectively guaranteed cash flows. This info would be extremely useful in valuing the company - the problem ,of course, is that these contracts are kept secret.

ERA says they are kept secret for commercial reasons.

I'm not sure how much ERA loses by making this info public but it strikes me as being totally against the princiiple of transparency.

Does anyone have opinions on this ?

Cheers

Peteai

- Joined

- 22 July 2006

- Posts

- 852

- Reactions

- 1

Re: ERA - Valuation

It's a bit tricky, because in my view a series of long term contracts are almost exactly the same thing as forward selling without upfront cost. Derivatives like forwards obviously are mandated for disclosure in accordance with the financial instruments standard. But they seem to be able to get away with absolutely no disclosure on the matter. Not even a bloody footnote! PWC are signing off, so I'm sure a big 4 firm would ensure it is compliant, they signed an unqualified report.

Is it transparent - no way. But accounts don't have to be transparent, they just have to obey accounting standards and present a true and fair view......

Cheers

I have been considering how ERAs long term contracts should be treated in valuing the company. The sales made last year are what affects the last profit reported. But the contracts being made today (largely around the U long term price ?_- and these contracts are more than projections they are effectively guaranteed cash flows. This info would be extremely useful in valuing the company - the problem ,of course, is that these contracts are kept secret.

ERA says they are kept secret for commercial reasons.

I'm not sure how much ERA loses by making this info public but it strikes me as being totally against the princiiple of transparency.

Does anyone have opinions on this ?

Cheers

Peteai

It's a bit tricky, because in my view a series of long term contracts are almost exactly the same thing as forward selling without upfront cost. Derivatives like forwards obviously are mandated for disclosure in accordance with the financial instruments standard. But they seem to be able to get away with absolutely no disclosure on the matter. Not even a bloody footnote! PWC are signing off, so I'm sure a big 4 firm would ensure it is compliant, they signed an unqualified report.

Is it transparent - no way. But accounts don't have to be transparent, they just have to obey accounting standards and present a true and fair view......

Cheers

- Joined

- 4 February 2006

- Posts

- 564

- Reactions

- 0

getting squeezed into a decission which way soon

they may well be in a "commercial in confidence" situation with running contracts but cannot see how this prevents them providing indications as to quantity and end dates so that analyst have a little more info to analyse/project - annoying to say the least

they may well be in a "commercial in confidence" situation with running contracts but cannot see how this prevents them providing indications as to quantity and end dates so that analyst have a little more info to analyse/project - annoying to say the least

Attachments

- Joined

- 4 February 2006

- Posts

- 564

- Reactions

- 0

comsec

......2007 2008 2009 2010

EPS 41.7 57.0 93.5 172.1

DPS 20.0 28.6 70.3 112.7

and westpac

.................Curr 2008 2009

EPS (c) ......41.7 57.0 93.5

PE Ratio (x) 47.3 34.6 21.1

DPS (c) ......20.0 28.6 70.3

Div Yield (%) 1.0 1.5 3.6

so what are they working from??

......2007 2008 2009 2010

EPS 41.7 57.0 93.5 172.1

DPS 20.0 28.6 70.3 112.7

and westpac

.................Curr 2008 2009

EPS (c) ......41.7 57.0 93.5

PE Ratio (x) 47.3 34.6 21.1

DPS (c) ......20.0 28.6 70.3

Div Yield (%) 1.0 1.5 3.6

so what are they working from??

- Joined

- 22 July 2006

- Posts

- 852

- Reactions

- 1

comsec

......2007 2008 2009 2010

EPS 41.7 57.0 93.5 172.1

DPS 20.0 28.6 70.3 112.7

and westpac

.................Curr 2008 2009

EPS (c) ......41.7 57.0 93.5

PE Ratio (x) 47.3 34.6 21.1

DPS (c) ......20.0 28.6 70.3

Div Yield (%) 1.0 1.5 3.6

so what are they working from??

Puddle lanes pond......

Muddle puddle - does anyone remember that silly show on ABC?

It would just be an educated stab in the dark I would have thought Treefrog, much like the valuation I have already put up....

Cheers

Re: ERA - transparency * Insider Trading

I also see a bigger issue related to lack of transparency. There would be certain group of people in ERA who know a lot more about these contracts than the market. Should they be allowed to trade with this information advantage ? There is nothing to stop them so they probably are!

Cheers,

I also see a bigger issue related to lack of transparency. There would be certain group of people in ERA who know a lot more about these contracts than the market. Should they be allowed to trade with this information advantage ? There is nothing to stop them so they probably are!

Cheers,

Similar threads

- Replies

- 1

- Views

- 1K

- Replies

- 21

- Views

- 2K